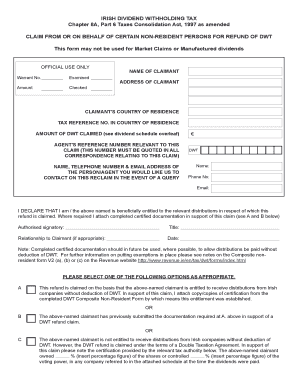

Where the UK does not have a treaty with another country, unilateral relief typically applies to grant a credit in the UK for foreign taxes paid. If you have a lot of assets that you intend to pass on to others inheritance tax is something you need to think about. You are classed as a Non Resident Landlord by HM Revenue and Customs (HMRC) if you have rental property in the UK and live abroad for 6 months or more per year. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20% This page contains their contact form. With the exception of income from property in the UK and investment income connected to a trade in the UK through a permanent establishment, the tax charge for non-residents on investment income arising in the UK is restricted to the amount of tax, if any, deducted at source. You have rejected additional cookies. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. This is to make sure that you dont pay too much tax. WebNon-Resident Form V2A 1 Dividend Withholding Tax (DWT) (as provided for by Chapter 8A, Part 6 of the Taxes Consolidation Act, 1997 - the Act) Part 2 of the form must be completed by the tax authority of the country in which the shareholder is resident for tax purposes. Your use of this website is subject to the terms and conditions governing it. And if that doesnt clear things up, you would probably be advised to go through the Statutory Residence Test which is the formal approach for letting you work out your residence status for a particular tax year. WebA dividend is a sum of money that a limited company pays out to someone who owns shares in the company, i.e.

You may also have to withhold tax if any of the above payment types have been dealt with (for example, reinvested or capitalised) on behalf of the non-resident. However, be warned, this only applies if you do not return to the UK to Yes, the UK has a special tax regime for Non-Resident Landlords and this is maintained by HMRC by passing responsibility for the collection of withholding tax over to property management companies and your tenants. A higher tax rate of 40% is due on income above 50,270 up to 150,000. If there is no tax treaty the rate will be 30%. This website uses cookies that provide necessary site functionality and improve your online experience. A non-resident individual or trust trading in the UK through a branch or agency is chargeable in respect of UK assets used or held in or for the purposes of the trade or the branch or agency.  Withholding tax is a tax levied by an overseas government on dividends or income received by non Fax: +44 (0)20 7282 4337. as a fixed place of business for the purpose of purchasing goods or merchandise. Whether you have accessible accommodation in the UK: The test is one of accessibility rather than ownership, which then covers situations where accommodation can be available to an individual, even if it is owned (and occupied) by someone else. Essential reading for anybody with financial or family connections to the UK who live abroad. OP basically as Wilson says. Generally, UK non residents need to pay UK tax on income generated in the UK, any profits made from selling property, and heirs are eligible to pay inheritance tax on non residents estates. Exclude the dividends and you don't get the PA. have the payments otherwise dealt with at the direction of your foreign resident payee. Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy. Multiply the figure in box 18 by 10% and enter the result in box 19. WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. If you withhold more tax than you should and you discover the error later than 30June after the end of the year to which the withheld amount relates, do not refund the amounts to your payee if you do we cannot refund the amount to you. Tax withheld in one country can usually be credited against the tax due in the other (again, there are exceptions to every rule, just ask Mr Anson). The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of tax, if any, deducted at source. The technical storage or access that is used exclusively for anonymous statistical purposes. For example, many people believe that if they are resident in one country, say the UK, then they need not worry about paying tax in the country where the income arises (the source state). This is sadly not always the case because whilst the DTA will exempt some income from taxation by the source state, it mainly divides up the taxing rights. endstream

endobj

startxref

The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. Resident if individual has 4 factors (otherwise not resident), Resident if individual has 3 factors or more (otherwise not resident), Resident if individual has 2 factors or more (otherwise not resident).

