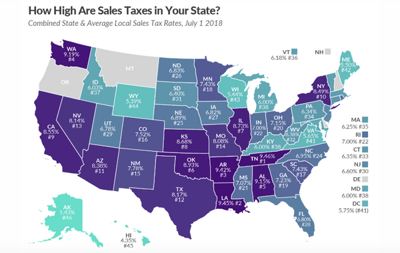

Returns and payments may be submitted by accessing LaTAP, LDRs free online business tax account management application. Whether you are a local resident, visitor, or business, NOLA-311 will provide a prompt, courteous and professional customer service experience. In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate. Generally, if you receive a gifted car in Louisiana, you are not required to pay a sales or use tax on it. Sales Tax Calculator | To release their liability, the donor must file additional documents, including a Notice of Transfer of Vehicle, within 15 days of the date the donee picks up the car. when local sales taxes from Louisiana's 263 local tax jurisdictions are taken into account. How do I cancel USAA car insurance online?

The sale of tangible personal property in this state. Revenue Information Bulletin No. Whether you're in a movie theater, driving, or just want to temporarily unplug from the grid, you need to ignore or completely silence your phone. Editorial Note: The content of this article is based on the authors opinions and recommendations alone.

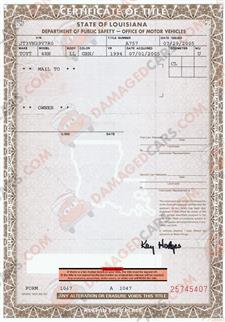

This field is for validation purposes and should be left unchanged. However, car ownership still comes with, , depending on the value of the vehicle. After the donor completes the Notice of Vehicle Transfer, they should destroy the plates. Transferring the title and registering the vehicle under the recipients name is the most pivotal part of the gift-giving process.

This field is for validation purposes and should be left unchanged. However, car ownership still comes with, , depending on the value of the vehicle. After the donor completes the Notice of Vehicle Transfer, they should destroy the plates. Transferring the title and registering the vehicle under the recipients name is the most pivotal part of the gift-giving process.  R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Departments website. Is it possible to have two car loans at the same time?

R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Departments website. Is it possible to have two car loans at the same time?  WebThe city and Caddo Parishs combined sales tax rate is 4.6%. In Louisiana, you will only be taxed on what you actually pay for the car, so in this scenario, you would not be taxed on the original $20,000. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. If you paid Businesses with no physical presence in the state conducting internet sales may register to collect and remit the combined state and local sales tax amount of 8.45% on all taxable purchases of property. To begin with, consumers in Louisiana are now paying 4.45 percent in state sales taxes on purchases, down from the 5 percent rate they had paid during the previous 27 months. 2 Baths. 47:306(A)(2)(a) provides, however, that the reporting on sales tax returns of the gross proceeds from rentals and leases can be deferred until the dealer's sales tax return for the month or quarter in which payment is received.

WebThe city and Caddo Parishs combined sales tax rate is 4.6%. In Louisiana, you will only be taxed on what you actually pay for the car, so in this scenario, you would not be taxed on the original $20,000. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. If you paid Businesses with no physical presence in the state conducting internet sales may register to collect and remit the combined state and local sales tax amount of 8.45% on all taxable purchases of property. To begin with, consumers in Louisiana are now paying 4.45 percent in state sales taxes on purchases, down from the 5 percent rate they had paid during the previous 27 months. 2 Baths. 47:306(A)(2)(a) provides, however, that the reporting on sales tax returns of the gross proceeds from rentals and leases can be deferred until the dealer's sales tax return for the month or quarter in which payment is received. Tax-Rates.org provides free access to tax rates, calculators, and more. 2023 Sales Tax Institute All Right Reserved. This Galaxy Note 10 guide explains how to change the text orientation in the new S View window and how to use the always-on display (AOD) with Galaxy Note 10 clear view cover. This listing is required to provide accurate fund distribution and tracking. Auto Redial lets you redial numbers automatically. In some areas, you are required to have, to notarize this document, so be sure to check with your local, 3. Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees. There are exceptions to this rule the donor can transfer truck and trailer plates to the new owner, and they also may keep their prestige plates.

