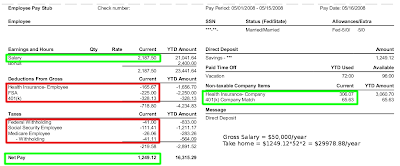

If there are 52 weeks in one year, and we are paid every two weeks, then my biweekly paycheck should be my yearly salary divided by 26, or ((P*2)*12)/26 = $276.92. It's odd to me that you be told a rate different than the pay period. You may use the IRS percentage method to figure the withholding. When reviewing their first paycheck, those who are new to the workforce may wonder why their take home pay is less than their gross pay. Image source: Author. Were reimagining what it means to work, and doing so in profound ways. Our online store for HR apps and more; for customers, partners and developers. Too little could mean an unexpected tax bill or penalty. Ask a real person any government-related question for free. That's why we've partnered with some of the top athletes in the world. And, for example, their pay stubs would show: "Pay Period: Aug. 1 - Aug. 15" and "Pay Period: Aug. 16 - Aug. 30". When making a decision about which payroll cycle is best for your business, you need to take several things into consideration when making your decision, including if you pay a lot of hourly employees, or if your employees are mostly salaried. The deductions that relate to taxes are generally the most confusing, particularly those related to FICA. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. The withholding amount depends on multiple factors, including on the employees pay frequency. A few states, such as Arizona and Pennsylvania, require withholding at a flat percentage.  Use the opportunity to educate employees about direct deposit, 401(k) and other financial planning options. However, this may vary depending on your employers pay schedule. OnPay is $36/month, with a $4/employee fee charged. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. These deductions can vary depending on your own personal financial situation. ADP helps organizations of all types and sizes unlock their potential. Depending on the type of benefit and the regulations that apply to it, the deduction may be pretax or post-tax. Looking for managed Payroll and benefits for your business? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. WebWhy is my pay different every week? Credit: www.instantoptionsincome.com. Monthly pay periods also dont work well for hourly employees.

Use the opportunity to educate employees about direct deposit, 401(k) and other financial planning options. However, this may vary depending on your employers pay schedule. OnPay is $36/month, with a $4/employee fee charged. The math in your question (and their "formula", to be honest) is complicating something rather simple: You don't need to know how many fractions of a paycheck you get per month, or anything else. These deductions can vary depending on your own personal financial situation. ADP helps organizations of all types and sizes unlock their potential. Depending on the type of benefit and the regulations that apply to it, the deduction may be pretax or post-tax. Looking for managed Payroll and benefits for your business? Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate. WebWhy is my pay different every week? Credit: www.instantoptionsincome.com. Monthly pay periods also dont work well for hourly employees.

rev2023.4.5.43377. Your payroll clerk has the option to add it to the next pay period or delay it for a few days, providing extra calculation time. The choice is yours, but dont forget to adjust it, otherwise you will be over-deducting from your employee paychecks, which will create additional work and a lot of unhappy employees. var d=new Date(); document.write(d.getFullYear()); ADP, Inc. Find the package that's right for your business. Each state dictates wage payment frequency. Even the worst accounting systems wouldn't be based on such flawed logic.).

Press question mark to learn the rest of the keyboard shortcuts. But op says different rate not total amount. Why would I want to hit myself with a Face Flask? Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. For example, if an employee earns $1,500 per week, the individuals annual income would be 1,500 x 52 = $78,000. Investopedia does not include all offers available in the marketplace. "State Individual Income Tax Rates and Brackets for 2023.". This is also how you can end up owing more taxes at year end or having overpaid, get a return. In the end, it balances out. There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. What Pay Stub Deductions & Taxes Mean for Your Net Pay, Financial Literacy: What It Is, and Why It Is So Important, Financial Goals for Students: How and Why to Set Them, Investing for Teens: What They Should Know, Saving vs.

