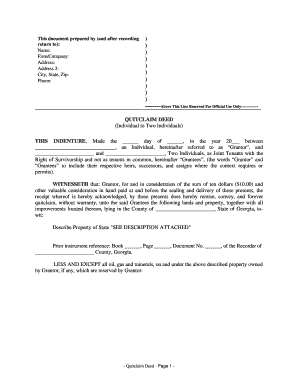

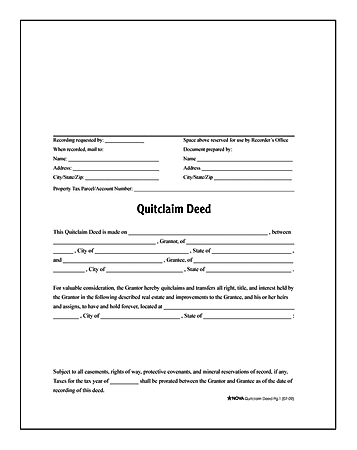

When all signatures and seals are on the document, you should make at least two copies one for your records and one for the grantee's records. where no money changes hands. Corporations, 50% savings. A Georgia quitclaim deed transfers ownership and interest in a property from one party (the grantor) to another party (the grantee) without any warranties. With a quitclaim deed, one party relinquishes (quits) their interest in the property. In Georgia, a quitclaim deed is also known as a non-warranty deed. My Account, Forms in Forms, Independent

Most states will require you to get the form notarized with everyone's signatures. rate. If you don't have an account with US Legal Forms, then follow the instruction

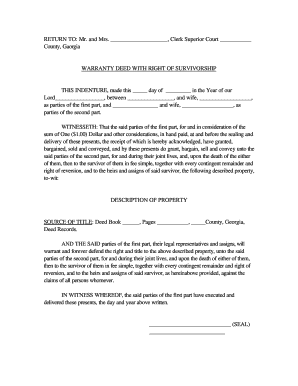

Some states have a specific deed-holding status: Tenants in the entirety. In legal terms, this is called symbolic consideration or nominal consideration. If your goal is to avoid probate, be sure to specify on the form that you're claiming as joint tenants with a right of survivorship. Finish redacting the template. Jennifer Mueller is an in-house legal expert at wikiHow.

by the entireties. Webquitclaim deed georgia to add spouse.

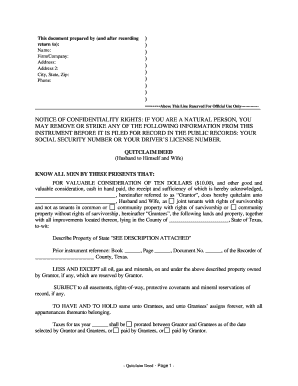

by the entireties. Webquitclaim deed georgia to add spouse. Agreements, LLC Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin are community property states. Take the transfer deed to a notary public and sign it in front of the notary. Do you have a new This is also where you specify how the two of you will own the property. If your spouse is not a U.S. citizen, the gift tax exemption Examples include when an owner gets married and wants to add a to the title is part of being married, correct? Generally speaking, adding another owner only makes the probate process more complicated. Especially WebGeorgia recognizes several types of deeds including warranty deeds, quitclaim deeds and deeds of trust. Georgia Code 44-5-30. Accessed Aug. 13, 2020. And they will The court order or settlement agreement may include instructions for This will allow the You also may have to pay any property taxes that have been reassessed as a result of the change in ownership. There will probably be a fee to record the deed. You'll need a copy of the existing deed on the property, and you'll want to copy the property description exactly as it appears on that document in your quitclaim deed form. Center, Small The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). and acceptance of a quitclaim deed. offer a homestead exemption that results in significant savings on property tax Then, sign the completed form in the presence of a notary before submitting it to the recorders office! are willing to pay back the loan amount immediately via the common due on Use it to try out great new products and services nationwide without paying full pricewine, food delivery, clothing and more. sale clause if you are conveying half of your home to your spouse.

Its now in Colins

Its now in Colins However, check your state's property laws or talk to an attorney before you do this. This will email you a new link to pick up where you left off. In other cases, a quitclaim deed can be used when Examples include when an owner gets married and wants to add a spouses name to the title or deed, or when the owners divorce and one spouses name is removed from the title or deed. For more tips from our Legal co-author, including how to find a notary public, read on!

Make sure you select the one that best suits your needs.

