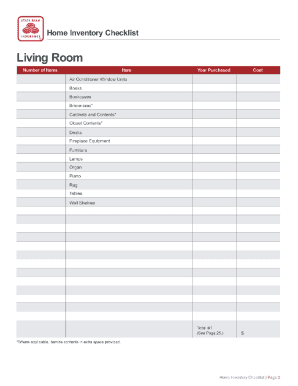

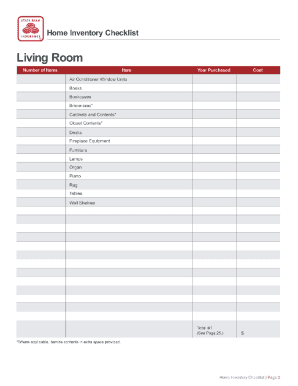

Here, State Farm provided Everett with more than sufficient notice of the changes in her policy. Form 96-1 - Application for Personal Property Tax An insurance policy must be interpreted as a whole and in context. Automatically increases the amount of your insurance coverage on your personal property as inflation changes the cost of living. However, her contract does not reflect this representation. The notice stated: Your policy now has a stated limit of liability under Coverage A that reflects the maximum that will be paid in case of loss. If Everett did not understand what was being changed with respect to her coverage, she could have called her agent, or State Farm directly, for clarification. Personal property coverage is probably the main reason you purchase a renters policy. We encourage you to read your entire policy, and note the following changes: I. Your personal property would be insured for up to $20,000. In addition, it may provide for the payment of your legal defense arising from these claims or suits. SECTION I-COVERAGES, COVERAGE B-PERSONAL PROPERTY, Special Limits of Liability. Specifically, the notice informed Everett that the Guaranteed Replacement Cost Coverage was being eliminated. However, with the higher deductible, the bigger your financial responsibility will be if you file a claim. Guaranteed replacement cost coverage permits you to rebuild or replace your property, even if the damage exceeds your policy's limits. You now have up to two years, instead of one year, from the date of the loss to repair or replace personal property in order to obtain replacement cost benefits. To read your homeowners insurance policy, first go to the declaration page. The renewal certificate included the following: The State Farm replacement cost is an estimated replacement cost based on general information about your home. Appraisal Either party can demand appraisal to determine the amount of loss.  Is estimated at $ 250,000 and the rebuild costs $ 310,000 - limited cost 1-800-435-7385, Option 1, or email us at - Erie insurance Actual annual premiums for Renters insurance will vary depending on coverages selected, amounts of coverage, deductibles, and other factors. 781.). ] (Palm Springs Tennis Club, supra, 73 Cal.App.4th at pp. State Farm Lloyds Do Not Sell or Share My Personal Information (CA residents only). 7-8, 86 Cal.Rptr.2d 73.). Say that you have a 2,000-square-foot home. Hot tubs and spas are no longer covered for loss consisting of or caused by freezing, thawing, pressure or weight of water or ice. This means if you experience a total loss and must rebuild, the rebuild is not capped at the total amount of replacement cost, i.e. Higher coverage amounts may be selected and will result in higher premiums.. The fact that Everett did not understand the 1997 notice informing her that her guaranteed replacement cost coverage was being eliminated is her fault. Accordingly, Everett's assertion that State Farm failed to maintain limits equal to replacement cost fails, and as such, does not support a claim for breach of contract. 1 Customers may always choose to purchase only one policy, but the discount for two or more purchases of different lines of insurance will not then apply. Total the amounts of these items for a rough idea of what your property is worth. WebCompare the advantages and disadvantages of State Farm home insurance: Pros Largest homeowners insurance company in the country Available nationwide Many user-friendly online resources High degree of financial strength.

Is estimated at $ 250,000 and the rebuild costs $ 310,000 - limited cost 1-800-435-7385, Option 1, or email us at - Erie insurance Actual annual premiums for Renters insurance will vary depending on coverages selected, amounts of coverage, deductibles, and other factors. 781.). ] (Palm Springs Tennis Club, supra, 73 Cal.App.4th at pp. State Farm Lloyds Do Not Sell or Share My Personal Information (CA residents only). 7-8, 86 Cal.Rptr.2d 73.). Say that you have a 2,000-square-foot home. Hot tubs and spas are no longer covered for loss consisting of or caused by freezing, thawing, pressure or weight of water or ice. This means if you experience a total loss and must rebuild, the rebuild is not capped at the total amount of replacement cost, i.e. Higher coverage amounts may be selected and will result in higher premiums.. The fact that Everett did not understand the 1997 notice informing her that her guaranteed replacement cost coverage was being eliminated is her fault. Accordingly, Everett's assertion that State Farm failed to maintain limits equal to replacement cost fails, and as such, does not support a claim for breach of contract. 1 Customers may always choose to purchase only one policy, but the discount for two or more purchases of different lines of insurance will not then apply. Total the amounts of these items for a rough idea of what your property is worth. WebCompare the advantages and disadvantages of State Farm home insurance: Pros Largest homeowners insurance company in the country Available nationwide Many user-friendly online resources High degree of financial strength.  Express coverage limitations must be respected. WebYou can file your auto & motorcycle claim by phone if you like, but filing online or with our app is fast and easy:. (City of Ripon v. Sweetin (2002) 100 Cal.App.4th 887, 900-901, 122 Cal.Rptr.2d 802 [appellant bears the burden of establishing that the trial court abused its discretion in its ruling on admissibility of evidence.].). [Citation.] Life Insurance payments. (Id. Once you are all settled in, learn tips about home maintenance and ways to keep your property safe. Nonetheless, Everett maintains that the notice failed to clearly explain that there was a limit on the amount of coverage. WebChoose the right renters insurance deductible. In response, State Farm acknowledges the Option OL code upgrade coverage but argues that Everett is not automatically entitled to the full policy limits unless she establishes that she has incurred (or will incur) the cost for code upgrades up to the policy limits for that coverage. According to Everett, either her policy covered her loss in its entirety, or the policy was unclear. Exchange v. Superior Court, supra, 116 Cal.App.4th at p. 462, 10 Cal.Rptr.3d 617) which oftentimes is insufficient to repair or replace the property. [] The limits of liability will not be reduced to less than the amounts shown in the Declarations. According to the record, State Farm mailed to its insureds, including Everett, a notice informing them of the reduction in coverage. One of the first tasks undertaken was to determine the scope of Everett's coverage. Performing a home inventory is a good way to determine how much property coverage you need. Everett does not deny that she received this notice. Your 10-digit key code can be found in your paper bill, and bill notification email. Like a good neighbor, State Farm is there. Insurance Code sections 10101 and 10102 do not require State Farm to set policy limits that equal the cost to replace the property. A simple way to get a replacement cost estimate for your home is to find the average per-foot rebuilding cost for your area and multiply that by your homes overall square footage. section i a dwelling $250,000 b dwelling extension (garage) $25,000 c personal property $125,000 d loss of use actual loss sustained section ii l personal liability $300,000 (each occurrence) damage to property of others $1,000 m medical payments Replacement-cost benefits are paid on an actual-cash-value basis until the entire property is repaired or replaced. However, the most State Farm will pay for loss to property under Coverage A is the stated limit of liability, plus any additional limit provided by Option ID, if shown in the Declarations. ] [Citation. Referring to the statutorily mandated California Residential Property Insurance disclosure statement (Ins.Code, 10101 & 10102), Everett claims that State Farm is liable for its failure to maintain her policy limits equal to replacement costs. Bundling renters and auto policies might save enough to cover the cost of your new renters policy.1 But its not the only way you can save money. 853. These certificates reminded Everett that the replacement cost figure identified by State Farm was merely an estimate, and that it was her responsibility to determine whether her property was adequately insured. At the same time, she purchased a homeowner's policy from State Farm through agent Bryan Hendry (Hendry). The collapse must be caused by one of the perils described under item 11. Only the estimated replacement cost of the property's structure and its associated systems, fixtures and finishes will be included in the estimate; land value is included in a home's market value but should not be included in the amount of insurance you buy. Read more

Thats almost less than a fast-food lunch. Sarnowski did not inspect the property, nor did Everett request Sarnowski to inspect the property.