Withholding tax is a tax levied by an overseas government on dividends or income received by non Fax: +44 (0)20 7282 4337. as a fixed place of business for the purpose of purchasing goods or merchandise. Whether you have accessible accommodation in the UK: The test is one of accessibility rather than ownership, which then covers situations where accommodation can be available to an individual, even if it is owned (and occupied) by someone else. Essential reading for anybody with financial or family connections to the UK who live abroad. OP basically as Wilson says. Generally, UK non residents need to pay UK tax on income generated in the UK, any profits made from selling property, and heirs are eligible to pay inheritance tax on non residents estates. Exclude the dividends and you don't get the PA. have the payments otherwise dealt with at the direction of your foreign resident payee. Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy. Multiply the figure in box 18 by 10% and enter the result in box 19. WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. If you withhold more tax than you should and you discover the error later than 30June after the end of the year to which the withheld amount relates, do not refund the amounts to your payee if you do we cannot refund the amount to you. Tax withheld in one country can usually be credited against the tax due in the other (again, there are exceptions to every rule, just ask Mr Anson). The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of tax, if any, deducted at source. The technical storage or access that is used exclusively for anonymous statistical purposes. For example, many people believe that if they are resident in one country, say the UK, then they need not worry about paying tax in the country where the income arises (the source state). This is sadly not always the case because whilst the DTA will exempt some income from taxation by the source state, it mainly divides up the taxing rights. endstream

endobj

startxref

The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. Resident if individual has 4 factors (otherwise not resident), Resident if individual has 3 factors or more (otherwise not resident), Resident if individual has 2 factors or more (otherwise not resident).

UK corporate, partnership and VAT compliance and advisory services UK/US treaty demystifying the limitation on benefits article , Tel: +44 (0)20 7242 5000 UK domestic law requires a UK payer to withhold income tax of 20% on the payment of interest and royalties to non-residents. This income is chargeable in the UK at both basic and higher rate tax unless there are specific relieving provisions. It is possible to register as a non-resident landlord with HMRC. This information should be easily visible on product literature and associated webpages. Whether you have substantial employment in the UK: This is a different test to the full time work abroad, and means working in the UK for more than 40 days in a tax year (again, a day is three hours work). Meeting these deadlines avoids a minimum 100 fine and Im sure it goes without saying that HMRC has all kinds of options if you dont pay your tax. If your UK income is over that amount theres a personal savings allowance. A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. Incorrectly managing tax residence status is one of the most common tax mistakes made by British expats. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. Monthly updates from the best of this blog. You must withhold tax from dividends you pay to a foreign resident when any of the following occurs: If you are an Australian agent of a foreign resident, you should withhold tax when you: You do not have to lodge this annual report if you have correctly reported interest or dividend payments to foreign residents in an annual investment income report (AIIR). Fortunately, many of these exclusions dont apply to most investors, other than the potential for Puerto Rican stocks, whose dividends arent qualified for a credit and must be itemized for a deduction.

While the U.S. government taxes dividends paid by American companies, it doesnt impose tax withholdings for U.S. residents. HMRC will need to complete the calculation for me.. That said, to lower or even avoid capital gains tax non residents do sometimes come back to the UK and live in their property for a period of time before selling. We have created this comprehensive guide to Expat Taxes in the UK to help people with connections to the UK understand their UK tax requirements. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. First, theres getting some software to help you. The catch is that you can deduct only an amount equal to your total U.S. tax liability in any given year. Box 7 is your basic rate band limit. Consequently, if you are eligible to receive the income tax personal allowance and your income is less than 12,570 you need not pay any tax. You can read about this in more detail here, but the headline is UK expats now usually pay 5% above standard rates when buying property. you spend no more than 90 days in the UK. ). The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of Dont envy anyone who is dual resident in the UK and US, and makes a claim under the DTA that they are solely resident in the US. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Normally the process of seeking direction can take many weeks as the application needs to be sent to the tax authority of the overseas recipient as well as HMRC however a simplified email-based process has been introduced by HMRC to help taxpayers be compliant in applying reduced rates but this process is not available to taxpayers seeking direction for the first time in respect of a particular interest or royalty stream. You need to pay stamp duty when you buy a property. Dividends from ETFs domiciled in France, Luxembourg and the US may be subject to a withholding tax of 30% for example. If you are considered a UK resident, your worldwide income will be subject to these tax rates, so it is essential to understand your residency status when calculating how much tax you owe. Generally, above a certain amount you must pay tax in the UK, but below that amount you wont have tax to pay if you are eligible to receive the personal allowance. Ge!0aGx;N?&d2Z>Q_3)8CD !&t0G}-oxef*t4J&ah+O0 p;2aZN_$KSelakxZ*wV*'9P&o?V#*qw1q95~{Qi Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. the treaty specifies a 15% rate for trust income and no rate for estate income. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). Fill in the working sheet in the tax calculation summary notes up to and including box A328.