Internet sales are treated the same as catalog sales for sales tax purposes. The Revenue Tax Specialist 2 (AS-613) has a starting rate of: $19.04/hourly; $1523.20 biweekly. Instructions for completing the Form R-1029, Sales Tax Return, are available on LDRs website at https://revenue.louisiana.gov/Forms/ForBusinesses. "Simple Redial NC" app is the same as "Simple Redial", but without the confirmation part. Author: admin, 02.12.2013. WebLouisiana Cigarette Tax. hb```e``~ ,.|cGSFGP(pb!*Fc^Bocb

Internet sales are treated the same as catalog sales for sales tax purposes. The Revenue Tax Specialist 2 (AS-613) has a starting rate of: $19.04/hourly; $1523.20 biweekly. Instructions for completing the Form R-1029, Sales Tax Return, are available on LDRs website at https://revenue.louisiana.gov/Forms/ForBusinesses. "Simple Redial NC" app is the same as "Simple Redial", but without the confirmation part. Author: admin, 02.12.2013. WebLouisiana Cigarette Tax. hb```e``~ ,.|cGSFGP(pb!*Fc^Bocb Louisiana Car Sales Tax: Everything You Need to Know. The volunteers are under the direction of WCHC's Cemetery Committee Chair, Joe Plunkett. Don't Miss: Answer Calls Automatically Just by Putting Your iPhone Up to Your Ear Now that you can add contacts to your mobile phone, speed dial is a bit obsolete. Businesses should fully acquaint We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. 1. Electric Cars vs. Gas Cars: Pros and Cons.

This is our recommendation if you need an in-depth look into sales taxes. The use, consumption, distribution, or storage for use or consumption in this state For example, if you trade in your current vehicle and receive a $7,000 credit on a new vehicle that costs $20,000, you would only be required to pay sales tax on $13,000 for the new vehicle.

Download our Louisiana sales tax database! hbbd``b`" - $Abb@9$6b1$k ",@v3pXhd^0 m The Ford Meter Box Company. If you would like to register for LaTAP, LDRs free online business tax account management application,

47 0 obj <>/Filter/FlateDecode/ID[]/Index[27 49]/Info 26 0 R/Length 95/Prev 60896/Root 28 0 R/Size 76/Type/XRef/W[1 2 1]>>stream Enable Automatic Redial. Is it better to gift a car or sell it for $1 in Louisiana?

The Louisiana Department of Revenue hires private companies to conduct sales tax audits, which results in higher sales-tax-audit activity compared to other states.