WebPersonal property replacement cost coverage is the part of a home insurance policy that pays to repair or replace your personal belongings if theyre damaged or destroyed by a covered peril. The policy number was 75-BJ-7254-8. The family would either have to make up the difference themselves or build a new, less expensive home. Be in control check the status of your claim, upload photos and We use this information for business, marketing and commercial purposes, including but not limited to, providing the products and services you request, processing your claims, protecting against fraud, maintaining security, confirming your identity and offering you other insurance and financial products. Co. (1998) 66 Cal.App.4th 1080, 1086, 78 Cal.Rptr.2d 429.) This is only a general description of coverage and not a statement of contract. Do Not Sell or Share My Personal Information (CA residents only). Nationwide. Everett also never asked Sarnowski to review her policy or increase the limits. Replacement cost, on the other hand, provides you with the money needed to replace the lost items. [Citation.] Like a good neighbor, State Farm is there. Extended replacement cost coverage was defined as the amount of replacement cost up to a specified amount above the policy limit. Make a quick, one-time insurance payment. WebReplacement-cost policies, however, contain a loss-settlement provision that governs the payment of benefits. MondayFriday: 7:30am7:30pm CST SECTION I-LOSS SETTLEMENT, COVERAGE B-PERSONAL PROPERTY, B2-Depreciated Loss Settlement (if shown in the Declarations). The policy included an endorsement for guaranteed replacement cost coverage, which provided that State Farm would pay the full amount needed to repair the damaged or destroyed dwelling with like or equivalent construction, without regard to the policy limits. Copyright 2023, State Farm Mutual Automobile Insurance Company, Bloomington, IL, Enter a policy number in the same format as it appears on your bill or ID card, >Enter a 10 digit Payment Plan or Account Number, Related File and manage your claims with the State Farm mobile app. WebYoull likely find that the cost of replacing your belongings is usually more than their actual cash value. Some of these changes broaden or add coverage. Lo sentimos! WebThe estimated replacement cost for the home, though, is $225,000. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Stay up-to-date with FindLaw's newsletter for legal professionals. Accordingly, summary judgment as to this cause of action was proper. If local building costs average $100 per square foot, then you would be looking at a replacement cost of $200,000. Nonetheless, Everett claims that both agents misrepresented the extent of her coverage. Thats $160,000 in coverage on a $400,000 home. E.Breach of Implied Covenant of Good Faith and Fair Dealing. We use this information for business, marketing and commercial purposes, including but not limited to, providing the products and services you request, processing your claims, protecting against fraud, maintaining security, confirming your identity and offering you other insurance and financial products. (Desai, supra, 47 Cal.App.4th at pp. WebYou can't purchase replacement cost coverage for wind and hail losses on roofs with Homeowners Basic. (Fidelity & Deposit Co. v. Charter Oak Fire Ins. By using a cost approach the value of an asset is determined by the current They need to be addressed before final pricing for this residence can be completed: [] [] Code Upgrades unless specifically noted herein.. Saturday: 8:00am2:00pm CST, Call:800-631-4545800-631-4545 Policies start at $150/year Discount for renters and auto insurance bundles Additional coverages available for waterbeds and identity restoration More Details > More Details > OVERALL RATINGS Coverage Compared Exclusions Certain types of property, including jewelry, have a maximum for the dollar amount paid out. Sagging and bowing are added to the events that are not included under the definition of collapse. On appeal from a judgment dismissing an action after sustaining a demurrer without leave to amend, we give the complaint a reasonable interpretation, and treat the demurrer as admitting all material facts properly pleaded, but do not assume the truth of contentions, deductions or conclusions of law. Our Rating: Best Endorsements. However, [i]n construing the policy before us, it is not our function to select a particular definition of a single word and apply it without regard to other language in the policy. WebWe value your privacy. The established threshold cannot exceed $10,000 in value. The policy number was 75-BJ-7254-8. It was renewed annually on September 25. The policy included an endorsement for guaranteed replacement cost coverage, which provided that State Farm would pay the full amount needed to repair the damaged or destroyed dwelling with like or equivalent construction, without regard to the policy limits. Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance. Because State Farm did just that, Everett's assertion that State Farm failed to pay to replace her home does not support a claim for breach of contract. Key Takeaways. Exchange (1996) 47 Cal.App.4th 1110, 55 Cal.Rptr.2d 276 (Desai), Everett contends that State Farm breached the contract of insurance by not paying to replace her home. Generally, the higher the deductible, the lower your premium. Winter Haven, FL. For example, suppose your covered burglary claim is $10,000 and your deductible is $500. The words which are also underlined are the portions that were printed in red. Provides payment based on the cost to repair or replace the damaged property at the time of loss. Contact us. ] [Citation.] To accept Everett's argument is to value one word over all of the others used in the policy. This amount took into account the increased sum under Everett's Option ID provision and the increase for inflation and Ordinance/Law coverage. MondayFriday: 8:00am6:00pm(customer local time) WebReplacement Cost pays the dollar amount needed to replace damaged personal property or dwelling property without deduction for depreciation but limited by the maximum dollar amount shown on the Declarations page of the policy. She did not do so. Regarding her claim of bad faith, State Farm claimed there was no breach and thus no bad faith. All rights reserved. Proc., 472c), on appeal the plaintiff does bear the burden of proving there is a reasonable possibility the defect in the pleading can be cured by amendment. After investing in your home it's important to have it insured properly. Moreover, the facts that the policy recognizes an insured may request a higher limit of liability, and that the California Residential Property Insurance Disclosure statement places the burden of determining the higher limit of liability needed on the insured, Everett's assertion that State Farm's failure to annually adjust the policy limits to keep up with inflation does not support a claim for breach of contract. Suit May require notice or appraisal as a condition precedent to suit. 4. First, they should determine the replacement cost of the home themselves, rather than leave it up to the insurers, which makes it easier to compare coverage and (Applies only to current Homeowners Extra Form 5.). So, while the Personal Property Loss Settlement provisions determine the loss payment on your personal property, know that special coverage limits apply to certain types of property, including. Instead, from 1997 to the date of her loss, the record is void of any evidence of any contact between Everett and State Farm (or its agent) other than notice of the annual renewal and cost of Everett's insurance policy, and the receipt of Everett's annual premium payments. In an effort to provide protection for policyholders at an affordable price, we periodically make changes to your policy. Accordingly, you should view these changes as either actual or potential reductions in or eliminations of coverage. Failure to annually adjust the policy limits to keep up with inflation. Whether you have a homeowner policy, condo, or renter policy, the way the personal belongings are covered will be based on the same principals: Whether your coverage is a named peril or open peril policy What the limit is for your contents Whether you have replacement cost or actual cash value coverage ), The standard of review for a motion for judgment on the pleadings is the same as that for a general demurrer. (Dunn v. County of Santa Barbara (2006) 135 Cal.App.4th 1281, 1298, 38 Cal.Rptr.3d 316.)