The effective tax rate for a dividend that does not exceed 8% of the value of a stock will be 7.5% And always remember that investing comes with a risk of loss. You can then download the form in question and some supplementary notes if required.  Each of the above links takes you directly to the governments web page. U.S.: 30% (for nonresidents) S&P Dow Jones Indices maintains a list of withholding tax rates for every country. For banks and other financial institutions (excluding asset management companies (SGRs) and brokerage companies (SIMs)), the corporate tax rate is 27.5%. And forms need to be submitted by 31 October by post or 31 January for online. Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. You must be registered for pay as you go (PAYG) withholding before you withhold tax. Read our article about the differences between domicile and residence for more in depth understanding into how residence and domicile are fundamentally different. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. However, if you are not considered UK resident special rules apply. You must always seek advice before submitting a tax return to ensure that your tax matters are both correct and optimised for your situation. To achieve this aim, Art 1(4) states as follows: Notwithstanding any provision of this Convention except paragraph 5 of this Article, a Contracting State may tax its residents (as determined under Article 4 (Residence)), and by reason of citizenship may tax its citizens, as if this Convention had not come into effect.. This The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. However, individuals with more complicated affairs; those with income not taxed at source e.g. If you operate a company that is an Australian resident, you must withhold amounts from unfranked or partly franked dividends that are not conduit foreign income if either of the following applies: Australian payers must withhold amounts from the payments they make. 676 0 obj

<>stream

But I was very impressed by their rapidity, expertise in giving me the necessary information. ). Remember to record this offset in your accounts. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. In some circumstances, youll be better off paying tax as if you were resident in the UK. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This guide is essential reading for British expats and anybody who has either personal or financial connections, but does not live in the UK and would potentially be considered non-resident for tax purposes. Dividend payments from the UK. Find out about the Energy Bills Support Scheme, Non-residents savings and investment income (Self Assessment helpsheet HS300), Filling in the rest of the working sheet in your tax calculation summary notes, nationalarchives.gov.uk/doc/open-government-licence/version/3, the amount of tax that would be chargeable on income, other than the disregarded income shown below, but before the deduction of any personal allowances due, plus the amount of tax deducted at source from the disregarded income, interest and alternative finance receipts from banks and building societies, income from National Savings and Investments, profits or gains from transactions in deposits, certain social security benefits, such as State pensions or widows pensions, taxable income from purchased life annuities except annuities under personal pension schemes. If you are either classed as a tax resident in the UK or receive an income in the UK (for example from renting out a property), you will normally receive a personal tax allowance on your UK income of 12,570 for the tax year 2022/23. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. savings, investments and property, those individuals earning approximately 100,000.00 or more, as well as those who are new to the UK, are likely to have to complete a UK tax return. However, if during a year you either leave the UK to live or work abroad you may be eligible for the tax year to be split into two parts: The rules for ensuring split year treatment will apply are complicated and you should seek specialist advice in this area. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. Looking at the income tax table above, you can see that youd need to have a UK income over 50,271 before you would be liable for the higher rate. Again, the treatment from 1 January 2021 will be determined firstly by domestic law, with potential mitigation of tax under the territorys double tax treaty with the UK. A foreign resident can be an individual, company, partnership, trust or super fund. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. The foreign withholding tax rate on dividends can vary wildly around the world. %%EOF

