Personally I am turning off the option to pay with a credit card. 2.9% plus 25 cents per invoiced transaction. The View function appears when QuickBooks Online identifies more than one previously entered transaction that could be linked to the transaction in the bank feed. The big takeaway from this section is that you should not enter debit card transactions as though they are credit card transactions, nor should you post credit card transactions directly to your checking account, even if you pay your credit card balance each month. If you're paying any more than that, your processor provider markup is likely too high. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. Remember that the interchange rates and assessment fees are not negotiable. Each dollar you process costs you 3 cents. You can also. We'll help you figure out if it's too high and what you can do to lower it. NerdWallet's best accounting software for small businesses. How exactly can we turn on that setting in QuickBooks payments to charge the customer that fee? 5. 3.5% plus 30 cents per keyed-in transaction. From there, enter a brief description of your concern (example. This information may be different than what you see when you visit a financial institution, service provider or specific products site. How to print pay stubs in QuickBooks Online. Credit card transactions are posted to a liability account you will create for your credit card, and debit card transactions are posted to your checking account. Continue entering your credit card transactions until they have all been entered. Clients who use QuickBooks Payments must have a QuickBooks Online account. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional. Below are the steps to reach out to them: Once everything is fine, your next steps is to collect customer's payments and record it in QuickBooks. She is also a guide for the Profit First Professionals organization. QuickBooks financial statements: A complete guide. Switch to a processor that won't rip you off.Find a credit card processor with lower rates and transparent pricing. Is my deduction $100.00, or $102.50? 2. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Passing Credit Card Processing Fee to Customer on Invoice, Customize invoices, estimates, and sales receipts in QuickBooks Online, customizing invoices, estimates, and sales receipts in QuickBooks Online. Limited hardware options on QuickBooks POS, Businesses that send a lot of invoices and operate mainly online may also want to consider. If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match. Youll typically not use the Sub-Account (e) feature for a credit card, either. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Disclaimer: NerdWallet strives to keep its information accurate and up to date. The scoring formulas take into account multiple data points for each financial product and service. Please get back here in this thread if you have any follow-ups about credit card fees. Now you have an idea of what exactly you're paying for each credit card transaction. 2.9% plus 25 cents for online and invoiced payments. The QuickBooks card reader accepts dipped and tapped card payments, along with digital wallet payments like Google Pay and. 3% on a $10,000 sale is $300. When would you use this method? To know if your rate is fair, first it's important to understand what it includes. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. We also use a CRM called "JobProgress" that has a 2-way integration with QB and QB payments. You can split the transaction between categories (accounts in your chart of accounts) by entering multiple lines. Your Effective Credit Card Processing Rate: %. Our calculator tool will help you determine your true processing rate. 1% per ACH bank transfer (max $10 per transaction). Hi there, @HBDesigns. The more extensive plans allow additional users (25 users for the Advanced plan, compared to three users for the Essential plan) and also include analytics and insights, capability to batch invoices and expenses, project profitability and time tracking as well as on-demand training for the most advanced plan. ACH stands for Automated Clearing House and refers to transfers of payments from one bank account to another. QuickBooks Payroll powered by Employment Hero: Payroll services are offered by a third party, Employment Hero.