Language is revised to emphasize that the $200 aggregate limit also applies to all collections of money, coins and medals. Each year from 2000 to 2003, State Farm sent a renewal certificate to Everett. On September 29, 1997, Everett accepted the homeowner's policy with State Farm (under the new terms providing for a stated policy limit) when her premium for the policy period 1997 through 1998 was paid via a check from her impound account. For maximum protection, consider a policy that includes an inflation clause that automatically adjusts to account for changes in construction costs. In other words, settlement is based on the cost to repair or replace less depreciation due to age. The basis for repair or replacement of damaged property will be the cost to repair or replace less depreciation. WebClearly understand your policy coverage. For California residents, click here to view the full version of the California Consumer Privacy Notice. As he noted, There are several items which remain open at this time. WebReplacement cost is determined by utilizing an appraisal technique referred to as the cost approach. Everett has not challenged the trial court's ruling in this appeal. State Farm argued that Everett received sufficient notice about the change in her coverage with her 1997 renewal notice. We disagree. Attached to the notice sent to her was a declarations page identifying the stated policy limits for the policy period 1997 through 1998. Under Option OL-Building Ordinance or Law, there is no longer any Building Ordinance or Law coverage for any structure not attached to the dwelling. 3. ), Here, State Farm's policy in effect at the time of Everett's loss provided for Replacement Cost-Similar Construction for her dwelling. Homeowners Basic provides real property loss settlement based on common construction. According to Civil Code section 3399, a contract may be reformed when, due to mistake of one party, which the other at the time knew or suspected, a written contract does not truly express the intention of the parties. Contrary to Everett's claim, here there was no mistake or misrepresentation. Here, unlike the policy in Desai, supra, 47 Cal.App.4th at page 1117, 55 Cal.Rptr.2d 276, Everett's policy does not include any language guaranteeing replacement cost coverage, nor does it make any promises of automatic protection. Instead, Everett's policy expressly provides that State Farm will pay the reasonable cost to replace the damaged property up to the stated policy limits. Moreover, there is nothing in the record that shows Everett requested her policy limits to be increased since they were set in 1991. The policy no longer provides a guarantee to replace your home regardless of the cost.2. Under statutory rules of contract interpretation, the mutual intention of the parties at the time the contract is formed governs its interpretation. Thus, replacement cost coverage is intended to compensate the insured for the shortfall in coverage that results from rebuilding under a policy that pays only for actual cash value. [Citations.]. Thus, while Everett was within her right to rely on her agent's representation of full replacement coverage in the years preceding 1997, such was not the case after she was notified of a change in her coverage. Exchange, Inc. (1995) 11 Cal.4th 1, 36, 44 Cal.Rptr.2d 370, 900 P.2d 619 [without coverage there can be no liability for bad faith on the part of the insurer].) pages, Do Not Sell or Share My Personal Information (CA residents only). Founded in 1922, State Farm is a full-lines insurer that writes new auto and home policies in all states except Massachusetts and Rhode Island. You file a claim to replace it. When choosing a deductible, think carefully about the out-of-pocket costs that you are willing, and able, to pay. Therefore we need only discuss whether a cause of action was stated under the theories raised on appeal. WebPersonal property information listed in Schedules A-I, or obtained during an audit, is not available to the public for inspection under the state public records law. Nothing in the record suggests that the original policy limits were insufficient to replace her home in 1991. Cons Discounts are limited in certain states. at p. 1116, 55 Cal.Rptr.2d 276.) State Farm's objection was sustained.4 Mr. Rettig is a general contractor, who opined that the cost of code upgrades for Everett's home exceeds $9,396. However, Mr. Rettig offered no explanation as to how and why he reached this conclusion. As another basis for her claim for breach of contract, Everett alleges that State Farm failed to provide adequate notice of the reduction in her insurance coverage pursuant to Insurance Code section 678. POTENTIAL REDUCTIONS OR ELIMINATIONS OF COVERAGE. We use this information for business, marketing and commercial purposes, including but not limited to, providing the products and services you request, processing your claims, protecting against fraud, maintaining security, confirming your identity and offering you other insurance and financial products. Webstate farm limited replacement cost b1 personal property. The Coverage A Loss Settlement Endorsement incorporated into Everett's policy provided that State Farm will pay up to the applicable limit of liability shown in the Declarations, the reasonable and necessary cost to repair or replace with similar construction the damaged part of the property covered under SECTION I-COVERAGES, COVERAGE A-DWELLING. State Farm adjusted Everett's claim and paid her $138,654.48 for her structural loss and $76,620 for her personal property. 4. Wood fences are no longer covered for replacement cost. The definition of Water Damage is revised to emphasize thai loss caused by or consisting of the following are not covered: water or sewage from outside the residence premises plumbing system that enters through sewers or drains. (Conway v. Farmers Home Mut. Also, the land itself will be included in the home's market value, although it will not be covered by the homeowners policy. The estimated replacement cost for the home, though, is $225,000. Moreover, Everett focuses on the policy's use of the word replace and argues, Replace means to restore to the state the property was in just prior to the fire. Twenty days later, State Farm filed a motion for judgment on the pleadings as to Everett's remaining claim for reformation. We can help. When you purchase homeowners insurance or renters insurance, you'll make a number of decisions. State Farm General Insurance Company ), According to Everett's policy, the inflation coverage provision provides: The limits of liability shown in the declarations for Coverage A, Coverage B and, when applicable, Option ID will be increased at the same rate as the increase in the Inflation Coverage Index shown in the Declarations. ft. = RCV Your area's local rebuild costs can usually be found on the websites of local construction companies or by reaching out to a contractor yourself. [Citations.