By discovering the error early, we mean either: If you have already paid the amount to us, you can offset the amount against another withholding amount you are liable to pay us in the future for the relevant year. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. Nowadays there are plenty of services available. Your presence in the UK in the previous two tax years: This factor is satisfied if an individual has been in the UK for 90 days or more in either of the two previous tax years. Tax treaties are special agreements that Australia has entered into with over 40countries. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. It includes a working sheet, which you only need to use if you decide to calculate your tax. For more information about online forms, phone numbers and addresses contact Self Assessment: general enquiries. We use some essential cookies to make this website work. For a more detailed overview of Split Year Treatment, please read ourSplit Year Treatment article >. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. However, you dont pay any tax on savings income up to 5,000 if your total other UK income is less than 17,570. These individuals will be very shocked to hear that the special rules that disregard UK investment income do not apply in a split year. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. The purpose of the qualified person test is to sort the wheat from the chaff or, as HMRC put it: These tests, which determine whether a particular category of UK or US resident is a qualified person, are all based on the concept that a substantial commercial and economic connection must exist between the taxpayer and the UK or the US to warrant entitlement to treaty benefits. In order to avoid double taxation, in which dividend investors are taxed by both foreign governments and the IRS, the U.S. has worked out tax treaties with over 60 nations to reduce the foreign tax paid on dividends. Include the dividends and you do get the PA at which point the UK resident (normal) tax liability would be 5,175, however a non res gets a 46,275 @ 7.5% tax credit = 3,470, giving a net liability of You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products). payment you make is effectively connected with the payee's business. a shareholder. A permanent establishment means a fixed place through which a business entity carries on their business activities in part or in full, and can include a: An establishment may not be counted as a permanent establishment if is just used: Temporary residents of Australia who pay dividends to foreign lenders do not have to withhold tax from the payments they make. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not.

Each of the above links takes you directly to the governments web page. U.S.: 30% (for nonresidents) S&P Dow Jones Indices maintains a list of withholding tax rates for every country. For banks and other financial institutions (excluding asset management companies (SGRs) and brokerage companies (SIMs)), the corporate tax rate is 27.5%. And forms need to be submitted by 31 October by post or 31 January for online. Overview of any fees, charges and services that you may need to get your expat tax affairs in order, without any obligation to proceed. You must be registered for pay as you go (PAYG) withholding before you withhold tax. Read our article about the differences between domicile and residence for more in depth understanding into how residence and domicile are fundamentally different. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. However, if you are not considered UK resident special rules apply. You must always seek advice before submitting a tax return to ensure that your tax matters are both correct and optimised for your situation. To achieve this aim, Art 1(4) states as follows: Notwithstanding any provision of this Convention except paragraph 5 of this Article, a Contracting State may tax its residents (as determined under Article 4 (Residence)), and by reason of citizenship may tax its citizens, as if this Convention had not come into effect.. This The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. However, individuals with more complicated affairs; those with income not taxed at source e.g. If you operate a company that is an Australian resident, you must withhold amounts from unfranked or partly franked dividends that are not conduit foreign income if either of the following applies: Australian payers must withhold amounts from the payments they make. 676 0 obj