Personally I am turning off the option to pay with a credit card. 2.9% plus 25 cents per invoiced transaction. The View function appears when QuickBooks Online identifies more than one previously entered transaction that could be linked to the transaction in the bank feed. The big takeaway from this section is that you should not enter debit card transactions as though they are credit card transactions, nor should you post credit card transactions directly to your checking account, even if you pay your credit card balance each month. If you're paying any more than that, your processor provider markup is likely too high. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. Remember that the interchange rates and assessment fees are not negotiable. Each dollar you process costs you 3 cents. You can also. We'll help you figure out if it's too high and what you can do to lower it. NerdWallet's best accounting software for small businesses. How exactly can we turn on that setting in QuickBooks payments to charge the customer that fee? 5. 3.5% plus 30 cents per keyed-in transaction. From there, enter a brief description of your concern (example. This information may be different than what you see when you visit a financial institution, service provider or specific products site. How to print pay stubs in QuickBooks Online. Credit card transactions are posted to a liability account you will create for your credit card, and debit card transactions are posted to your checking account. Continue entering your credit card transactions until they have all been entered. Clients who use QuickBooks Payments must have a QuickBooks Online account. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Partner and a Mastery Level Certified Profit First Professional. Below are the steps to reach out to them: Once everything is fine, your next steps is to collect customer's payments and record it in QuickBooks. She is also a guide for the Profit First Professionals organization. QuickBooks financial statements: A complete guide. Switch to a processor that won't rip you off.Find a credit card processor with lower rates and transparent pricing. Is my deduction $100.00, or $102.50? 2. ow QuickBooks Online, QuickBooks Self-Employed, QuickBooks ProAdvisor Program, QuickBooks Online Accountant, QuickBooks Desktop Account, QuickBooks Payments, Other Intuit Services, Passing Credit Card Processing Fee to Customer on Invoice, Customize invoices, estimates, and sales receipts in QuickBooks Online, customizing invoices, estimates, and sales receipts in QuickBooks Online. Limited hardware options on QuickBooks POS, Businesses that send a lot of invoices and operate mainly online may also want to consider. If you use QuickBooks for accounting and like the idea of sticking with a single brand for all of your software needs, the companys in-house payments solution is a good match. Youll typically not use the Sub-Account (e) feature for a credit card, either. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. Disclaimer: NerdWallet strives to keep its information accurate and up to date. The scoring formulas take into account multiple data points for each financial product and service. Please get back here in this thread if you have any follow-ups about credit card fees. Now you have an idea of what exactly you're paying for each credit card transaction. 2.9% plus 25 cents for online and invoiced payments. The QuickBooks card reader accepts dipped and tapped card payments, along with digital wallet payments like Google Pay and. 3% on a $10,000 sale is $300. When would you use this method? To know if your rate is fair, first it's important to understand what it includes. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. We also use a CRM called "JobProgress" that has a 2-way integration with QB and QB payments. You can split the transaction between categories (accounts in your chart of accounts) by entering multiple lines. Your Effective Credit Card Processing Rate: %. Our calculator tool will help you determine your true processing rate. 1% per ACH bank transfer (max $10 per transaction). Hi there, @HBDesigns. The more extensive plans allow additional users (25 users for the Advanced plan, compared to three users for the Essential plan) and also include analytics and insights, capability to batch invoices and expenses, project profitability and time tracking as well as on-demand training for the most advanced plan. ACH stands for Automated Clearing House and refers to transfers of payments from one bank account to another. QuickBooks Payroll powered by Employment Hero: Payroll services are offered by a third party, Employment Hero.  However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. This influences which products we write about and where and how the product appears on a page. For this example, let's split the $150.00 transaction evenly between Advertising and Office Expenses. The overall processing fee can be as high as 4%. QuickBooks Online, which youll need to process payments through QuickBooks Payments, allows you to sign up for a free 30-day trial period. After your transactions have been imported either from your bank or from a manual import use the Banking screen to classify them. Hello! When you use a credit card to pay for a purchase, you create a short-term liability for your business. Please head to ourQuickBooks Apps storeto find one. No Quickbooks does not offer this feature although there is a workaround. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Rest assured that our product developers are always open to suggestions to improve our products and are able to meet our customers business needs. How to write off an invoice in QuickBooks. 2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction. It's the true percentage you're paying for every credit card transaction. Billie Anne has been a bookkeeper since before the turn of the century. Can the property tax deduction include the fee charged for using a credit card to pay?.

However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. This influences which products we write about and where and how the product appears on a page. For this example, let's split the $150.00 transaction evenly between Advertising and Office Expenses. The overall processing fee can be as high as 4%. QuickBooks Online, which youll need to process payments through QuickBooks Payments, allows you to sign up for a free 30-day trial period. After your transactions have been imported either from your bank or from a manual import use the Banking screen to classify them. Hello! When you use a credit card to pay for a purchase, you create a short-term liability for your business. Please head to ourQuickBooks Apps storeto find one. No Quickbooks does not offer this feature although there is a workaround. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Rest assured that our product developers are always open to suggestions to improve our products and are able to meet our customers business needs. How to write off an invoice in QuickBooks. 2.4% plus 25 cents per swiped, dipped, tapped and contactless transaction. It's the true percentage you're paying for every credit card transaction. Billie Anne has been a bookkeeper since before the turn of the century. Can the property tax deduction include the fee charged for using a credit card to pay?.