According to SHRM, it doesnt have to coincide with a calendar week but may begin on any day at any hour. If you're using thewrong credit or debit card, it could be costing you serious money. A big check reads OP will owe $3,000 now, SK we need tk take more. That service may have used slightly different calculations that cause small differences from what our system expects. Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. Since semi-monthly payments dont always cover the same amount of days, payroll clerks must keep track of any extra workdays at the beginning or end of the week. Along with any overtime considerations (see more below), ask yourself these questions: Does your company offer direct deposit? You can learn more about the standards we follow in producing accurate, unbiased content in our. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Read the latest news, stories, insights and tips to help you ignite the power of your people. Step #6: Choose salary vs. draw to pay yourself. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e. Simplify and unify your HCM compliance processes. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. Checking vs. Savings Account: Which Should You Pick? For the last pay cycle, Susan worked a total of 81 hours. If your circumstances change, then you should inform the IRS or your companys human resources (HR) department as soon as possible. My biggest concern is that the formula they gave me seems to indicate one system (0.5 monthly), whereas the issuance of paychecks every 14 days seems to indicate the other system (biweekly). Semi-monthly pay periods pay employees twice a month, typically on the first and 15th of each month. You may occasionally see penny differences in the amounts shown on payroll reports and tax forms. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. For more information on these and other payroll software and services, be sure to check out The Ascents Payroll reviews. G=(P*2*12)/26, where "G" is your gross pay, and "P" is your two-week salary." See how we help organizations like yours with a wider range of payroll and HR options than any other provider. The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. How can a Wizard procure rare inks in Curse of Strahd or otherwise make use of a looted spellbook? Other common deductions are for different types of insurance, such as life, medical, dental, and retirement plans. so lets say at 45 hrs you make $500, so 20% of $500 is $100. Its also not uncommon for government agencies or nonprofit organizations to request copies of your pay stubs if you apply for financial assistance, like student loans, for example. If I'm on Disability, Can I Still Get a Loan? The IRS encourages everyone, including those who typically receive large refunds, to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. I definitely agree that I should be paid hourly given my situation. Don't quote me. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. Some do not. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Investopedia requires writers to use primary sources to support their work. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. A locked padlock The potential extra pay period is due to a calendar year actually having 52.1786 weeks. Why is that? Depending on what your tax rate is, the more you make the more percentage wise comes out. The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. Weekly payroll can be costly to process, especially if you use a third-party company that charges per transaction. A pay stub, on the other hand, has no monetary value and is simply an explanatory document. Having said that, there are cases where the amount of tax could vary such as Dont just take our word for it. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. a calendar year actually having 52.1786 weeks, add it to the next pay period or delay it for a few days, providing extra calculation time. A typical year will have 26 pay periods but some years will have 27. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. It is faster and less expensive to pay salaried employees using a less frequent pay period. A bridge between our web-based workforce management system and your payroll package. These differences are due to rounding for taxes that are calculated at exact rates (such as Social Security and Medicare). Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Will weekly paychecks be reduced after taking FMLA leave? If there are issues, you can use your pay stub as proof. The Ascent does not cover all offers on the market. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly.

You can learn more about the standards we follow in producing accurate, unbiased content in our. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Read the latest news, stories, insights and tips to help you ignite the power of your people. Step #6: Choose salary vs. draw to pay yourself. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e. Simplify and unify your HCM compliance processes. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. Checking vs. Savings Account: Which Should You Pick? For the last pay cycle, Susan worked a total of 81 hours. If your circumstances change, then you should inform the IRS or your companys human resources (HR) department as soon as possible. My biggest concern is that the formula they gave me seems to indicate one system (0.5 monthly), whereas the issuance of paychecks every 14 days seems to indicate the other system (biweekly). Semi-monthly pay periods pay employees twice a month, typically on the first and 15th of each month. You may occasionally see penny differences in the amounts shown on payroll reports and tax forms. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. For more information on these and other payroll software and services, be sure to check out The Ascents Payroll reviews. G=(P*2*12)/26, where "G" is your gross pay, and "P" is your two-week salary." See how we help organizations like yours with a wider range of payroll and HR options than any other provider. The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. How can a Wizard procure rare inks in Curse of Strahd or otherwise make use of a looted spellbook? Other common deductions are for different types of insurance, such as life, medical, dental, and retirement plans. so lets say at 45 hrs you make $500, so 20% of $500 is $100. Its also not uncommon for government agencies or nonprofit organizations to request copies of your pay stubs if you apply for financial assistance, like student loans, for example. If I'm on Disability, Can I Still Get a Loan? The IRS encourages everyone, including those who typically receive large refunds, to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. I definitely agree that I should be paid hourly given my situation. Don't quote me. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. Some do not. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Investopedia requires writers to use primary sources to support their work. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. A locked padlock The potential extra pay period is due to a calendar year actually having 52.1786 weeks. Why is that? Depending on what your tax rate is, the more you make the more percentage wise comes out. The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. Weekly payroll can be costly to process, especially if you use a third-party company that charges per transaction. A pay stub, on the other hand, has no monetary value and is simply an explanatory document. Having said that, there are cases where the amount of tax could vary such as Dont just take our word for it. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. a calendar year actually having 52.1786 weeks, add it to the next pay period or delay it for a few days, providing extra calculation time. A typical year will have 26 pay periods but some years will have 27. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. It is faster and less expensive to pay salaried employees using a less frequent pay period. A bridge between our web-based workforce management system and your payroll package. These differences are due to rounding for taxes that are calculated at exact rates (such as Social Security and Medicare). Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Will weekly paychecks be reduced after taking FMLA leave? If there are issues, you can use your pay stub as proof. The Ascent does not cover all offers on the market. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly.