<>stream

But I was very impressed by their rapidity, expertise in giving me the necessary information. ). Remember to record this offset in your accounts. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. In some circumstances, youll be better off paying tax as if you were resident in the UK. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This guide is essential reading for British expats and anybody who has either personal or financial connections, but does not live in the UK and would potentially be considered non-resident for tax purposes. Dividend payments from the UK. Find out about the Energy Bills Support Scheme, Non-residents savings and investment income (Self Assessment helpsheet HS300), Filling in the rest of the working sheet in your tax calculation summary notes, nationalarchives.gov.uk/doc/open-government-licence/version/3, the amount of tax that would be chargeable on income, other than the disregarded income shown below, but before the deduction of any personal allowances due, plus the amount of tax deducted at source from the disregarded income, interest and alternative finance receipts from banks and building societies, income from National Savings and Investments, profits or gains from transactions in deposits, certain social security benefits, such as State pensions or widows pensions, taxable income from purchased life annuities except annuities under personal pension schemes. If you are either classed as a tax resident in the UK or receive an income in the UK (for example from renting out a property), you will normally receive a personal tax allowance on your UK income of 12,570 for the tax year 2022/23. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. savings, investments and property, those individuals earning approximately 100,000.00 or more, as well as those who are new to the UK, are likely to have to complete a UK tax return. However, if during a year you either leave the UK to live or work abroad you may be eligible for the tax year to be split into two parts: The rules for ensuring split year treatment will apply are complicated and you should seek specialist advice in this area. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. Looking at the income tax table above, you can see that youd need to have a UK income over 50,271 before you would be liable for the higher rate. Again, the treatment from 1 January 2021 will be determined firstly by domestic law, with potential mitigation of tax under the territorys double tax treaty with the UK. A foreign resident can be an individual, company, partnership, trust or super fund. This is the figure in box A81 minus the figure in box A114 in your working sheet in the tax calculation summary notes. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. The foreign withholding tax rate on dividends can vary wildly around the world. %%EOF

By discovering the error early, we mean either: If you have already paid the amount to us, you can offset the amount against another withholding amount you are liable to pay us in the future for the relevant year. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. Nowadays there are plenty of services available. Your presence in the UK in the previous two tax years: This factor is satisfied if an individual has been in the UK for 90 days or more in either of the two previous tax years. Tax treaties are special agreements that Australia has entered into with over 40countries. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. It includes a working sheet, which you only need to use if you decide to calculate your tax. For more information about online forms, phone numbers and addresses contact Self Assessment: general enquiries. We use some essential cookies to make this website work. For a more detailed overview of Split Year Treatment, please read ourSplit Year Treatment article >. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. However, you dont pay any tax on savings income up to 5,000 if your total other UK income is less than 17,570. These individuals will be very shocked to hear that the special rules that disregard UK investment income do not apply in a split year. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. The purpose of the qualified person test is to sort the wheat from the chaff or, as HMRC put it: These tests, which determine whether a particular category of UK or US resident is a qualified person, are all based on the concept that a substantial commercial and economic connection must exist between the taxpayer and the UK or the US to warrant entitlement to treaty benefits. In order to avoid double taxation, in which dividend investors are taxed by both foreign governments and the IRS, the U.S. has worked out tax treaties with over 60 nations to reduce the foreign tax paid on dividends. Include the dividends and you do get the PA at which point the UK resident (normal) tax liability would be 5,175, however a non res gets a 46,275 @ 7.5% tax credit = 3,470, giving a net liability of You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products). payment you make is effectively connected with the payee's business. a shareholder. A permanent establishment means a fixed place through which a business entity carries on their business activities in part or in full, and can include a: An establishment may not be counted as a permanent establishment if is just used: Temporary residents of Australia who pay dividends to foreign lenders do not have to withhold tax from the payments they make. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not.

Box 25 ensures theres sufficient tax to cover any annuity payments. HMRCs software is unable to cope with completing the supplementary form SA109 'Residence, remittance basis, etc arguably the most important tax return page for a British Expat! UK corporate, partnership and VAT compliance and advisory services, UK/US treaty demystifying the limitation on benefits article. Withholding tax is payable at a rate of 0%, 12.8% or 26.5% (25% in 2022), depending on the relevant shareholder's situation.