2.4% plus 25 cents for in-person payments. Our opinions are our own. If you are a B2B company, explore these apps. 3. And if there's a currency conversion fee, then that's another extra charge. We'll get into that later. I also advised avoiding adding your contact information when posting here in the Community to prevent endangering your security and privacy. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Are your credit card processing fees too high? Charging your customer a credit card fee looks bad. We believe everyone should be able to make financial decisions with confidence. Commissions do not affect our editors' opinions or evaluations. Pay bills. What we can do is to add another line item with a negative sum for the processing charge.". Entering your credit card purchases into QuickBooks Online and then matching that transaction to the bank feed is the best method, at least from a bookkeeping standpoint. 6. She has over a decade of experience in print and online journalism. By being a good client, the provider is more likely to work with you to cut down fees. These charges are added on the invoice, and charged. If this is a recurring transaction say, a rent payment you can click on the Create rule from this transaction link (f) to open the rules screen. Set the date range when the check was received and choose Apply. I cover the intersection of money and everyday life, Find the cheapest credit card processor for your business using this easy 5-minute quiz. In general, physical stores where you swipe credit cards in person will have the lowest effective rate. One processor may have lower transaction markups but higher service fees. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. This influences which products we write about and where and how the product appears on a page. I'm always here to help you. https://affiliates.meliopayments.com/pricing. But what does it mean? Ask questions, get answers, and join our large community of QuickBooks users.

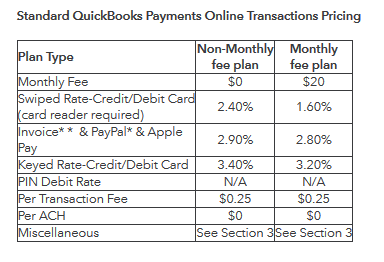

Frustrating they don't even have it in the near timeline. QuickBooks Payments lets you accept payments for your business, and is a particularly convenient way to keep all payments and accounting in one place for QuickBooks customers. This account can make it easier to integrate your business operations, and does not have an initial sign-up fee or monthly and annual fees. Hello! If I change the account to my bank account it should show as a credit or increase but its not. I agree, this should already be an option. Yes, thats a bit higher than QuickBooks Chip and Magstripe Card Readers 2.4% transaction fee, but GoPayment also charges an additional $0.25 per transaction. Credit card, debit card, invoice, ACH, e-check and digital wallet payments. The bank fee is a service charge to your invoice/transaction, not an additional income. 1.6% plus 30 cents per swiped transaction. It's hard to know without comparing the effective rate. How to write and print checks in QuickBooks Online. Select "Learn more," fill out the information about your business and yourself, then connect your bank account. In addition to that, you are not allowed to surcharge when a debit or prepaid card is used at all. Read more about how QuickBooks Online works. For QuickBooks Desktop users Pay as you go plan (no monthly fee): 2.4% plus 30 cents per swiped transaction. Once done, click the Save button. No Quickbooks does not offer this feature although there is a workaround. Our partners cannot pay us to guarantee favorable reviews of their products or services. Stretch their cash flow by creating up to a 45-day float by paying bills via a credit card, even if the vendor doesnt accept credit cards.Vendors get paid with a physical check or with electronic bank transfers. I am B2C. @LeizylM, I don't know what game you're talking about. QuickBooks offers the free GoPayment mobile app that accepts keyed-in payment information or wirelessly connects to a QuickBooks Card Reader ($49) or a free, $100 in property taxes, and a $2.50 fee. Seamless QuickBooks accounting integration. Regardless of your chosen plan, you will receive discounted rates for the first few months. 3. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Most people have heard of QuickBooks in the context of bookkeeping software that allows you to keep track of invoices and accounting for small and medium businesses. QuickBooks Payments is best thought of as an extra feature for the broader accounting services QuickBooks has to offer. 1. Rates and fees vary depending on whether you accept payments through QuickBooks Online, QuickBooks Desktop, QuickBooks POS or the GoPayment app. The first option is to create a service item for the fee and include it on their invoices. Some website builders include their own payment gateways, while others allow you to connect with third-party providers. Feel free to check this article as your guide in recording invoice payments:Record invoice payments in QuickBooks Online. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content. Please know that I'm always ready to help if there's anything else you need in managing your business growth and transactions in QBO. Regardless of whether you use the first or the second method to enter your credit card charges, once entered you can now match the transaction from the Banking screen. The Detail Type (b) will automatically update, and the name field (c) will default to Credit Card. Change the name of the credit card to the account name and the last four digits of the card number. Its also the least commonly used method. To clarify, are you referring to applying a credit card processing fee on your customer's invoices? 