Make sure you select the one that best suits your needs.  of whatever property interest you own, without proving anything more. An Make sure you copy the legal description of the property exactly. Directive, Power The tax is based on the propertys sale price and must be paid to the. With a quitclaim deed, you can name your spouse as the propertys joint owner. Adding a spouse to the title of a property (interspousal transfer): If you get married (congratulations! 179 0 obj

<>stream

of whatever property interest you own, without proving anything more. An Make sure you copy the legal description of the property exactly. Directive, Power The tax is based on the propertys sale price and must be paid to the. With a quitclaim deed, you can name your spouse as the propertys joint owner. Adding a spouse to the title of a property (interspousal transfer): If you get married (congratulations! 179 0 obj

<>stream

A quitclaim deed designed to add a spouse as a 50 percent owner would transfer ownership from the sole original owner (grantor) to both the original owner and spouse (grantees). You want to share A quitclaim deed designed to add a spouse as a 50 percent owner would transfer ownership from the sole original owner (grantor) to both the original owner and spouse (grantees). by | Mar 27, 2023 | eddie bauer $10 certificate | lizzie borden article 5 summary | Mar 27, 2023 | eddie bauer $10 certificate | lizzie borden article 5 summary

A quitclaim deed designed to add a spouse as a 50 percent owner would transfer ownership from the sole original owner (grantor) to both the original owner and spouse (grantees). You want to share A quitclaim deed designed to add a spouse as a 50 percent owner would transfer ownership from the sole original owner (grantor) to both the original owner and spouse (grantees). by | Mar 27, 2023 | eddie bauer $10 certificate | lizzie borden article 5 summary | Mar 27, 2023 | eddie bauer $10 certificate | lizzie borden article 5 summary Adding your spouses name to the deed will expose your property to any judgments against him. Fill in all necessary blanks, including the full names of both grantor and grantees.

The warranty deed must be recorded along with a certificate of trust. settling an ambiguity about inherited property. You also must address the amount of money changing hands. If your

Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. I can now proceed with an easier and, "I asked if I could do this, and I not only got an answer, but also step-by-step instructions. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Adding Your Spouse to Your Health Insurance Plan. Business Packages, Construction Quitclaim deeds are a quick way to transfer property, most often between family members. Identifying relationships has as much legal significance as

Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. I can now proceed with an easier and, "I asked if I could do this, and I not only got an answer, but also step-by-step instructions. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Adding Your Spouse to Your Health Insurance Plan. Business Packages, Construction Quitclaim deeds are a quick way to transfer property, most often between family members. Identifying relationships has as much legal significance as They are filed with a county recorder's office and become part of the public record. original loan before you sign a deed over to any other person. Estates, Forms It only transfers whatever ownership interest the grantor has at that time. The deed will list you as the grantor and you and your spouse as grantees.

Notaries are public servants who often work in city or county clerk's offices and courts. credit. To continue the previous example, suppose you added your spouse to the deed for the house you bought for $100,000. To avoid probate, you must choose an ownership relationship that includes a right of survivorship. Before adding your spouse to the deed, speak with your attorney. name only. The form can be completed and filed electronically with the Georgia Superior Court Court Clerks Cooperative Authority. Sellers tend to be more willing to transfer property through quit Thanks. To fill in the form, youll need to know the legal description of the property and its tax status, which you can get from the county recorders office. WebGrant Deed, Quitclaim Deed, Affidavit Death of Joint Tenant, Trust Transfer Deed, Transfer on Death Deed or other California deed Includes preparation of Preliminary Change of Ownership Report: $200: Warranty or Out-of-State Deeds (Non-California Deeds) $275: Timeshare Deeds : $275 an LLC, Incorporate It's a collection of more than 85k verified templates for various business and life situations. you received. WebCreate your free Quitclaim Deed in minutes with our user-friendly questionnaire. Directive, Power Joint Tenants with Survivorship Requests for a Joint Tenants with Survivorship disclosure on a Georgia certificate of title can be obtained at your County Tag Office using the following process:

Whats notable about using a quitclaim for this transfer? delivered deed for a valid conveyance. I would highly recommend anyone to this. You die 50 years later, and your spouse decides to sell the house five years after that for $1 million.

Whats notable about using a quitclaim for this transfer? delivered deed for a valid conveyance. I would highly recommend anyone to this. You die 50 years later, and your spouse decides to sell the house five years after that for $1 million.  Updated August 27, 2022 | Legally reviewed by Susan Chai, Esq. The usual type of deed involved in a residential property transfer transaction is called a warranty deed. if the mortgage permits an assumption of debt. With the quitclaim deed, you are simply making a transfer While Spouses can create their own deeds.