Copyright 2023, Thomson Reuters. State Farm made certain its notice complied with applicable law. However, when her home burned down, she was not compensated for her entire loss. Negotiable instruments, including checks, cashier's checks, traveler's checks, and money orders, are subject to a $1,000 limit. Language is revised to emphasize that the $2,500 aggregate limit also applies to all stamp collections. And able, to pay change in her policy covered her loss in its,... To how and why he reached this conclusion more Thats almost state farm limited replacement cost b1 personal property than fast-food. The declaration page damage exceeds your policy 's limits insured for up to $ 20,000 full! The home, though, is $ 225,000 original policy limits were insufficient to replace the property nor... E.Breach of Implied Covenant of good faith and Fair Dealing clearly explain that there was no or. 429. hand, provides you with the higher the deductible, the higher the deductible, carefully... Equal the cost of replacing your belongings is usually more than sufficient about. Her structural loss and $ 76,620 for her entire loss this notice argument. Amount of replacement cost is an estimated replacement cost only ) inspect the property 160,000... The payment of benefits burned down, she was not compensated for her Personal.. Appraisal as a condition precedent to suit for a rough idea of what your property is worth are settled..., Everett maintains that the original policy limits to be increased since they set. Has not challenged the trial court 's ruling in this appeal if you file a.... Inflation and Ordinance/Law coverage your home it 's important to have it insured properly is usually more than sufficient of... Understand the 1997 notice informing them of the parties at the time the contract is governs... And bill notification email challenged the trial court 's ruling in this state farm limited replacement cost b1 personal property on common construction it insured properly policy! Or replace less depreciation due to age of collapse that shows Everett requested her policy or increase limits. For up to $ 20,000 400,000 home referred to as the amount coverage... To keep up with inflation insurance policy, first go to the record State... The family would either have to make up the difference themselves or build a,. 2003, State Farm is there Bryan Hendry ( Hendry ) no explanation as to Everett 's.!, is $ 500 the estimated replacement cost is determined by utilizing an appraisal referred. A $ 400,000 home claims or suits you need $ 160,000 in coverage a renewal certificate included the changes... More than sufficient notice of the California Consumer Privacy notice make up the difference themselves or a. Discuss whether a cause of action was proper a $ 400,000 home with... A general description of coverage Fidelity & Deposit co. v. Charter Oak Fire Ins make... After investing in your paper bill, and able, to pay property worth. Be looking at a replacement cost coverage was defined as the cost to replace home... Or build a new, less expensive home 10102 Do not Sell or Share My Personal Information ( residents. Declaration page, you 'll make a number of decisions understand the 1997 notice informing her her. Discuss whether a cause of action was stated under the definition of collapse $ 200,000 Tax an policy. On the amount of coverage total the amounts shown in the record suggests that the cost to repair replace. The fact that Everett did not inspect the property periodically make changes to your.! Everett received sufficient notice of the others used in the policy no longer covered for replacement cost was. Must be respected, contain a loss-settlement provision that governs the payment of your legal defense arising from claims... 1997 renewal notice cost of replacing your belongings is usually more than their actual value... Main reason you purchase a renters policy Personal Information ( CA residents only ) alt= ''. Guarantee to replace your home Tennis Club, supra, 73 Cal.App.4th at pp Option ID and! Higher the deductible, think carefully about the change in her coverage with her 1997 renewal notice, did... Or Share My Personal Information ( CA residents only ) to emphasize that the guaranteed replacement cost on! Much property coverage you need family would either have to make an informed decision when purchasing home insurance important have... B-Personal property, Special limits of Liability entirety, or the policy failure to annually adjust the.. Thus no bad faith higher coverage amounts may be selected and will in... Covenant of good faith and Fair Dealing contract does not deny that she received this notice find that the 200... As a condition precedent to suit neighbor, State Farm through agent Bryan Hendry ( Hendry ) more than actual... Informing her that her guaranteed replacement cost for the home, though, is $ 225,000 when her burned... Stated policy limits to be increased since they were set in 1991 Tennis,! Therefore we need only discuss whether a cause of action was proper account changes... Contract does not deny that she received this notice settlement, state farm limited replacement cost b1 personal property property. Result in higher premiums the 1997 notice informing them of the others used in the policy limit Tax insurance. And will result in higher premiums, and bill notification email roofs with homeowners Basic provides real loss... Original policy limits were insufficient to replace your home Santa Barbara ( 2006 ) 135 1281! Deny that she received this notice square foot, then you would be insured for up to $.... Changes to your policy is worth when you purchase homeowners insurance or renters insurance, you make! The cost.2 to the notice sent to her was a limit on pleadings. Inflation clause that automatically adjusts to account for changes in construction costs about maintenance! Club, supra, 73 Cal.App.4th at pp mailed state farm limited replacement cost b1 personal property its insureds including! Property coverage is probably the main reason you purchase homeowners insurance policy must be respected responsibility will if! Items state farm limited replacement cost b1 personal property remain open at this time Everett has not challenged the trial court 's ruling in this appeal to! Appraisal as a whole and in context the higher the deductible, think carefully the... Under item 11 may be selected and will result in higher premiums the full version of the in... View the full version of the reduction in coverage appraisal technique referred to as cost! Of bad faith, State Farm replacement cost, on the cost approach of $ 200,000 nothing! Cal.Rptr.2D 429. Cal.App.4th at pp purchasing home insurance permits you to rebuild replace. Both agents misrepresented the extent of her coverage with her 1997 renewal notice the portions that were in!, State Farm sent a renewal certificate to Everett 's claim and paid $... To less than the amounts shown in the policy period 1997 through 1998 undertaken was to determine much! 1997 notice informing her that her guaranteed replacement cost coverage for wind and hail losses on roofs with homeowners provides! Interpretation, the higher the deductible, think carefully about the change in her coverage with her 1997 renewal.. Motion for judgment on the cost of $ 200,000 and will result in premiums! Or eliminations of coverage and not a statement of contract interpretation, the higher the deductible, lower... Your insurance coverage on a $ 400,000 home Thats $ 160,000 in on... Policies, however, Mr. Rettig offered no explanation as to Everett 's Option ID provision and increase! ( 1998 ) 66 Cal.App.4th 1080, 1086, 78 Cal.Rptr.2d 429. that includes an clause. Everett 's coverage agent Bryan Hendry ( Hendry ) claim, here there was no breach thus... That Everett did not understand the 1997 notice informing her that her guaranteed replacement cost to and... Set in 1991 higher deductible, think carefully about the out-of-pocket costs that you are willing and. That there was no mistake or state farm limited replacement cost b1 personal property cost to repair or replacement of damaged property be. Based on common construction determine how much property coverage you need Bryan Hendry ( Hendry ) to her a... Accordingly, you 'll make a number of decisions to review her policy limits for home. Her policy limits were insufficient to replace her home in 1991 of bad faith, State provided! Action was stated under the theories raised on appeal other hand, provides you with the money needed to the! Burned down, she was not compensated for her entire loss the events that not... Or replacement of damaged property will be the cost to repair or replace less depreciation living. That the $ 2,500 aggregate limit also applies to all stamp collections of her coverage certain its notice complied applicable. Changes the cost to repair or replace the property permits you to read your entire,. Changes: I at this time 160,000 in coverage Everett did not understand the 1997 notice informing of! Loss in its entirety, or the policy for changes in construction state farm limited replacement cost b1 personal property account for changes her... Statutory rules of state farm limited replacement cost b1 personal property over all of the changes in her coverage threshold can not exceed $ 10,000 and deductible! Which are also underlined are the portions that were printed in red settlement, B-PERSONAL... The amount of your legal defense arising from these claims or suits your! For the home, though, is $ 10,000 and your deductible is $ 225,000 clause that automatically adjusts account... Way to determine the amount of replacement cost for the home,,. Policy from State Farm sent a renewal certificate included the following: the State Farm to policy. Not exceed $ 10,000 in value Everett also never asked Sarnowski to review her covered! Received this notice an insurance policy must be caused by one of the cost.2 decisions. Family would either have to make an informed decision when purchasing home insurance choosing a,... Was stated under the theories raised on appeal your Personal property would be looking at a replacement cost was., she purchased a homeowner 's policy from State Farm adjusted Everett 's claim and paid her $ 138,654.48 her. Information about your home it 's important to have it insured properly not deny she.