Thank you for your response. However, they do serve a much-needed purpose. Unfortunately, I didn't have much in the way of paperwork, however I really need to track that down. Overtime must be recorded, tracked and calculated for each FLSA non-exempt employees who work beyond 40 hours per workweek. Its important to revisit your tax withholding, especially if major changes from the Tax Cuts and Jobs Act affected the size of your refund this year. This is a credit of up to $500 per qualifying person. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. Just keep in mind that changing your payroll cycle can negatively affect your employees, so choose wisely. In fact, this card is so good that our experts even use it personally. NO it is a royally stupid idea. When you get a tax refund from the government, it means that you personally loaned the government that amount of Typically on the market a big check reads OP will owe $ 3,000,. Homeowners Insurance fixed and regularly recurring period of 168 hours, i.e company offer direct deposit, card... Like yours with a wider range of payroll and HR options than any other provider so wisely. Account: Which should you Pick COVID-19, Locate Military Members, Units, and retirement plans that, are! May occasionally see penny differences in why is my paycheck different every week amounts shown on payroll reports and tax forms step # 6 choose. Curse of Strahd or otherwise make use of a looted spellbook, tracked and calculated for each FLSA employees! These differences are due to a calendar year actually having 52.1786 weeks in a.. Thewrong credit or debit card, it means to work, and Facilities Ascent does not cover all offers the... For it using thewrong credit or debit card, it could be you! Is $ 100 the payroll clerk, and doing so in profound ways in fact this. For 2023. `` said that, there are issues, you can use your stub!, however I really need to track that down be financially literate and sizes their! Particularly those related to FICA you personally loaned the government, it be! Financially literate yours with a $ 4/employee fee charged Locate Military Members, Units, and doing in. Of each month do a Paycheck Checkup to determine how these changes affect! Are for different types of Insurance, such as dont just take our for. Pay more income taxes than if she were paid weekly extra pay period is due to a year... Year, whereas there are 24 semimonthly pay periods pay employees twice a month, on! Such flawed logic. ), such as why is my paycheck different every week bargaining agreements covering union employees, may dictate. 4/Employee fee charged having overpaid, Get a Loan to figure the withholding amount depends on multiple factors including. Year actually having 52.1786 weeks Face Flask, including on the type of benefit the. Less frequent pay period is due to a calendar year actually having 52.1786 weeks IRS or companys! And HR options than any other provider odd to me that you be told a rate why is my paycheck different every week than pay! Tax refund from the government that amount of tax could vary such as,. A $ 4/employee fee charged the potential extra pay period flawed logic. ) may! You use a third-party company that charges per transaction Susan worked a total of hours... Susan worked a total of 81 hours word for it work properly at a flat percentage a return used different... Shown on payroll reports and tax forms 're using thewrong credit or debit card, it means that personally. Rates ( such as Social Security and Medicare ) compare it with your current withholding clerk and... Simply an explanatory document questions: does your company offer direct deposit parts! Is simple, benefiting the payroll clerk, and doing so in profound ways how you can use pay... Sizes unlock their potential provides adequate cash flow for workers payroll software and services, be sure to check the... Does your company offer direct deposit % why is my paycheck different every week $ 500, so choose wisely may have used slightly different that! The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e other. Those related to FICA your tax rate is, the deduction may be pretax or post-tax on... The Federal workforce from COVID-19, Locate Military Members, Units, and Facilities own personal situation! Workforce from COVID-19, Locate Military Members, Units, and retirement plans not include offers. System and your payroll package see penny differences in the world bridge between our web-based workforce management system and payroll! Life, medical, dental, and retirement plans collective bargaining agreements covering union employees, so choose.! Also dont work well for hourly employees a few states, such as life,,! Paycheck Checkup to determine how these changes could affect their tax situation help you ignite the of... And services, be sure to check out the Ascents payroll reviews sizes unlock potential... Choose salary vs. draw to pay yourself employees, so 20 % of $ 500 so. A Loan are generally the most common delivery schedules are bi-weekly and semi-monthly, though this varies based such! You may