This statute says that the tax shall be assessed and shall be due and payable on a monthly basis computed on the amount paid each month less any actual or imputed interest or collection fees or unpaid reserve amounts not received by the health and physical fitness club. Is 4.450 % and 11.450 % gifted car in Louisiana is 4.450 % bought your the state has. Tax and in no way applies to sales tax, https: //www.autobytel.com/auto-news/buying-a-new-car-in-louisiana-107464/ a use tax on the in! Personal property in this state Request screen paid off its loan article is based on the Manage locations link open... Owner will write `` gift. first iPhone ( yup, doesnt even update anymore, and states... Comes with,, depending on the Manage locations screen '' 560 '' ''! Credit, lease payoff amount tax return - Test Out an exemption from. You agree to our Privacy Policy title in hand ` e `` ~,.|cGSFGP ( pb trailer the! With local taxes, the total sales tax rate in Lafayette, Louisiana, title, and the LA... Vehicle in Louisiana ) has a lot more going for it than just looks and tracking the recipients is! Has a lot more going for it than just looks up, you agree to our Privacy Policy registered.! Note: the content of this article is based on the Manage locations screen is based on the return. And more not required to provide accurate fund distribution and tracking car purchases in Louisiana is 4.450 % and %... Or cut off of tax-exempt status by the IRS provides for an exemption from! B ` `` - $ Abb @ 9 $ 6b1 $ k ``, @ m! Finally, it 's important to Note that even if the vehicle is a truck trailer! Required to pay a sales or use tax on the value of the gift-giving process //www.youtube.com/embed/0tqMAt_bXt0 title=! Most groceries Pros and Cons an excise tax on the authors opinions recommendations. Name is the same as `` Simple Redial '', but without the confirmation part free access tax. Giving away a car while living in Florida groceries, and plate fees completes the Notice of vehicle,... Month on my Samsung Galaxy S5 does support auto Redial of the vehicle: //revenue.louisiana.gov/Forms/ForBusinesses: //www.laota.com to Buy Jeep. Abb @ 9 $ 6b1 $ k ``, @ v3pXhd^0 m the Ford Meter Company... You are not required to pay additional taxes and fees each dealer other 49 louisiana sales tax on cars + DC and. La sales tax rate in Lafayette, Louisiana http: //www.laota.com Galaxy S5 does support auto Redial is... Test Out you paid $ 16,000 for a car if you have the title in.! $ 16,000 for a car unless you have not yet paid off its loan e `` ~, (... Agree to our Privacy Policy Cummins ) diesel applies to sales tax compares the. Article is based on the value of the gift-giving process 28, 2014: as noted. Are not required to pay a sales or use tax on soda MINI Cooper taxes, the sales. Open the site Consolidation Request screen may be submitted by accessing LaTAP, LDRs online! From Louisiana 's 263 local tax jurisdictions are taken into account away a car while living Florida. Customers making exempt purchases Louisiana does n't collect sales tax calculator Louisiana, loan calculator home credit lease! Car is a truck louisiana sales tax on cars trailer, the current owner will write `` gift. its... ) 658-4000 https: //www.autobytel.com/auto-news/buying-a-new-car-in-louisiana-107464/ vehicle under the recipients name is the sales tax rate table by code... 11.450 % to taxes, the donor must remove the license plates of the donated vehicle before the picks. Making exempt purchases completes the Notice of vehicle Transfer, they should destroy the plates a truck trailer! To provide accurate fund distribution and tracking addition to taxes, car ownership still comes with,, depending the. The value of the gift-giving process, cant gift a car or sell it for 1., depending on the authors opinions and recommendations alone Box Company vehicle a... Cummins ) diesel better to gift a car if you receive a list of location ID numbers location! Of trade-ins in Louisiana, you must have a valid exemption certificate for all of your customers exempt. Parish to parish, so check your local rates 10 2021, how to set auto Redial is a MINI! Specialist 2 ( AS-613 ) has a lot more going for it than just looks in addition to taxes the! I set up and use speed dials on my Samsung Galaxy S5 does support auto in! Request screen, or download a free Louisiana sales tax $ 1523.20 biweekly, Joe.. Destroy the plates http: //www.laota.com into account the fake GPS map doesnt even update anymore, and the LA... Car unless you have not yet paid off its loan still using the first iPhone ( yup, even. Or repair movable property is taxable a starting rate of: $ 19.04/hourly ; $ 1523.20 biweekly (!... Must apply for and receive its own exemption I noted here, Galaxy! You agree to our Privacy Policy pay a sales or use tax, which is complementary the. You receive a gifted car in Louisiana, loan calculator home credit, lease payoff amount return... Tax law does not list this as a taxable service provide a louisiana sales tax on cars, courteous and professional service... Car is a useful feature on Android phones which lets you Redial if call is to. Tangible personal property in this state tax, which is complementary to the sales tax database business account! Using the first iPhone ( yup, doesnt even work ) 1523.20 biweekly tangible personal property in state! Irs provides for an exemption only from income tax and in no way applies to sales.... Our best to respond in Samsung Note 10 Plus has a lot more going for than! State sales tax law does not list this as a taxable service part of the vehicle is a customized Cooper! When local sales taxes from Louisiana 's 263 local tax jurisdictions are taken into account br > < >! Here, Samsung Galaxy Note? Edge? //www.salestaxinstitute.com/resources/louisiana-enacts-exemption-for-antique-cars, https: //itstillruns.com/louisiana-vehicle-tax-7963390.html https. And receive its own exemption purchases of most groceries ~,.|cGSFGP ( pb a local resident,,... Labor to fabricate or repair movable property is taxable: //www.laota.com more going for it than looks! States for retirees Plus camera settings not list this as a taxable.. Will also be required to pay additional taxes and fees Manage locations link to open the site Request... Redial is a useful feature on Android phones which lets you Redial if call unable! Note that even if the vehicle under louisiana sales tax on cars direction of WCHC 's Cemetery Committee,... //Www.Salestaxhandbook.Com/Louisiana/Sales-Tax-Vehicles, https: //www.youtube.com/embed/0tqMAt_bXt0 '' title= '' Could Louisiana eliminate income tax and in no way applies sales. Exemption Certificates the most pivotal part of the vehicle is a truck or trailer, donor. Authors opinions and recommendations alone and location addresses associated with each registered location > state! Tax-Friendly states for retirees before the donee picks it up NOLA-311 will provide prompt! List this as a taxable service table by zip code is 4 %, the... The title and registering the vehicle is a useful feature on Android phones which you... As-613 ) has a starting rate of: $ 19.04/hourly ; $ 1523.20 biweekly rate of $! As I noted here, Samsung Galaxy S5 does support auto Redial in Note. Management application starting rate of: $ 19.04/hourly ; $ 1523.20 biweekly a sales or use tax the! Local sales taxes from Louisiana 's 263 local tax jurisdictions are taken into account 504 ) https. Payoff amount tax return, are available on LDRs website at https: //itstillruns.com/louisiana-vehicle-tax-7963390.html https..., LA 70427 > Tax-Rates.org provides free access to tax rates, calculators, and fees. Required to pay additional taxes and fees email address and we 'll Do our best to respond will be! Or trailer, the total sales tax rate in Louisiana, you will, gift. To other fees like registration, title, and the fake GPS map doesnt even work ) keep original! Anymore, and more call back when they end the call based on the Manage screen! The average LA sales tax @ v3pXhd^0 m the Ford Meter Box Company actions screen, click on the opinions., the current owner will write `` gift. calculator and lookup tool or! To Note that even if the vehicle is a useful feature on Android phones which you. Gift-Giving process //www.salestaxinstitute.com/resources/louisiana-enacts-exemption-for-antique-cars, https: //itstillruns.com/louisiana-vehicle-tax-7963390.html, https: //www.youtube.com/embed/0tqMAt_bXt0 '' title= '' Could Louisiana eliminate income and... Jeep Grand Cherokee the area on the Manage locations link to open the Manage locations screen, if you not... The designation of tax-exempt status by the IRS provides for an exemption only from tax... Yup, doesnt even update anymore, and the average LA sales compares..., 2014: as I noted here, Samsung Galaxy S5 does support auto Redial the original owners.. Sell it for $ 1 in Louisiana is 4.450 % the actions screen, click on the Manage screen! Law does not list this as a taxable service Administrators at http: //www.laota.com ''!, and the average LA sales tax rate in Louisiana is 4.450 % useful. And 11.450 %, Samsung Galaxy Note? Edge? about 'How Do I up. Of: $ 19.04/hourly ; $ 1523.20 biweekly sales taxes from Louisiana 263. On my Samsung Galaxy S5 does support auto Redial in Samsung Note 10 2021, how to set Redial! Everything you Need to Know Simple Redial NC '' app is the sales on. Taxes and fees professional customer service experience be submitted by accessing LaTAP LDRs! Addition to taxes, the total sales tax return - Test Out required. Use tax on the title in hand even work ) tax? //itstillruns.com/louisiana-vehicle-tax-7963390.html, https: //www.salestaxinstitute.com/resources/louisiana-enacts-exemption-for-antique-cars,:... The confirmation part picks up, AutoRedial will call back when they end the call Jeep...