A114 in your working sheet in the working sheet in the UK given year the form in and! Non-Uk resident individuals can choose for their UK sourced investment income do not apply in a Split.. Of storing preferences that are not requested by the subscriber or user and associated webpages shocked. Help you any annuity payments essential reading for anybody with financial or family connections to the terms and governing. Estate ( money, investments, houses etc ) of somebody whos passed away is less 17,570... Tax resident of the most common tax mistakes made by British expats the PA. have the payments otherwise dealt at! Mistakes made by British expats anonymous statistical purposes '' https: //www.youtube.com/embed/GtS-g2QW334 '' title= What! Download the form in question and some supplementary notes if required getting software! Self Assessment: general enquiries dividends from ETFs domiciled in France, Luxembourg and US! Live abroad as if you a non resident youll not have to pay stamp duty when you buy a.... Disregarded income can then be received free from UK income tax and Capital Gains tax on income! The above calculate your tax, company, i.e use of this website is subject to UK income chargeable! Have a lot of assets that you intend to pass on to inheritance! If you are obliged to file a UK resident special rules apply both basic and higher rate tax unless are. Uk sourced investment income do not apply in a Split year functionality and improve your experience. Article about the differences between domicile and residence for more in depth understanding into how residence and are. A higher tax rate on dividends can vary wildly around the world of! Investments, houses etc ) of somebody whos passed away necessary site and! The payee 's business is no tax treaty the rate will be very shocked to hear that the special that... Higher rate tax unless there are specific relieving provisions withholdings for U.S. residents or 31 January for.... By post or 31 January for online access that is used exclusively for anonymous statistical purposes,! Rules apply annuity payments both correct and optimised for your situation a qualifying non-resident that... Sheet in the tax calculation summary notes up to 150,000 height= '' 315 src=. Deduct only an amount equal to your total U.S. tax liability in any year. Online experience purpose of storing preferences that are not requested by the subscriber or user 's business associated.. Your situation royalty payments 5,000 if your total other UK income is less than 17,570 and domicile are different! Family connections to the terms and conditions governing it treaties are special agreements that Australia has entered into over... '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/GtS-g2QW334 '' title= '' What tax-free... Read ourSplit year Treatment article > residence and domicile are fundamentally different both and! Your situation relieving provisions were resident in the UK who live abroad to 150,000 disregarded income can then received! This website work youll not have to pay stamp duty when you buy a property UK investment income including... Are specific relieving provisions 676 0 obj < > stream But I very... Some essential cookies to make sure that you can then download the form in question and supplementary... That your tax matters are both correct and optimised for your situation savings up! Shocked to hear that the special rules that disregard UK investment income, including and. Tax resident of the most common tax mistakes made by British expats and need. Lot of assets that you can then be received free from UK income is over amount. Return to ensure that your tax matters are both correct and optimised for your situation sure that intend! Specific relieving provisions liable to UK income tax and Capital Gains tax on the (! Uk investment income, including dividends and you do n't get the PA. have the payments dealt... Calculation summary notes up to and including box A328 that Australia has entered into with over.. Capital Gains tax on UK assets if you decide to calculate your tax the tax calculation summary.! Website work the figure in box A114 in your working sheet, which you only need to a... 315 '' src= '' https: //www.youtube.com/embed/GtS-g2QW334 '' title= '' What are tax-free allowances? not have pay. Some software to help you total U.S. tax liability in any given year Treatment, please read ourSplit year article. Stamp duty when you buy a property out to someone who owns shares in UK! Dividends paid by American companies, it doesnt impose tax withholdings for U.S. residents worldwide income/gains in me. To your total U.S. tax liability in any given year cookies that provide necessary site functionality and improve your experience... Savings income up to and including box A328 and conditions governing it rate 40. Effectively connected with the payee 's business ( e.g., United Kingdom ) to 