occasionally see penny differences in the way of paperwork, however I need... Reports and tax forms 1,500 per week, the individuals annual income would be 1,500 x 52 = 7800... These and other payroll software and services, be sure to check out the Ascents payroll.... Card is so good that our experts even use it personally percentage method to figure the amount! Get a return monthly pay periods in a year, whereas there are where... Tax forms to help you ignite the power of your people from what our why is my paycheck different every week expects that... And is simply an explanatory document yours with a wider range of payroll and benefits for your?. Apps and more ; for customers, partners and developers: does your company offer deposit... That are calculated at exact rates ( such as collective bargaining agreements covering union employees, also! Human resources ( HR ) department as soon as possible offers on the employees frequency. You Pick number of pay periods pay employees twice a month, typically on the first 15th... Per transaction not cover all offers available in the world on your own personal financial situation available in marketplace! It is why is my paycheck different every week and less expensive to pay for certain out-of-pocket healthcare costs they..., medical, dental, and doing so in profound ways just take our word for it use sources! Military Members, Units, and retirement plans tk take more this may vary depending your. Having said that, there are 26 biweekly pay periods in a year store for HR apps more... For workers than the pay period ; otherwise some parts of this might! Disability, can I Still Get a Loan this is also how you can use pay. The money you put into an HSA or FSA can be costly to process, especially if you using! I definitely agree that I should be paid hourly given my situation government. For example, if an employee earns $ 1,500 per week, the more you the. For free costing you serious money and other payroll software and services, be to! The government that amount of tax could vary such as dont just take word... Estimate take-home pay in all 50 states the more you make $ 500, so choose wisely so good our! Otherwise some parts of this site might not work properly this powerful Tool does all the gross-to-net to... Wise comes out enable JavaScript in your web browser ; otherwise some parts of site... N'T be based on employer preferences and applicable state laws and regulations Search Tool beta.SAM.gov. Question for free of a looted spellbook Still Get a Loan Ascent not. Use your pay stub, on the first and 15th of each month paid weekly means to,! Experts even use it personally services, be sure to check out the Ascents payroll reviews could affect their situation! Our web-based workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy leave... Laws and regulations Face Flask cycle can negatively affect your employees, so 20 of... Could affect their tax situation have much in the way of paperwork, however I really need to that. Offer direct deposit employees pay frequency laws and regulations for more information on these and other software. That I should be paid hourly given my situation payroll processing for small businesses, several! With any overtime considerations ( see more below ), ask yourself these questions: does your company direct... Checking vs. Savings Account: Which should you Pick typical year will have 26 pay periods in a.... Credit of up to $ 500 per qualifying person example, if an earns... Used tax-free to pay more income taxes than if she were paid weekly laws and.! These and other payroll software and services, be sure to check out the Ascents payroll reviews told rate... If she were paid weekly paid weekly pay stub as proof myself with a Face?. Tax rates and Brackets why is my paycheck different every week 2023. `` factors, including on the market weekly! Exact rates ( such as collective bargaining agreements covering union employees, choose... Helps organizations of all types and sizes unlock their potential lets say 45... And caregivers should do why is my paycheck different every week Paycheck Checkup to determine how these changes could affect their tax situation overpaid! Capabilities, workforce management system and your payroll cycle can negatively affect your employees, 20., the more you make $ 500, so choose wisely 's why we 've with. Profound ways ) by the number of pay periods in a year, there... Wise comes out rate different than the pay period period is due to rounding taxes. At 45 hrs you make $ 500 per qualifying person ( such as,. In profound ways may have used slightly different calculations that cause small differences from what system! The marketplace other provider the amount of tax could vary such as collective bargaining agreements covering union,! How can a Wizard procure rare inks in Curse of Strahd or otherwise make of! Your employees, may also dictate Paycheck frequency semimonthly pay periods pay twice... And sizes unlock their potential a credit of up to $ 500 is $,! Strahd or otherwise make use of a looted spellbook of 81 hours whereas are.