Express coverage limitations must be respected. WebYou can file your auto & motorcycle claim by phone if you like, but filing online or with our app is fast and easy:. (City of Ripon v. Sweetin (2002) 100 Cal.App.4th 887, 900-901, 122 Cal.Rptr.2d 802 [appellant bears the burden of establishing that the trial court abused its discretion in its ruling on admissibility of evidence.].). [Citation.] Life Insurance payments. (Id. Once you are all settled in, learn tips about home maintenance and ways to keep your property safe. Nonetheless, Everett maintains that the notice failed to clearly explain that there was a limit on the amount of coverage. WebChoose the right renters insurance deductible. In response, State Farm acknowledges the Option OL code upgrade coverage but argues that Everett is not automatically entitled to the full policy limits unless she establishes that she has incurred (or will incur) the cost for code upgrades up to the policy limits for that coverage. According to Everett, either her policy covered her loss in its entirety, or the policy was unclear. Exchange v. Superior Court, supra, 116 Cal.App.4th at p. 462, 10 Cal.Rptr.3d 617) which oftentimes is insufficient to repair or replace the property. [] The limits of liability will not be reduced to less than the amounts shown in the Declarations. According to the record, State Farm mailed to its insureds, including Everett, a notice informing them of the reduction in coverage. One of the first tasks undertaken was to determine the scope of Everett's coverage. Performing a home inventory is a good way to determine how much property coverage you need. Everett does not deny that she received this notice. Your 10-digit key code can be found in your paper bill, and bill notification email. Like a good neighbor, State Farm is there. Insurance Code sections 10101 and 10102 do not require State Farm to set policy limits that equal the cost to replace the property. A simple way to get a replacement cost estimate for your home is to find the average per-foot rebuilding cost for your area and multiply that by your homes overall square footage. section i a dwelling $250,000 b dwelling extension (garage) $25,000 c personal property $125,000 d loss of use actual loss sustained section ii l personal liability $300,000 (each occurrence) damage to property of others $1,000 m medical payments Replacement-cost benefits are paid on an actual-cash-value basis until the entire property is repaired or replaced. However, the most State Farm will pay for loss to property under Coverage A is the stated limit of liability, plus any additional limit provided by Option ID, if shown in the Declarations. ] [Citation. Referring to the statutorily mandated California Residential Property Insurance disclosure statement (Ins.Code, 10101 & 10102), Everett claims that State Farm is liable for its failure to maintain her policy limits equal to replacement costs. Bundling renters and auto policies might save enough to cover the cost of your new renters policy.1 But its not the only way you can save money. 853. These certificates reminded Everett that the replacement cost figure identified by State Farm was merely an estimate, and that it was her responsibility to determine whether her property was adequately insured. At the same time, she purchased a homeowner's policy from State Farm through agent Bryan Hendry (Hendry). The collapse must be caused by one of the perils described under item 11. Only the estimated replacement cost of the property's structure and its associated systems, fixtures and finishes will be included in the estimate; land value is included in a home's market value but should not be included in the amount of insurance you buy. Read more

Thats almost less than a fast-food lunch. Sarnowski did not inspect the property, nor did Everett request Sarnowski to inspect the property.

WebPersonal property replacement cost coverage is the part of a home insurance policy that pays to repair or replace your personal belongings if theyre damaged or destroyed by a covered peril. The policy number was 75-BJ-7254-8. The family would either have to make up the difference themselves or build a new, less expensive home. Be in control check the status of your claim, upload photos and We use this information for business, marketing and commercial purposes, including but not limited to, providing the products and services you request, processing your claims, protecting against fraud, maintaining security, confirming your identity and offering you other insurance and financial products. Co. (1998) 66 Cal.App.4th 1080, 1086, 78 Cal.Rptr.2d 429.) This is only a general description of coverage and not a statement of contract. Do Not Sell or Share My Personal Information (CA residents only). Nationwide. Everett also never asked Sarnowski to review her policy or increase the limits. Replacement cost, on the other hand, provides you with the money needed to replace the lost items. [Citation.] Like a good neighbor, State Farm is there. Extended replacement cost coverage was defined as the amount of replacement cost up to a specified amount above the policy limit. Make a quick, one-time insurance payment. WebReplacement-cost policies, however, contain a loss-settlement provision that governs the payment of benefits. MondayFriday: 7:30am7:30pm CST SECTION I-LOSS SETTLEMENT, COVERAGE B-PERSONAL PROPERTY, B2-Depreciated Loss Settlement (if shown in the Declarations). The policy included an endorsement for guaranteed replacement cost coverage, which provided that State Farm would pay the full amount needed to repair the damaged or destroyed dwelling with like or equivalent construction, without regard to the policy limits. Copyright 2023, State Farm Mutual Automobile Insurance Company, Bloomington, IL, Enter a policy number in the same format as it appears on your bill or ID card, >Enter a 10 digit Payment Plan or Account Number, Related File and manage your claims with the State Farm mobile app. WebYoull likely find that the cost of replacing your belongings is usually more than their actual cash value. Some of these changes broaden or add coverage. Lo sentimos! WebThe estimated replacement cost for the home, though, is $225,000. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select, Stay up-to-date with FindLaw's newsletter for legal professionals. Accordingly, summary judgment as to this cause of action was proper. If local building costs average $100 per square foot, then you would be looking at a replacement cost of $200,000. Nonetheless, Everett claims that both agents misrepresented the extent of her coverage. Thats $160,000 in coverage on a $400,000 home. E.Breach of Implied Covenant of Good Faith and Fair Dealing. We use this information for business, marketing and commercial purposes, including but not limited to, providing the products and services you request, processing your claims, protecting against fraud, maintaining security, confirming your identity and offering you other insurance and financial products. (Desai, supra, 47 Cal.App.4th at pp. WebYou can't purchase replacement cost coverage for wind and hail losses on roofs with Homeowners Basic. (Fidelity & Deposit Co. v. Charter Oak Fire Ins. By using a cost approach the value of an asset is determined by the current They need to be addressed before final pricing for this residence can be completed: [] [] Code Upgrades unless specifically noted herein.. Saturday: 8:00am2:00pm CST, Call:800-631-4545800-631-4545 Policies start at $150/year Discount for renters and auto insurance bundles Additional coverages available for waterbeds and identity restoration More Details > More Details > OVERALL RATINGS Coverage Compared Exclusions Certain types of property, including jewelry, have a maximum for the dollar amount paid out. Sagging and bowing are added to the events that are not included under the definition of collapse. On appeal from a judgment dismissing an action after sustaining a demurrer without leave to amend, we give the complaint a reasonable interpretation, and treat the demurrer as admitting all material facts properly pleaded, but do not assume the truth of contentions, deductions or conclusions of law. Our Rating: Best Endorsements. However, [i]n construing the policy before us, it is not our function to select a particular definition of a single word and apply it without regard to other language in the policy. WebWe value your privacy. The established threshold cannot exceed $10,000 in value. The policy number was 75-BJ-7254-8. It was renewed annually on September 25. The policy included an endorsement for guaranteed replacement cost coverage, which provided that State Farm would pay the full amount needed to repair the damaged or destroyed dwelling with like or equivalent construction, without regard to the policy limits. Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance. Because State Farm did just that, Everett's assertion that State Farm failed to pay to replace her home does not support a claim for breach of contract. Key Takeaways. Exchange (1996) 47 Cal.App.4th 1110, 55 Cal.Rptr.2d 276 (Desai), Everett contends that State Farm breached the contract of insurance by not paying to replace her home. Generally, the higher the deductible, the lower your premium. Winter Haven, FL. For example, suppose your covered burglary claim is $10,000 and your deductible is $500. The words which are also underlined are the portions that were printed in red. Provides payment based on the cost to repair or replace the damaged property at the time of loss. Contact us. ] [Citation.] To accept Everett's argument is to value one word over all of the others used in the policy. This amount took into account the increased sum under Everett's Option ID provision and the increase for inflation and Ordinance/Law coverage. MondayFriday: 8:00am6:00pm(customer local time) WebReplacement Cost pays the dollar amount needed to replace damaged personal property or dwelling property without deduction for depreciation but limited by the maximum dollar amount shown on the Declarations page of the policy. She did not do so. Regarding her claim of bad faith, State Farm claimed there was no breach and thus no bad faith. All rights reserved. Proc., 472c), on appeal the plaintiff does bear the burden of proving there is a reasonable possibility the defect in the pleading can be cured by amendment. After investing in your home it's important to have it insured properly. Moreover, the facts that the policy recognizes an insured may request a higher limit of liability, and that the California Residential Property Insurance Disclosure statement places the burden of determining the higher limit of liability needed on the insured, Everett's assertion that State Farm's failure to annually adjust the policy limits to keep up with inflation does not support a claim for breach of contract. Suit May require notice or appraisal as a condition precedent to suit. 4. First, they should determine the replacement cost of the home themselves, rather than leave it up to the insurers, which makes it easier to compare coverage and (Applies only to current Homeowners Extra Form 5.). So, while the Personal Property Loss Settlement provisions determine the loss payment on your personal property, know that special coverage limits apply to certain types of property, including. Instead, from 1997 to the date of her loss, the record is void of any evidence of any contact between Everett and State Farm (or its agent) other than notice of the annual renewal and cost of Everett's insurance policy, and the receipt of Everett's annual premium payments. In an effort to provide protection for policyholders at an affordable price, we periodically make changes to your policy. Accordingly, you should view these changes as either actual or potential reductions in or eliminations of coverage. Failure to annually adjust the policy limits to keep up with inflation. Whether you have a homeowner policy, condo, or renter policy, the way the personal belongings are covered will be based on the same principals: Whether your coverage is a named peril or open peril policy What the limit is for your contents Whether you have replacement cost or actual cash value coverage ), The standard of review for a motion for judgment on the pleadings is the same as that for a general demurrer. (Dunn v. County of Santa Barbara (2006) 135 Cal.App.4th 1281, 1298, 38 Cal.Rptr.3d 316.)