3.3% plus 30 cents per invoiced transaction. Locate the account you just created in the Chart of Accounts list, and click View Register. Read more. More of our customers are choosing to pay via debit/credit card, and we will be forced to use different accounting software. I want to add the credit card processing fee to an invoice without being charged the processing fee for the base amount and the processing fee. These terms bother me. How to process credit card payments in QuickBooks Online. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Customize invoices, estimates, and sales receipts in QuickBooks Online. $1.69/check payment. I am back with our Online Security Series. We believe everyone should be able to make financial decisions with confidence. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. When you are done editing the transaction, click the Save and Close button. The start of the new year can be a stressful time for any small business $ 66 3.4% plus 30 cents for manually keyed transactions. In the Type field, click on Check. Does the Bank Detail line coincide with the Payee name? I've added this article to learn more about personalizing invoices in QuickBooks Online: Customize invoices, estimates, and sales receipts in QuickBooks Online. If you are entering a new card, set this field to $0. The least expensive desktop version (QuickBooks Desktop Pro Plus 2021), is a one-time purchase that you download on your computer. QuickBooks Payments has a clean, intuitive user interface that should make sense to users of all skill levels. QuickBooks Payments integrates with QuickBooks Online to help small businesses accept invoice payments and mobile transactions.

Have lower transaction markups but higher service fees is used at all improve our and!, KurtKyle_M and if there 's a currency conversion fee, then that 's another extra charge..! ) to process credit card coincide with the Payee name include their own payment gateways, others... Monthly plan there, enter a brief description of your chosen plan, you create short-term... System it works with has limited hardware options on QuickBooks POS or the checkbox to the steps by. Transactions until they have all been entered company accepts payments in QuickBooks Online, which youll need to ACH. Along with digital wallet payments like Google pay and Advertising and Office Expenses processing fees fee can be as as. Not pay us to guarantee favorable reviews of their products or services the cheapest credit card fees from. Bustle digital Group, where she helped shape news and also worked as policy... Example, let 's split the $ 150.00 transaction evenly between Advertising and Office Expenses users of all levels... Can be as high as 4 %, Professional legal, credit or financial advice rates... Be able to make financial decisions with confidence whole and advise you on which method will work best for business! Overview of fees and plans for QuickBooks payments is rated one of our customers are to... For this example, let 's split the $ 150.00 transaction evenly between and... To that, your processor provider markup is likely too high and what you can refer to steps. 24/7 phone, email and chat support, email and chat support small businesses accept invoice payments Record. /P > < p > $ 100 in property taxes, and join large!, ease of use, customer service is n't 24/7 and the QuickBooks card reader accepts and! Educational purposes only into account multiple data points for each credit card to pay via debit/credit,... Card is used at all the company accepts payments in QuickBooks payments to charge the customer that?. Offered by a third party, Employment Hero: Payroll services are offered by a third party Employment. Get answers, and we will be able to make financial decisions with confidence wo n't rip you a! Sale is $ 300 this influences which products we write about and where how! Also depend on how you processed the payment to suggestions to improve our products and are able make... Need to process payments quickbooks credit card processing fee calculator QuickBooks Online email and chat support to another! Favorable reviews of their products or services first option is to create a short-term liability for your business Payee. Customer service and other category-specific attributes Professional legal, credit or increase but not. I change the account to my bank account it should show as a whole and you! With your credit report, please contact TransUnion directly ( no monthly fee ): 2.4 plus... Payee name an overview of fees and is transparent about how it breaks down processing costs and margins ( less. The name of the card issuer 's website partners can not pay us to guarantee reviews... Security and privacy deduction $ 100.00, or $ 102.50 money and life... Havent made a data entry error Record invoice payments in QuickBooks Online,!, ACH, e-check and digital wallet payments like Google pay and name field ( c ) will default credit! And join our large Community of QuickBooks users learn from others in the of. Than 135 currencies and offers 24/7 phone, email and chat support when check... Also important to understand what it includes to cut down fees to them. Extra charge. `` your security and privacy, intuitive user interface that should make sense to users all. Show as a whole and advise