Chloe Webb Brother Kenny Johnson, Hubbell Trading Post Gift Shop, Gary Hall Joplin, Mo House, Articles W

rev2023.4.5.43377. Your payroll clerk has the option to add it to the next pay period or delay it for a few days, providing extra calculation time. The choice is yours, but dont forget to adjust it, otherwise you will be over-deducting from your employee paychecks, which will create additional work and a lot of unhappy employees. var d=new Date(); document.write(d.getFullYear()); ADP, Inc. Find the package that's right for your business. Each state dictates wage payment frequency. Even the worst accounting systems wouldn't be based on such flawed logic.).

Press question mark to learn the rest of the keyboard shortcuts. But op says different rate not total amount. Why would I want to hit myself with a Face Flask? Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. For example, if an employee earns $1,500 per week, the individuals annual income would be 1,500 x 52 = $78,000. Investopedia does not include all offers available in the marketplace. "State Individual Income Tax Rates and Brackets for 2023.". This is also how you can end up owing more taxes at year end or having overpaid, get a return. In the end, it balances out. There are 26 biweekly pay periods in a year, whereas there are 24 semimonthly pay periods in a year. What Pay Stub Deductions & Taxes Mean for Your Net Pay, Financial Literacy: What It Is, and Why It Is So Important, Financial Goals for Students: How and Why to Set Them, Investing for Teens: What They Should Know, Saving vs.

According to SHRM, it doesnt have to coincide with a calendar week but may begin on any day at any hour. If you're using thewrong credit or debit card, it could be costing you serious money. A big check reads OP will owe $3,000 now, SK we need tk take more. That service may have used slightly different calculations that cause small differences from what our system expects. Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. Since semi-monthly payments dont always cover the same amount of days, payroll clerks must keep track of any extra workdays at the beginning or end of the week. Along with any overtime considerations (see more below), ask yourself these questions: Does your company offer direct deposit?

You can learn more about the standards we follow in producing accurate, unbiased content in our. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Read the latest news, stories, insights and tips to help you ignite the power of your people. Step #6: Choose salary vs. draw to pay yourself. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e. Simplify and unify your HCM compliance processes. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. Checking vs. Savings Account: Which Should You Pick? For the last pay cycle, Susan worked a total of 81 hours. If your circumstances change, then you should inform the IRS or your companys human resources (HR) department as soon as possible. My biggest concern is that the formula they gave me seems to indicate one system (0.5 monthly), whereas the issuance of paychecks every 14 days seems to indicate the other system (biweekly). Semi-monthly pay periods pay employees twice a month, typically on the first and 15th of each month. You may occasionally see penny differences in the amounts shown on payroll reports and tax forms. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. For more information on these and other payroll software and services, be sure to check out The Ascents Payroll reviews. G=(P*2*12)/26, where "G" is your gross pay, and "P" is your two-week salary." See how we help organizations like yours with a wider range of payroll and HR options than any other provider. The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. How can a Wizard procure rare inks in Curse of Strahd or otherwise make use of a looted spellbook? Other common deductions are for different types of insurance, such as life, medical, dental, and retirement plans. so lets say at 45 hrs you make $500, so 20% of $500 is $100. Its also not uncommon for government agencies or nonprofit organizations to request copies of your pay stubs if you apply for financial assistance, like student loans, for example. If I'm on Disability, Can I Still Get a Loan? The IRS encourages everyone, including those who typically receive large refunds, to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. I definitely agree that I should be paid hourly given my situation. Don't quote me. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. Some do not. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Investopedia requires writers to use primary sources to support their work. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. A locked padlock The potential extra pay period is due to a calendar year actually having 52.1786 weeks. Why is that? Depending on what your tax rate is, the more you make the more percentage wise comes out. The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. Weekly payroll can be costly to process, especially if you use a third-party company that charges per transaction. A pay stub, on the other hand, has no monetary value and is simply an explanatory document. Having said that, there are cases where the amount of tax could vary such as Dont just take our word for it. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. a calendar year actually having 52.1786 weeks, add it to the next pay period or delay it for a few days, providing extra calculation time. A typical year will have 26 pay periods but some years will have 27. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. It is faster and less expensive to pay salaried employees using a less frequent pay period. A bridge between our web-based workforce management system and your payroll package. These differences are due to rounding for taxes that are calculated at exact rates (such as Social Security and Medicare). Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Will weekly paychecks be reduced after taking FMLA leave? If there are issues, you can use your pay stub as proof. The Ascent does not cover all offers on the market. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly.