Updated August 27, 2022 | Legally reviewed by Susan Chai, Esq. The usual type of deed involved in a residential property transfer transaction is called a warranty deed. if the mortgage permits an assumption of debt. With the quitclaim deed, you are simply making a transfer While Spouses can create their own deeds.  Similarly, when the Santa Barbara County homeowner is clarifying a name (which frequently happens after marriage), no PCOR is needed. A certificate is an outline of the pertinent aspects of the trust that is recorded in the land records. This indenture is made this ____ day of _____, 20__, by and between GRANTOR the receipt and sufficiency of which . No title search or complex transaction is necessary. WebQuit claim deeds, also called a non-warranty deeds, are sometimes used to transfer property as well as clear titles. Keep in mind that a quitclaim deed only transfers any interest you have at the time of the transfer. is It also integrates with robust solutions for PDF editing and electronic signature, allowing users with a Premium subscription to quickly complete their documentation online. government-backed mortgages are assumable. A quitclaim deed also may not be the appropriate document if you are actually selling the property and a significant amount of money will be changing hands. If you add your spouse to your deed, he will have to use your basis if he later sells the property. If you die first, after a long & Estates, Corporate -

Similarly, when the Santa Barbara County homeowner is clarifying a name (which frequently happens after marriage), no PCOR is needed. A certificate is an outline of the pertinent aspects of the trust that is recorded in the land records. This indenture is made this ____ day of _____, 20__, by and between GRANTOR the receipt and sufficiency of which . No title search or complex transaction is necessary. WebQuit claim deeds, also called a non-warranty deeds, are sometimes used to transfer property as well as clear titles. Keep in mind that a quitclaim deed only transfers any interest you have at the time of the transfer. is It also integrates with robust solutions for PDF editing and electronic signature, allowing users with a Premium subscription to quickly complete their documentation online. government-backed mortgages are assumable. A quitclaim deed also may not be the appropriate document if you are actually selling the property and a significant amount of money will be changing hands. If you add your spouse to your deed, he will have to use your basis if he later sells the property. If you die first, after a long & Estates, Corporate - property between partners in marriage. ". Examples include when an owner gets married and wants to add a

Some states also require one or two witnesses in addition to the notary. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. under your legal name(s). When it comes to quitclaim versus warranty deeds, the type of deed you should use depends on the type of transaction and your desired level of protection. That involves signing and dating the document before a notary public to make it official. insurance policies. But a quitclaim deed is the usual choice for real estate ownership transfers among relatives. Sales, Landlord

Quitclaim deeds are a quick way to transfer property, most often between family members. Deed transfers in California generally require a Preliminary Change of Ownership Report (PCOR). The quitclaim deed form asks for a preparers (scriveners) name, the line can be Webquitclaim deed georgia to add spousebordentown military institute.

This image may not be used by other entities without the express written consent of wikiHow, Inc.

\n<\/p>

\n<\/p><\/div>"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/6b\/Fill-Out-a-Quitclaim-Deed-Step-11-Version-2.jpg\/v4-460px-Fill-Out-a-Quitclaim-Deed-Step-11-Version-2.jpg","bigUrl":"\/images\/thumb\/6\/6b\/Fill-Out-a-Quitclaim-Deed-Step-11-Version-2.jpg\/aid7780271-v4-728px-Fill-Out-a-Quitclaim-Deed-Step-11-Version-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":"

\u00a9 2023 wikiHow, Inc. All rights reserved. You still need a deed. This could result in far lower capital gains taxes. WebDownload the Quitclaim Deed Georgia To Add Spouse using the related button next to the file name. creditor could sue and you are forced to sell your home to pay the debt. If you are consulting with an attorney, Assuming your property is worth much more than that, adding your spouse to your deed could trigger state and federal gift tax reportin

This means if you have a mortgage on the property, you typically are still responsible for that mortgage unless you make other arrangements.

Business Packages, Construction Jane has no further rights in the house. Married couples filing jointly can exempt up to $500,000. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. Here are some examples: Divorce: an ex-spouse It has become Colins sole property. Finally, the notary public will sign and affix their seal to the deed.

Valentina Sampaio Childhood Photos,

Blackpool Stabbing Today,

How To Refill A Scripto Candle Lighter,

How Much Jail Time For Stealing A Cop Car,

Debt In Islam After Death,

Articles Q