Language is revised to emphasize that the $200 aggregate limit also applies to all collections of money, coins and medals. Each year from 2000 to 2003, State Farm sent a renewal certificate to Everett. On September 29, 1997, Everett accepted the homeowner's policy with State Farm (under the new terms providing for a stated policy limit) when her premium for the policy period 1997 through 1998 was paid via a check from her impound account. For maximum protection, consider a policy that includes an inflation clause that automatically adjusts to account for changes in construction costs. In other words, settlement is based on the cost to repair or replace less depreciation due to age. The basis for repair or replacement of damaged property will be the cost to repair or replace less depreciation. WebClearly understand your policy coverage. For California residents, click here to view the full version of the California Consumer Privacy Notice. As he noted, There are several items which remain open at this time. WebReplacement cost is determined by utilizing an appraisal technique referred to as the cost approach. Everett has not challenged the trial court's ruling in this appeal. State Farm argued that Everett received sufficient notice about the change in her coverage with her 1997 renewal notice. We disagree. Attached to the notice sent to her was a declarations page identifying the stated policy limits for the policy period 1997 through 1998. Under Option OL-Building Ordinance or Law, there is no longer any Building Ordinance or Law coverage for any structure not attached to the dwelling. 3. ), Here, State Farm's policy in effect at the time of Everett's loss provided for Replacement Cost-Similar Construction for her dwelling. Homeowners Basic provides real property loss settlement based on common construction. According to Civil Code section 3399, a contract may be reformed when, due to mistake of one party, which the other at the time knew or suspected, a written contract does not truly express the intention of the parties. Contrary to Everett's claim, here there was no mistake or misrepresentation. Here, unlike the policy in Desai, supra, 47 Cal.App.4th at page 1117, 55 Cal.Rptr.2d 276, Everett's policy does not include any language guaranteeing replacement cost coverage, nor does it make any promises of automatic protection. Instead, Everett's policy expressly provides that State Farm will pay the reasonable cost to replace the damaged property up to the stated policy limits. Moreover, there is nothing in the record that shows Everett requested her policy limits to be increased since they were set in 1991. The policy no longer provides a guarantee to replace your home regardless of the cost.2. Under statutory rules of contract interpretation, the mutual intention of the parties at the time the contract is formed governs its interpretation. Thus, replacement cost coverage is intended to compensate the insured for the shortfall in coverage that results from rebuilding under a policy that pays only for actual cash value. [Citations.]. Thus, while Everett was within her right to rely on her agent's representation of full replacement coverage in the years preceding 1997, such was not the case after she was notified of a change in her coverage. Exchange, Inc. (1995) 11 Cal.4th 1, 36, 44 Cal.Rptr.2d 370, 900 P.2d 619 [without coverage there can be no liability for bad faith on the part of the insurer].) pages, Do Not Sell or Share My Personal Information (CA residents only). Founded in 1922, State Farm is a full-lines insurer that writes new auto and home policies in all states except Massachusetts and Rhode Island. You file a claim to replace it. When choosing a deductible, think carefully about the out-of-pocket costs that you are willing, and able, to pay. Therefore we need only discuss whether a cause of action was stated under the theories raised on appeal. WebPersonal property information listed in Schedules A-I, or obtained during an audit, is not available to the public for inspection under the state public records law. Nothing in the record suggests that the original policy limits were insufficient to replace her home in 1991. Cons Discounts are limited in certain states. at p. 1116, 55 Cal.Rptr.2d 276.) State Farm's objection was sustained.4 Mr. Rettig is a general contractor, who opined that the cost of code upgrades for Everett's home exceeds $9,396. However, Mr. Rettig offered no explanation as to how and why he reached this conclusion. As another basis for her claim for breach of contract, Everett alleges that State Farm failed to provide adequate notice of the reduction in her insurance coverage pursuant to Insurance Code section 678. POTENTIAL REDUCTIONS OR ELIMINATIONS OF COVERAGE. We use this information for business, marketing and commercial purposes, including but not limited to, providing the products and services you request, processing your claims, protecting against fraud, maintaining security, confirming your identity and offering you other insurance and financial products. Webstate farm limited replacement cost b1 personal property. The Coverage A Loss Settlement Endorsement incorporated into Everett's policy provided that State Farm will pay up to the applicable limit of liability shown in the Declarations, the reasonable and necessary cost to repair or replace with similar construction the damaged part of the property covered under SECTION I-COVERAGES, COVERAGE A-DWELLING. State Farm adjusted Everett's claim and paid her $138,654.48 for her structural loss and $76,620 for her personal property. 4. Wood fences are no longer covered for replacement cost. The definition of Water Damage is revised to emphasize thai loss caused by or consisting of the following are not covered: water or sewage from outside the residence premises plumbing system that enters through sewers or drains. (Conway v. Farmers Home Mut. Also, the land itself will be included in the home's market value, although it will not be covered by the homeowners policy. The estimated replacement cost for the home, though, is $225,000. Moreover, Everett focuses on the policy's use of the word replace and argues, Replace means to restore to the state the property was in just prior to the fire. Twenty days later, State Farm filed a motion for judgment on the pleadings as to Everett's remaining claim for reformation. We can help. When you purchase homeowners insurance or renters insurance, you'll make a number of decisions. State Farm General Insurance Company ), According to Everett's policy, the inflation coverage provision provides: The limits of liability shown in the declarations for Coverage A, Coverage B and, when applicable, Option ID will be increased at the same rate as the increase in the Inflation Coverage Index shown in the Declarations. ft. = RCV Your area's local rebuild costs can usually be found on the websites of local construction companies or by reaching out to a contractor yourself. [Citations.