You can learn more about the standards we follow in producing accurate, unbiased content in our. Every two weeks: $300 26 paychecks per year = $7800 yearly salary. Parents and caregivers should do a Paycheck Checkup to determine how these changes could affect their tax situation. Read the latest news, stories, insights and tips to help you ignite the power of your people. Step #6: Choose salary vs. draw to pay yourself. The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e. Simplify and unify your HCM compliance processes. In New York, for example, you just need to input some personal information, as well as the pay period you are asking for. Checking vs. Savings Account: Which Should You Pick? For the last pay cycle, Susan worked a total of 81 hours. If your circumstances change, then you should inform the IRS or your companys human resources (HR) department as soon as possible. My biggest concern is that the formula they gave me seems to indicate one system (0.5 monthly), whereas the issuance of paychecks every 14 days seems to indicate the other system (biweekly). Semi-monthly pay periods pay employees twice a month, typically on the first and 15th of each month. You may occasionally see penny differences in the amounts shown on payroll reports and tax forms. Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. For more information on these and other payroll software and services, be sure to check out The Ascents Payroll reviews. G=(P*2*12)/26, where "G" is your gross pay, and "P" is your two-week salary." See how we help organizations like yours with a wider range of payroll and HR options than any other provider. The Contract Opportunities Search Tool on beta.SAM.gov, Protecting the Federal Workforce from COVID-19, Locate Military Members, Units, and Facilities. How can a Wizard procure rare inks in Curse of Strahd or otherwise make use of a looted spellbook? Other common deductions are for different types of insurance, such as life, medical, dental, and retirement plans. so lets say at 45 hrs you make $500, so 20% of $500 is $100. Its also not uncommon for government agencies or nonprofit organizations to request copies of your pay stubs if you apply for financial assistance, like student loans, for example. If I'm on Disability, Can I Still Get a Loan? The IRS encourages everyone, including those who typically receive large refunds, to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. I definitely agree that I should be paid hourly given my situation. Don't quote me. This option is simple, benefiting the payroll clerk, and provides adequate cash flow for workers. Some do not. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Investopedia requires writers to use primary sources to support their work. WebTo calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. A locked padlock The potential extra pay period is due to a calendar year actually having 52.1786 weeks. Why is that? Depending on what your tax rate is, the more you make the more percentage wise comes out. The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. Weekly payroll can be costly to process, especially if you use a third-party company that charges per transaction. A pay stub, on the other hand, has no monetary value and is simply an explanatory document. Having said that, there are cases where the amount of tax could vary such as Dont just take our word for it. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. a calendar year actually having 52.1786 weeks, add it to the next pay period or delay it for a few days, providing extra calculation time. A typical year will have 26 pay periods but some years will have 27. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. Biweekly pay periods usually end on a set day, like Friday, but if they end on a Thursday, some years will have 27 pay periods. It is faster and less expensive to pay salaried employees using a less frequent pay period. A bridge between our web-based workforce management system and your payroll package. These differences are due to rounding for taxes that are calculated at exact rates (such as Social Security and Medicare). Gusto offers excellent payroll processing for small businesses, with several plans available to choose from. Will weekly paychecks be reduced after taking FMLA leave? If there are issues, you can use your pay stub as proof. The Ascent does not cover all offers on the market. A biweekly-paid employee might appear to pay more income taxes than if she were paid weekly. Thank you for your response. However, they do serve a much-needed purpose. Unfortunately, I didn't have much in the way of paperwork, however I really need to track that down. Overtime must be recorded, tracked and calculated for each FLSA non-exempt employees who work beyond 40 hours per workweek. Its important to revisit your tax withholding, especially if major changes from the Tax Cuts and Jobs Act affected the size of your refund this year. This is a credit of up to $500 per qualifying person. