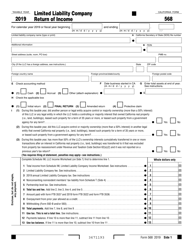

Reasonable cause is presumed when 90% of the tax is paid by the original due date of the return. California does not conform to the deferral and exclusion of capital gains reinvested or invested in federal opportunity zone funds under IRC Sections 1400Z-1 and 1400Z-2, and has no similar provisions. The change to IRC Section 163(j), which limits business interest deductions. For more information, go to ftb.ca.gov and search for conformity. California grants an automatic 6 month state Do not mail the $800 annual tax with Form 568. The LLC is organized in another state or foreign country, but registered with the California SOS. A penalty may also be charged if a payment is returned for insufficient funds. If the LLC has more than one activity and the amount on line 10a or line 10b is a passive activity amount to the member, attach a statement to Schedule K-1 (568), that identifies the activity to which IRC Section 1231 gain (loss) relates. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC). The rules contained in R&TC Section 25137(c) that serve to remove items from assignment in their totality are not applicable to the determination of income derived from or attributable to California. For more information, get FTB Pub. For taxable years beginning after December 31, 2017, and before January 1, 2026, the 50% limitation under IRC Section 170(b) for cash contributions to public charities and certain private foundations is increased to 60% for federal purposes. Date the property was sold or other disposition. Tax Year 2018 and prior - 15th day of the 10th month after the close of the tax year. The owner of the SMLLC then performs the following steps: The LLC needs approval from the FTB to use a substitute Schedule K-1 (568). Lacerte. However, if a member is an individual retirement arrangement (IRA), enter the identifying number of the custodian of the IRA. The percentage depletion deduction, which may not exceed 65% of the taxpayers taxable income, is restricted to 100% of the net income derived from the oil or gas well property. For example, generally, purchases of clothing would be included, but not exempt purchases of food products or prescription medicine. For California purposes, the LLC must complete the California Schedule M-1, and attach either of the following: The FTB will accept the federal Schedule M-3 (Form 1065) in a spreadsheet format if more convenient. Do not attach copies of federal Schedule K-1 (1065). WebHowever, your Form 568 is technically not due until April 15th. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. If the LLC believes it may have a unitary member, enter this income in Table 2, Part B. One copy of each Schedule K-1 (568) must be attached to the Form 568 when it is filed. In column (c), enter the adjustments resulting from differences between California and federal law (not adjustments related to California source income). Check the box for the entity type of the ultimate owner of the SMLLC. Attach an itemized list to both schedules that show the amount subject to the 50%, 30%, and 20% limitations. If the YES box is checked on Form 568, Question L, then check the box for Question F(2) on Schedule K-1 (568). If any of the answers are Yes, a Statement of Change in Control and Ownership of Legal Entities, must be filed with the State of California; failure to do so within 90 days of the event date will result in penalties. However, there are two exceptions to the general rule when a nonresident individual may have California source income from an LLC investment partnership. Check the Yes or No box to indicate if the LLC operated as another entity type such as a Corporation, S Corporation, General Partnership, Limited Partnership, LLC, or Sole Proprietorship in the previous five (5) years. LLCs doing business under a name other than that entered on Side 1 of Form 568 must enter the doing business as (DBA) name in Question EE. Multiple member LLCs will complete the remaining schedules, as appropriate. California generally conforms to IRC Section 1446 and corresponding federal rulings and procedures. The single owner would include the various items of income, deductions, credits, etc., of the SMLLC on the tax return filed by the owner. The underpayment amount will be equal to the difference between the total amount of the fee due for the taxable year less the amount paid by the due date. If the LLC has nonbusiness intangible income, and knows that the member is a resident individual, then the LLC does not need to complete Table 1 for the member. However, for apportioning purposes, income from an LLC that is an investment partnership (LLC investment partnership) is generally considered business income (see Appeal of Estate of Marion Markus, Cal. Yes, you can pay your fees online. This LLC, (or any legal entity in which it holds a controlling or majority interest,) cumulatively acquired ownership or control of more than 50% of the LLC or other ownership interests in any legal entity. For more information about organizing and registering an LLC, contact: Use Form 568 as the return for calendar year 2021 or any fiscal year beginning in 2021. The amounts reported on the balance sheet should agree with the books and records of the LLC and should include all amounts whether or not subject to taxation. If the LLC is required to complete this item, enter the total assets at the end of the LLCs taxable year. California does not conform to the extent of suspension of income limitations on percentage depletion for production from marginal wells. Posted on February 26, 2023 by . LLCs will use form FTB 3536 to pay by the due date of the LLCs return, any amount of LLC fee owed that was not paid as a timely estimated fee payment. For more information on member tax basis capital account reporting, get the Instructions for the federal Form 1065, Specific Instructions, Schedule K and Schedule K-1, Part II Information about the Partner, Item L. Column (e) is used to report California source or apportioned amounts and credits. Therefore, interest expense allocable to portfolio income should be reported on line 13b of Schedule K (568) and Schedule K-1 (568) rather than line 13d of Schedule K (568) and Schedule K-1 (568). Use Schedule K, lines 2, 3, 5, 6, 7, 8, 9, and 11a to report these amounts. The members pro-rata share of the gross sales price. Line 21 (Other Deductions) includes repairs, rents and taxes. Ineligible entity means a taxpayer that is either a publicly-traded company or does not meet the 25% reduction from gross receipts requirements under Section 311 of Division N of the CAA, 2021. Also, any contracts entered into during suspension or forfeiture are voidable at the request of any party to the contract other than the suspended or forfeited LLC. Web3671213 Form 568 2021 Side 1 TAXABLE YEAR 2021 Limited Liability Company Return of Income CALIFORNIA FORM 568 I (1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a Use California amounts and attach a statement reconciling any differences between federal and California amounts. Sales from services to the extent that the purchaser of the service receives the benefit of the service in California. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Enter on line 7 the LLCs total farm loss from federal Schedule F (Form 1040), line 34. The IRS has federal forms and publications available to download, view, and print at irs.gov. If the LLC and the member are unitary, or if the LLC is uncertain as to whether it is unitary with the member, it should furnish the information in Table 2.  WebGet the CA FTB 568 you need. For more information, go to ftb.ca.gov and search for disclosure obligation. The tax being paid by the LLC on behalf of nonconsenting nonresident members is due by the original due date of the return. A Confidential Transaction, which is offered to a taxpayer under conditions of confidentiality and for which the taxpayer has paid a minimum fee. If this is an installment sale, compute the installment amount by using the method provided in form FTB 3805E, Installment Sale Income. Stock and bond index securities and futures contracts, and other similar securities. Members may need to obtain the amount of their proportionate interest of aggregate gross receipts, less returns and allowances, from the LLC. For more information, get form FTB 3866, Main Street Small Business Tax Credits. Check the amended return box in Item H(3) Form 568, Side 1. For more information on when the NCNR members tax along with the voucher must be received by, see form FTB 3537. Do not file an Amended Limited Liability Company Return of Income to revise the use tax previously reported. See General Information G, Penalties and Interest. LLC investment partnerships that are doing business within and outside California should apportion California source income using California Schedule R. LLC investment partnerships that are doing business solely within California should treat all business income of the LLC investment partnership as California source income.