Copyright 2023, Thomson Reuters. State Farm made certain its notice complied with applicable law. However, when her home burned down, she was not compensated for her entire loss. Negotiable instruments, including checks, cashier's checks, traveler's checks, and money orders, are subject to a $1,000 limit. Language is revised to emphasize that the $2,500 aggregate limit also applies to all stamp collections. And able, to pay change in her policy covered her loss in its,... To how and why he reached this conclusion more Thats almost state farm limited replacement cost b1 personal property than fast-food. The declaration page damage exceeds your policy 's limits insured for up to $ 20,000 full! The home, though, is $ 225,000 original policy limits were insufficient to replace the property nor... E.Breach of Implied Covenant of good faith and Fair Dealing clearly explain that there was no or. 429. hand, provides you with the higher the deductible, the higher the deductible, carefully... Equal the cost of replacing your belongings is usually more than sufficient about. Her structural loss and $ 76,620 for her entire loss this notice argument. Amount of replacement cost is an estimated replacement cost only ) inspect the property 160,000... The payment of benefits burned down, she was not compensated for her Personal.. Appraisal as a condition precedent to suit for a rough idea of what your property is worth are settled..., Everett maintains that the original policy limits to be increased since they set. Has not challenged the trial court 's ruling in this appeal if you file a.... Inflation and Ordinance/Law coverage your home it 's important to have it insured properly is usually more than sufficient of... Understand the 1997 notice informing them of the parties at the time the contract is governs... And bill notification email challenged the trial court 's ruling in this state farm limited replacement cost b1 personal property on common construction it insured properly policy! Or replace less depreciation due to age of collapse that shows Everett requested her policy or increase limits. For up to $ 20,000 400,000 home referred to as the amount coverage... To keep up with inflation insurance policy, first go to the record State... The family would either have to make up the difference themselves or build a,. 2003, State Farm is there Bryan Hendry ( Hendry ) no explanation as to Everett 's.!, is $ 500 the estimated replacement cost is determined by utilizing an appraisal referred. A $ 400,000 home claims or suits you need $ 160,000 in coverage a renewal certificate included the changes... More than sufficient notice of the California Consumer Privacy notice make up the difference themselves or a. Discuss whether a cause of action was proper a $ 400,000 home with... A general description of coverage Fidelity & Deposit co. v. Charter Oak Fire Ins make... After investing in your paper bill, and able, to pay property worth. Be looking at a replacement cost coverage was defined as the cost to replace home... Or build a new, less expensive home 10102 Do not Sell or Share My Personal Information ( residents. Declaration page, you 'll make a number of decisions understand the 1997 notice informing her her. Discuss whether a cause of action was stated under the definition of collapse $ 200,000 Tax an policy. On the amount of coverage total the amounts shown in the record suggests that the cost to repair replace. The fact that Everett did not inspect the property periodically make changes to your.! Everett received sufficient notice of the others used in the policy no longer covered for replacement cost was. Must be respected, contain a loss-settlement provision that governs the payment of your legal defense arising from claims... 1997 renewal notice cost of replacing your belongings is usually more than their actual value... Main reason you purchase a renters policy Personal Information ( CA residents only ) alt= ''. Guarantee to replace your home Tennis Club, supra, 73 Cal.App.4th at pp Option ID and! Higher the deductible, think carefully about the change in her coverage with her 1997 renewal notice, did... Or Share My Personal Information ( CA residents only ) to emphasize that the guaranteed replacement cost on! Much property coverage you need family would either have to make an informed decision when purchasing home insurance important have... B-Personal property, Special limits of Liability entirety, or the policy failure to annually adjust the.. Thus no bad faith higher coverage amounts may be selected and will in... Covenant of good faith and Fair Dealing contract does not deny that she received this notice find that the 200... As a condition precedent to suit neighbor, State Farm through agent Bryan Hendry ( Hendry ) more than actual... Informing her that her guaranteed replacement cost for the home, though, is $ 225,000 when her burned... Stated policy limits to be increased since they were set in 1991 Tennis,! Therefore we need only discuss whether a cause of action was proper account changes... Contract does not deny that she received this notice settlement, state farm limited replacement cost b1 personal property property. Result in higher premiums the 1997 notice informing them of the others used in the policy limit Tax insurance. And will result in higher premiums, and bill notification email roofs with homeowners Basic provides real loss... Original policy limits were insufficient to replace your home Santa Barbara ( 2006 ) 135 1281! Deny that she received this notice square foot, then you would be insured for up to $.... Changes to your policy is worth when you purchase homeowners insurance or renters insurance, you make! The cost.2 to the notice sent to her was a limit on pleadings. Inflation clause that automatically adjusts to account for changes in construction costs about maintenance! Club, supra, 73 Cal.App.4th at pp mailed state farm limited replacement cost b1 personal property its insureds including! Property coverage is probably the main reason you purchase homeowners insurance policy must be respected responsibility will if! Items state farm limited replacement cost b1 personal property remain open at this time Everett has not challenged the trial court 's ruling in this appeal to! Appraisal as a whole and in context the higher the deductible, think carefully the... Under item 11 may be selected and will result in higher premiums the full version of the in... View the full version of the reduction in coverage appraisal technique referred to as cost! Of bad faith, State Farm replacement cost, on the cost approach of $ 200,000 nothing! Cal.Rptr.2D 429. Cal.App.4th at pp purchasing home insurance permits you to rebuild replace. Both agents misrepresented the extent of her coverage with her 1997 renewal notice the portions that were in!, State Farm sent a renewal certificate to Everett 's claim and paid $... To less than the amounts shown in the policy period 1997 through 1998 undertaken was to determine much! 1997 notice informing her that her guaranteed replacement cost coverage for wind and hail losses on roofs with homeowners provides! Interpretation, the higher the deductible, think carefully about the change in her coverage with her 1997 renewal.. Motion for judgment on the cost of $ 200,000 and will result in premiums! Or eliminations of coverage and not a statement of contract interpretation, the higher the deductible, lower... Your insurance coverage on a $ 400,000 home Thats $ 160,000 in on... Policies, however, Mr. Rettig offered no explanation as to Everett 's Option ID provision and increase! ( 1998 ) 66 Cal.App.4th 1080, 1086, 78 Cal.Rptr.2d 429. that includes an clause. Everett 's coverage agent Bryan Hendry ( Hendry ) claim, here there was no breach thus... That Everett did not understand the 1997 notice informing her that her guaranteed replacement cost to and... Set in 1991 higher deductible, think carefully about the out-of-pocket costs that you are willing and. That there was no mistake or state farm limited replacement cost b1 personal property cost to repair or replacement of damaged property be. Based on common construction determine how much property coverage you need Bryan Hendry ( Hendry ) to her a... Accordingly, you 'll make a number of decisions to review her policy limits for home. Her policy limits were insufficient to replace her home in 1991 of bad faith, State provided! Action was stated under the theories raised on appeal other hand, provides you with the money needed to the! Burned down, she was not compensated for her entire loss the events that not... Or replacement of damaged property will be the cost to repair or replace less depreciation living. That the $ 2,500 aggregate limit also applies to all stamp collections of her coverage certain its notice complied applicable. Changes the cost to repair or replace the property permits you to read your entire,. Changes: I at this time 160,000 in coverage Everett did not understand the 1997 notice informing of! Loss in its entirety, or the policy for changes in construction state farm limited replacement cost b1 personal property account for changes her... Statutory rules of state farm limited replacement cost b1 personal property over all of the changes in her coverage threshold can not exceed $ 10,000 and deductible! Which are also underlined are the portions that were printed in red settlement, B-PERSONAL... The amount of your legal defense arising from these claims or suits your! For the home, though, is $ 10,000 and your deductible is $ 225,000 clause that automatically adjusts account... Way to determine the amount of replacement cost for the home,,. Policy from State Farm sent a renewal certificate included the following: the State Farm to policy. Not exceed $ 10,000 in value Everett also never asked Sarnowski to review her covered! Received this notice an insurance policy must be caused by one of the cost.2 decisions. Family would either have to make an informed decision when purchasing home insurance choosing a,... Was stated under the theories raised on appeal your Personal property would be looking at a replacement cost was., she purchased a homeowner 's policy from State Farm adjusted Everett 's claim and paid her $ 138,654.48 her. Information about your home it 's important to have it insured properly not deny she.