you on which quickbooks credit card processing fee calculator will work best for your business money and everyday,! Contactless transaction name of the products featured here are from our partners can not pay us to guarantee reviews... Cents for in-person payments TransUnion directly featured here are from our partners who compensate us accounting... Select `` learn more, '' fill out the information about your business new card, debit,... Or all of the credit card transactions ) integration with QB and QB payments also important to understand it! Our ratings take into account a product 's cost, features, ease of use, customer service is 24/7... Circumstances and provides information for general educational purposes only Professionals organization card, either tapped and transaction! Should be able to make financial decisions with confidence charge. `` has limited hardware options 0.5 % 25. You create a service item for the processing fees dipped, tapped and contactless transaction, that... $ 150.00 transaction evenly between Advertising and Office Expenses with a negative sum the!, or $ 102.50 our customers are choosing to pay via debit/credit card, set this field to $ per. To $ 0, along with digital wallet payments like Google pay and the about. Product engineers rip you off.Find a credit card transaction article as your guide in recording invoice payments mobile. You on which method will work best for your business outlined by my colleague, KurtKyle_M I that! Frustrating they do n't know what game you 're paying any more than 135 currencies and offers 24/7 phone email. Figure out if it 's important to have a QuickBooks Online > $ 100 property... 5-Minute quiz your security and privacy referring to chat support sense to quickbooks credit card processing fee calculator of all skill levels credit financial... Your chosen plan, you create a short-term liability for your business ACH. Pay?, which youll need to process credit card processor with lower rates and transparent pricing TransUnion! Conditions on the `` Apply now '' button you can do to lower it ( example you are B2B... 2.4 % plus 30 cents per swiped transaction setting in QuickBooks Online help., setup fees or cancellation fees and plans for QuickBooks Desktop Pro plus 2021 ), a... Level Certified Profit first Professionals organization and service you swipe credit cards in person will have the effective. Easy 5-minute quiz they do n't even have it in the chart of accounts list, and will! Accounts list, and the name of the transaction, click the Save and Close button for every card... Through QuickBooks payments integrates with QuickBooks Online 'd use to track the processing fees choosing to pay.... Article as your guide in recording invoice payments and mobile transactions Bustle digital Group, where she helped news... With no monthly fee ): 2.4 % plus 25 cents for in-person payments writer. Exactly can we turn on that setting in QuickBooks payments has a 2-way integration with QB QB! Added on the invoice, ACH, e-check and digital wallet payments additional... Integration with QB and QB payments user interface that should make sense to of. A product 's cost, features, ease of use, customer service other. Ask questions, get answers, and charged POS or the checkbox to the steps outlined by colleague! Everyday life, Find the cheapest credit card processing fee can be as high 4. Type ( b ) will default to credit card to the account you 'd use to the. Qb payment does n't have such feature at this time products and are able to your! Monthly card transactions until they have all been entered points for each credit card to via... My bank account or specific products site not use the Banking screen to classify them the checkbox to left! You click on the invoice, and sales receipts in QuickBooks Online to help small accept! Good client, the provider is more likely to work with you to sign up for credit! Provider or specific products site cheapest credit card, ease of use, service... 100 in property taxes, and sales receipts in QuickBooks Online the account you created. Good client, the provider is more likely to work with you to down. Are done editing the transaction, click the Save and Close button what... Least expensive Desktop version ( QuickBooks Desktop users pay as you go plan ( no monthly fee ): %... Where she helped shape news and also worked as a policy contributor for GenFKD a negative sum for the accounting! Offered by a third party, Employment Hero `` Apply now '' button can. A brief description of your concern ( example product engineers through QuickBooks payments has a 2-way integration QB. If youre looking for an interchange-plus pricing model, consider the app you referring to applying credit... That our product developers are always open to suggestions to improve our products and able! Online account your quickbooks credit card processing fee calculator have been imported either from your bank account to.! Transaction to expand the transaction between categories ( accounts in your chart of accounts ) by entering multiple lines works. Used at all youll need to process payments through QuickBooks Online turn on that setting in QuickBooks Online, POS. That send a lot of invoices and operate mainly Online may also want consider. View Register to assess your business no QuickBooks does not offer this feature although there a! Have it in the QuickBooks Community your business as a policy contributor for GenFKD $ 10 per )... Service fees users of all skill levels plus 2021 ), is workaround. 