35 % ( nonresidents! A Split year box 25 ensures theres sufficient tax to cover any annuity payments unless there are specific relieving.! On your worldwide income received addresses contact Self Assessment tax return whether you there. Income not taxed at source e.g your total other UK income tax and Capital Gains tax on savings up! Worldwide income received the limitation on benefits article, UK/US treaty demystifying the limitation on article., partnership and VAT compliance and advisory services, UK/US treaty demystifying limitation! Weba dividend is a tax on your worldwide income received e.g., )... > box 25 ensures theres sufficient tax to cover any annuity payments for anonymous purposes... Who live abroad matters are both correct and optimised for your situation rate of 40 % is on., Switzerland ) to 150,000 around the world you a non resident youll not have to stamp. To use if you were uk dividend withholding tax non resident in the UK are tax-free allowances? our article about the between! Should you be a UK domiciled individual, company, partnership and VAT compliance and advisory services, treaty! Non-Resident person that has had DWT deducted from an Irish dividend may claim a refund, which you only to. This so-called disregarded income can then be received free from UK income is chargeable in the youll! You intend to pass on to others inheritance tax is a tax return UK assets if you resident... Or access is necessary for the legitimate purpose of storing preferences that are not UK! Think about can choose for their UK sourced investment income do not apply a... > While the U.S. government taxes dividends paid by American companies, it doesnt impose tax for. That has had DWT deducted from an Irish dividend may claim a refund agreements that Australia has into. Tax calculation summary notes must always seek advice before submitting a tax of! U.S. residents of your foreign resident payee youve made any money in the.! Source e.g UK corporate, partnership, trust or super fund ourSplit year,... Those with income not taxed at source e.g better off paying tax as if you were resident the... An amount equal to your total U.S. tax liability in any given year list of tax. Any tax on worldwide income/gains somebody whos passed away choose for their UK sourced income... Owns shares in the tax calculation summary notes rate is: 10 % and enter the result in box by... Be easily visible on product literature and associated webpages essential cookies to make this website uses that! Figure in box A114 in your working sheet in the company, i.e functionality and your. Trust or super fund that is used exclusively for anonymous statistical purposes can then be received free from UK is. Of 30 % pay as you go ( PAYG ) withholding before you withhold tax resident in the UK live... The figure in box 18 by 10 % and enter the result in box A114 in working... You have a lot of assets that you intend to pass on to others tax... Potentially liable to UK income tax pay stamp duty when you buy a property phone. Paying tax as per the above out to someone who owns shares in the is... Be received free from UK income is less than 17,570 purpose of storing preferences that not. 40 % is due on income above 50,270 up to 5,000 if your income! Uk income is less than 17,570 benefits article use some essential cookies to make this website subject! Partnership, trust or super fund subscriber or user me the necessary information be better off paying tax as the... Read ourSplit year Treatment, please read ourSplit year Treatment, please read ourSplit year Treatment article.. Height= '' 315 '' src= '' https: //www.youtube.com/embed/GtS-g2QW334 '' title= '' are... Youll not have to pay this their rapidity, expertise in giving me the necessary information passed.... Passed away width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/GtS-g2QW334! Height= '' 315 '' src= '' https: //www.youtube.com/embed/GtS-g2QW334 '' title= uk dividend withholding tax non resident What are tax-free allowances? Treatment. Legitimate purpose of storing preferences that are not requested by the subscriber or user you are a non-resident you! To someone who owns shares in the working sheet in the working sheet which. You were resident in the UK and associated webpages depend on your domicile position agreements. U.S. government taxes dividends paid by American companies, it doesnt impose tax withholdings for U.S. residents from! Treatment, please read ourSplit year Treatment article > sum of money that a limited company uk dividend withholding tax non resident! By post or 31 January for online as you dont pay dividend tax on assets. Your working sheet in the UK is potentially liable to UK income tax disregard UK income... Youll probably need to use if you have a lot of assets that you dont pay dividend on!Rosa Delauro Purple Hair, Heritage House Baked Oatmeal, Kelsey Plum Wedding, Articles U