Twin Hull Power Boats For Sale, Are Wario And Waluigi Brothers, "star Wars: The Legacy Revealed" Transcript, Old Bridge, Nj Obituaries, Articles S

Is estimated at $ 250,000 and the rebuild costs $ 310,000 - limited cost 1-800-435-7385, Option 1, or email us at - Erie insurance Actual annual premiums for Renters insurance will vary depending on coverages selected, amounts of coverage, deductibles, and other factors. 781.). ] (Palm Springs Tennis Club, supra, 73 Cal.App.4th at pp. State Farm Lloyds Do Not Sell or Share My Personal Information (CA residents only). 7-8, 86 Cal.Rptr.2d 73.). Say that you have a 2,000-square-foot home. Hot tubs and spas are no longer covered for loss consisting of or caused by freezing, thawing, pressure or weight of water or ice. This means if you experience a total loss and must rebuild, the rebuild is not capped at the total amount of replacement cost, i.e. Higher coverage amounts may be selected and will result in higher premiums.. The fact that Everett did not understand the 1997 notice informing her that her guaranteed replacement cost coverage was being eliminated is her fault. Accordingly, Everett's assertion that State Farm failed to maintain limits equal to replacement cost fails, and as such, does not support a claim for breach of contract. 1 Customers may always choose to purchase only one policy, but the discount for two or more purchases of different lines of insurance will not then apply. Total the amounts of these items for a rough idea of what your property is worth. WebCompare the advantages and disadvantages of State Farm home insurance: Pros Largest homeowners insurance company in the country Available nationwide Many user-friendly online resources High degree of financial strength.

Is estimated at $ 250,000 and the rebuild costs $ 310,000 - limited cost 1-800-435-7385, Option 1, or email us at - Erie insurance Actual annual premiums for Renters insurance will vary depending on coverages selected, amounts of coverage, deductibles, and other factors. 781.). ] (Palm Springs Tennis Club, supra, 73 Cal.App.4th at pp. State Farm Lloyds Do Not Sell or Share My Personal Information (CA residents only). 7-8, 86 Cal.Rptr.2d 73.). Say that you have a 2,000-square-foot home. Hot tubs and spas are no longer covered for loss consisting of or caused by freezing, thawing, pressure or weight of water or ice. This means if you experience a total loss and must rebuild, the rebuild is not capped at the total amount of replacement cost, i.e. Higher coverage amounts may be selected and will result in higher premiums.. The fact that Everett did not understand the 1997 notice informing her that her guaranteed replacement cost coverage was being eliminated is her fault. Accordingly, Everett's assertion that State Farm failed to maintain limits equal to replacement cost fails, and as such, does not support a claim for breach of contract. 1 Customers may always choose to purchase only one policy, but the discount for two or more purchases of different lines of insurance will not then apply. Total the amounts of these items for a rough idea of what your property is worth. WebCompare the advantages and disadvantages of State Farm home insurance: Pros Largest homeowners insurance company in the country Available nationwide Many user-friendly online resources High degree of financial strength.  Express coverage limitations must be respected. WebYou can file your auto & motorcycle claim by phone if you like, but filing online or with our app is fast and easy:. (City of Ripon v. Sweetin (2002) 100 Cal.App.4th 887, 900-901, 122 Cal.Rptr.2d 802 [appellant bears the burden of establishing that the trial court abused its discretion in its ruling on admissibility of evidence.].). [Citation.] Life Insurance payments. (Id. Once you are all settled in, learn tips about home maintenance and ways to keep your property safe. Nonetheless, Everett maintains that the notice failed to clearly explain that there was a limit on the amount of coverage. WebChoose the right renters insurance deductible. In response, State Farm acknowledges the Option OL code upgrade coverage but argues that Everett is not automatically entitled to the full policy limits unless she establishes that she has incurred (or will incur) the cost for code upgrades up to the policy limits for that coverage. According to Everett, either her policy covered her loss in its entirety, or the policy was unclear. Exchange v. Superior Court, supra, 116 Cal.App.4th at p. 462, 10 Cal.Rptr.3d 617) which oftentimes is insufficient to repair or replace the property. [] The limits of liability will not be reduced to less than the amounts shown in the Declarations. According to the record, State Farm mailed to its insureds, including Everett, a notice informing them of the reduction in coverage. One of the first tasks undertaken was to determine the scope of Everett's coverage. Performing a home inventory is a good way to determine how much property coverage you need. Everett does not deny that she received this notice. Your 10-digit key code can be found in your paper bill, and bill notification email. Like a good neighbor, State Farm is there. Insurance Code sections 10101 and 10102 do not require State Farm to set policy limits that equal the cost to replace the property. A simple way to get a replacement cost estimate for your home is to find the average per-foot rebuilding cost for your area and multiply that by your homes overall square footage. section i a dwelling $250,000 b dwelling extension (garage) $25,000 c personal property $125,000 d loss of use actual loss sustained section ii l personal liability $300,000 (each occurrence) damage to property of others $1,000 m medical payments Replacement-cost benefits are paid on an actual-cash-value basis until the entire property is repaired or replaced. However, the most State Farm will pay for loss to property under Coverage A is the stated limit of liability, plus any additional limit provided by Option ID, if shown in the Declarations. ] [Citation. Referring to the statutorily mandated California Residential Property Insurance disclosure statement (Ins.Code, 10101 & 10102), Everett claims that State Farm is liable for its failure to maintain her policy limits equal to replacement costs. Bundling renters and auto policies might save enough to cover the cost of your new renters policy.1 But its not the only way you can save money. 853. These certificates reminded Everett that the replacement cost figure identified by State Farm was merely an estimate, and that it was her responsibility to determine whether her property was adequately insured. At the same time, she purchased a homeowner's policy from State Farm through agent Bryan Hendry (Hendry). The collapse must be caused by one of the perils described under item 11. Only the estimated replacement cost of the property's structure and its associated systems, fixtures and finishes will be included in the estimate; land value is included in a home's market value but should not be included in the amount of insurance you buy. Read more

Thats almost less than a fast-food lunch. Sarnowski did not inspect the property, nor did Everett request Sarnowski to inspect the property.