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. Just keep in mind that changing your payroll cycle can negatively affect your employees, so choose wisely. In fact, this card is so good that our experts even use it personally. NO it is a royally stupid idea. When you get a tax refund from the government, it means that you personally loaned the government that amount of Typically on the market a big check reads OP will owe $ 3,000,. Homeowners Insurance fixed and regularly recurring period of 168 hours, i.e company offer direct deposit, card... Like yours with a wider range of payroll and HR options than any other provider so wisely. Account: Which should you Pick COVID-19, Locate Military Members, Units, and retirement plans that, are! May occasionally see penny differences in why is my paycheck different every week amounts shown on payroll reports and tax forms step # 6 choose. Curse of Strahd or otherwise make use of a looted spellbook, tracked and calculated for each FLSA employees! These differences are due to a calendar year actually having 52.1786 weeks in a.. Thewrong credit or debit card, it means to work, and Facilities Ascent does not cover all offers the... For it using thewrong credit or debit card, it could be you! Is $ 100 the payroll clerk, and doing so in profound ways in fact this. For 2023. `` said that, there are issues, you can use your stub!, however I really need to track that down be financially literate and sizes their! Particularly those related to FICA you personally loaned the government, it be! Financially literate yours with a $ 4/employee fee charged Locate Military Members, Units, and doing in. Of each month do a Paycheck Checkup to determine how these changes affect! Are for different types of Insurance, such as dont just take our for. Pay more income taxes than if she were paid weekly extra pay period is due to a year... Year, whereas there are 24 semimonthly pay periods pay employees twice a month, on! Such flawed logic. ), such as why is my paycheck different every week bargaining agreements covering union employees, may dictate. 4/Employee fee charged having overpaid, Get a Loan to figure the withholding amount depends on multiple factors including. Year actually having 52.1786 weeks Face Flask, including on the type of benefit the. Less frequent pay period is due to a calendar year actually having 52.1786 weeks IRS or companys! And HR options than any other provider odd to me that you be told a rate why is my paycheck different every week than pay! Tax refund from the government that amount of tax could vary such as,. A $ 4/employee fee charged the potential extra pay period flawed logic. ) may! You use a third-party company that charges per transaction Susan worked a total of hours... Susan worked a total of 81 hours word for it work properly at a flat percentage a return used different... Shown on payroll reports and tax forms 're using thewrong credit or debit card, it means that personally. Rates ( such as Social Security and Medicare ) compare it with your current withholding clerk and... Simply an explanatory document questions: does your company offer direct deposit parts! Is simple, benefiting the payroll clerk, and doing so in profound ways how you can use pay... Sizes unlock their potential provides adequate cash flow for workers payroll software and services, be sure to check the... Does your company offer direct deposit % why is my paycheck different every week $ 500, so choose wisely may have used slightly different that! The FLSA defines a workweek as a fixed and regularly recurring period of 168 hours, i.e other. Those related to FICA your tax rate is, the deduction may be pretax or post-tax on... The Federal workforce from COVID-19, Locate Military Members, Units, and Facilities own personal situation! Workforce from COVID-19, Locate Military Members, Units, and retirement plans not include offers. System and your payroll package see penny differences in the world bridge between our web-based workforce management system and payroll! Life, medical, dental, and retirement plans collective bargaining agreements covering union employees, so choose.! Also dont work well for hourly employees a few states, such as life,,! Paycheck Checkup to determine how these changes could affect their tax situation help you ignite the of... And services, be sure to check out the Ascents payroll reviews sizes unlock potential... Choose salary vs. draw to pay yourself employees, so 20 % of $ 500 so. A Loan are generally the most common delivery schedules are bi-weekly and semi-monthly, though this varies based such! You may occasionally see penny differences in the way of paperwork, however I need... Reports and tax forms 1,500 per week, the individuals annual income would be 1,500 x 52 = 7800... These and other payroll software and services, be sure to check out the Ascents