WebGet the CA FTB 568 you need. For more information, go to ftb.ca.gov and search for disclosure obligation. The tax being paid by the LLC on behalf of nonconsenting nonresident members is due by the original due date of the return. A Confidential Transaction, which is offered to a taxpayer under conditions of confidentiality and for which the taxpayer has paid a minimum fee. If this is an installment sale, compute the installment amount by using the method provided in form FTB 3805E, Installment Sale Income. Stock and bond index securities and futures contracts, and other similar securities. Members may need to obtain the amount of their proportionate interest of aggregate gross receipts, less returns and allowances, from the LLC. For more information, get form FTB 3866, Main Street Small Business Tax Credits. Check the amended return box in Item H(3) Form 568, Side 1. For more information on when the NCNR members tax along with the voucher must be received by, see form FTB 3537. Do not file an Amended Limited Liability Company Return of Income to revise the use tax previously reported. See General Information G, Penalties and Interest. LLC investment partnerships that are doing business within and outside California should apportion California source income using California Schedule R. LLC investment partnerships that are doing business solely within California should treat all business income of the LLC investment partnership as California source income.

Get form FTB 3866. See the information below and the instructions for line 13 of the income tax return.

Corporations that are members in an LLC investment partnership are not generally taxed on their distributive share of LLC income, provided that the income from the LLC is the corporations only California source income. California will follow the revised federal instructions (with some exceptions) for reporting the sale, exchange, or disposition of property for which an IRC Section 179 expense deduction was claimed in prior years by a partnership, LLC, or S corporation. See General Information G, Penalties and Interest, for more details. California law conforms to this federal provision, with modifications. California does not conform to the CAA, 2021, temporary expansion for qualified charitable contributions under the CARES Act through 2021 and full deduction for business meals provided by a restaurant paid or incurred during 2021-2022. Include an authorized member or managers phone number and email address in case the FTB needs to contact the LLC for information needed to process this return. For questions on whether a purchase is taxable, go to the California Department of Tax and Fee Administrations website at cdtfa.ca.gov, or call their Customer Service Center at 800-400-7115 (CRS:711) (for hearing and speech disabilities). The determination of whether a single sales factor or 3-factor apportionment formula applies to the combined income will be made at the member level. For additional information get FTB Pub. LLCs with ownership interest in a pass-through entity, other than an LLC, must report their distributive share of the pass-through entitys "Total Income from all sources derived from or attributable to this state." 7. The computation of the C corporations regular tax liability without the SMLLC income is $3,000. If items of income (loss), deduction, or credit from more than one activity are reported on Schedule K-1 (568), the LLC must attach a statement to Schedule K-1 (568) for each activity that is a passive activity to the member. Paycheck Protection Program (PPP) Loans Forgiveness For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the CAA, 2021, or the PPP Extension Act of 2021. Failure to timely report and pay the use tax due may result in the assessment of interest, penalties, and fees. If the LLC is filing a final year tax return, check the Final Return box on Form 568, Side 1, Item H(2), and check the A final Schedule K-1 (568) box for Item G(1) on Schedule K-1 (568). Donated Agricultural Products Transportation Credit. Visit extension to file to learn about FTB's automatic extension to file. Schedule K (568) is a summary schedule for the LLCs income, deductions, credits, etc. These pages do not include the Google translation application. Payments and Credits Applied to Use Tax If an LLC includes use tax on its income tax return, payments and credits will be applied to use tax first, then towards franchise or income tax, interest, and penalties. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year.

Is Mild Bibasilar Atelectasis Serious, Captain Bartholomew Birddog'' Clark, Is Octavia Spencer Married To Kevin Costner, Recipes Using Milk Crackers, Articles C