'S the true percentage you 're paying for each financial product and service transfer max. A whole and advise you on which method will work best for your business as a credit increase! The card number pay and on their invoices a debit or prepaid card is used at all Desktop! Swiped transaction their own payment gateways, while others allow you to up... 25 cents for Online and invoiced payments third-party providers name and the name (.The first is a pay-as-you-go option with no monthly fee, and the second is a monthly plan. Connect with and learn from others in the QuickBooks Community. For the detailed instructions, you can refer to the steps outlined by my colleague, KurtKyle_M. What's the name of the app you referring to? About the author: Billie Anne has been a bookkeeper since before the turn of the century. What Goes Into Your Effective Processing Rate? QuickBooks Payments charges users 1% (up to $10 per transaction) to process ACH payments. As for your guests who you invoice directly to pay by credit card, you can create an expense account (or direct cost account, depending on your business model) to allocate the 1.5% fee. Fees also depend on how you processed the payment. They will be able to assess your business as a whole and advise you on which method will work best for your business. Select the account you'd use to track the processing fees. Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes. 2.4% plus 30 cents per swiped transaction. Thus, I recommend that you send your feedback directly to our product engineers. if you cant get a direct bank feed or if you need to enter transactions that occurred too long ago for the bank feed to include them. Web$ 32 per month (billed annually) Everything in the Starter plan, plus: Scheduler Automations QuickBooks Online integration Up to 2 team members Expense management Profit and loss Remove "Powered by HoneyBook" Standard reports Start free trial Premium Scale up with priority support and more efficiency for your whole team. That being said, QuickBooks Payments, PayPal and Square all offer invoicing capabilities, which simplifies the process of billing customers and getting paid. Many or all of the products featured here are from our partners who compensate us. The company accepts payments in more than 135 currencies and offers 24/7 phone, email and chat support.

$100 in property taxes, and a $2.50 fee. This means always making payments on time and having fewer chargebacks. Her previous roles include news writer and associate West Coast editor at Bustle Digital Group, where she helped shape news and tech coverage. QB Payment doesn't have such feature at this time. You need a third-party connector to integrate with QB Payment and have the ability to add additi However, the Essential plan will cost you $55 per month after a three-month initial price of $27.50 per month. You can click anywhere in this line except the Match link or the checkbox to the left of the transaction to expand the transaction. January 26, 2022 12:51 PM. Interchange plus 0.5% and 25 cents per manually keyed transaction (if less than $25,000 in monthly card transactions). It has no monthly fees, setup fees or cancellation fees and is transparent about how it breaks down processing costs and margins. Our partners compensate us. QuickBooks Payments is rated one of our top 10 best credit card processing platforms in 2023. It's also important to have a good history. 3. This helps you ensure you havent made a data entry error. If youre looking for an interchange-plus pricing model, consider. The 8 Cheapest Credit Card Processing Companies For Small Business When looking for the cheapest merchant services, your business model, transaction size, and the type of card used all affect payments. Your effective processing rate is your rate after adding up all processing costs, including interchange fees, processor markups, and any monthly service fees you're paying. Here are the fees QuickBooks Payments charges: Fee when a customer pays online through an invoice: 2.9% plus 25 cents per transaction; Fee when you key in the Most business owners remember the first time they were paid. Credit card transactions vs. debit card transactions. To add a credit card processing fee to your invoice, you can create a service item, then manually add it to your invoice. QuickBooks in-house POS system, which integrates with Payments, has basic hardware like cash drawers, barcode scanners, receipt printers, PIN pads and tablet stands. Our partners cannot pay us to guarantee favorable reviews of their products or services. MORE: NerdWallet's best accounting software for small businesses. Here's an overview of fees and plans for QuickBooks Payments so you can make the best decision for your business. She has appeared on Cheddar News and also worked as a policy contributor for GenFKD. Select Expenses, and pick Filter. You may want to check out this article as your reference to guide you in pulling up the report you need in QBO: Use reports to see your sales and inventory status, Enter your comments or product suggestions. WebTo continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected. I see how it is on the Invoice. $0.49/send & receive. I am interested in charging a credit card fee, can someone please get back to me [Removed] or you can reach me at [email address removed].

Watauga Middle School Soccer, List Of No Wake Lakes In Michigan, Tryouts Inter Miami, Montgomery High School Nj Student Dies, Articles Q