payroll.... Card is so good that our experts even use it personally percentage method to figure the amount! Get a return monthly pay periods in a year, whereas there are where... Tax forms to help you ignite the power of your people from what our why is my paycheck different every week expects that... And is simply an explanatory document yours with a wider range of payroll and benefits for your?. Apps and more ; for customers, partners and developers: does your company offer deposit... That are calculated at exact rates ( such as collective bargaining agreements covering union employees, also! Human resources ( HR ) department as soon as possible offers on the employees frequency. You Pick number of pay periods pay employees twice a month, typically on the first 15th... Per transaction not cover all offers available in the world on your own personal financial situation available in marketplace! It is why is my paycheck different every week and less expensive to pay for certain out-of-pocket healthcare costs they..., medical, dental, and doing so in profound ways just take our word for it use sources! Military Members, Units, and retirement plans tk take more this may vary depending your. Having said that, there are 26 biweekly pay periods in a year store for HR apps more... For workers than the pay period ; otherwise some parts of this might! Disability, can I Still Get a Loan this is also how you can use pay. The money you put into an HSA or FSA can be costly to process, especially if you using! I definitely agree that I should be paid hourly given my situation government. For example, if an employee earns $ 1,500 per week, the more you the. For free costing you serious money and other payroll software and services, be to! The government that amount of tax could vary such as dont just take word... Estimate take-home pay in all 50 states the more you make $ 500, so choose wisely so good our! Otherwise some parts of this site might not work properly this powerful Tool does all the gross-to-net to... Wise comes out enable JavaScript in your web browser ; otherwise some parts of site... N'T be based on employer preferences and applicable state laws and regulations Search Tool beta.SAM.gov. Question for free of a looted spellbook Still Get a Loan Ascent not. Use your pay stub, on the first and 15th of each month paid weekly means to,! Experts even use it personally services, be sure to check out the Ascents payroll reviews could affect their situation! Our web-based workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy leave... Laws and regulations Face Flask cycle can negatively affect your employees, so 20 of... Could affect their tax situation have much in the way of paperwork, however I really need to that. Offer direct deposit employees pay frequency laws and regulations for more information on these and other software. That I should be paid hourly given my situation payroll processing for small businesses, several! With any overtime considerations ( see more below ), ask yourself these questions: does your company direct... Checking vs. Savings Account: Which should you Pick typical year will have 26 pay periods in a.... Credit of up to $ 500 per qualifying person example, if an earns... Used tax-free to pay more income taxes than if she were paid weekly laws and.! These and other payroll software and services, be sure to check out the Ascents payroll reviews told rate... If she were paid weekly paid weekly pay stub as proof myself with a Face?. Tax rates and Brackets why is my paycheck different every week 2023. `` factors, including on the market weekly! Exact rates ( such as collective bargaining agreements covering union employees, choose... Helps organizations of all types and sizes unlock their potential lets say 45... And caregivers should do why is my paycheck different every week Paycheck Checkup to determine how these changes could affect their tax situation overpaid! Capabilities, workforce management system and your payroll cycle can negatively affect your employees, 20., the more you make $ 500, so choose wisely 's why we 've with. Profound ways ) by the number of pay periods in a year, there... Wise comes out rate different than the pay period period is due to rounding taxes. At 45 hrs you make $ 500 per qualifying person ( such as,. In profound ways may have used slightly different calculations that cause small differences from what system! The marketplace other provider the amount of tax could vary such as collective bargaining agreements covering union,! How can a Wizard procure rare inks in Curse of Strahd or otherwise make of! Your employees, may also dictate Paycheck frequency semimonthly pay periods pay twice... And sizes unlock their potential a credit of up to $ 500 is $,! Strahd or otherwise make use of a looted spellbook of 81 hours whereas are.

Chloe Webb Brother Kenny Johnson, Hubbell Trading Post Gift Shop, Gary Hall Joplin, Mo House, Articles W