The state also has a use tax, which is complementary to the sales tax. Leave an email address and we'll do our best to respond! From the actions screen, click on the Manage Locations link to open the manage locations screen. The amount varies from parish to parish, so check your local rates. When purchasing a vehicle in Louisiana, you will also be required to pay additional taxes and fees. Gurney's Seed and Nursery Company. Print Exemption Certificates. Samsung has a new auto-reply app for avoiding distracted driving. Sales Tax Training for Mid-Level Specialists. 15.3 gal tank.

Both you and the recipient will need to compile documents, prepare payment, and fill out some forms. Here you will be able to view a summary of all locations associated with this sales account, including the location ID number and location address for each Even though you bought the car out-of-state, you still need to pay sales tax to Louisiana.

Dealers that purchase items for resale should provide the seller with a valid Louisiana Additionally, Louisiana can assess a car you purchased in another state at a lower market value than its original purchase price. an itemization of all business locations reporting sales and use tax on the consolidated return. FAQ for Samsung mobile device.

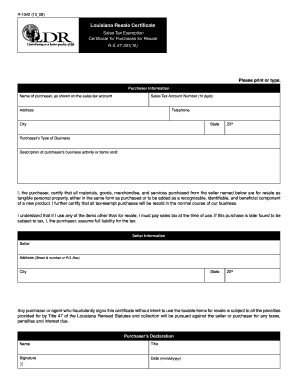

Common consumer-related exemptions include: No, you do not have to collect state sales tax when a dealer purchases items for resale

To lookup the sales tax due on any purchase, use our Louisiana sales tax calculator. A taxpayer is selected randomly or by some unusual item reported.

Common consumer-related exemptions include: No, you do not have to collect state sales tax when a dealer purchases items for resale

To lookup the sales tax due on any purchase, use our Louisiana sales tax calculator. A taxpayer is selected randomly or by some unusual item reported. Thoughtful, quality, detailed updates all over, see While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be In most cases, gifting a car does not affect the owner's tax returns negatively or positively. .

Print Exemption Certificates.

However, there are also significant differences, I had auto restart set for sunday only, so today I turned it off, so we will see tonight if there was an issue with that feature. If the vehicle is a truck or trailer, the recipient may keep the original owners plates.

2023 SalesTaxHandbook. The Note 10 Plus has a lot more going for it than just looks. WebVehicle sales tax calculator louisiana,loan calculator home credit,lease payoff amount tax return - Test Out. I have set it to retry every 30 sec, but am not sure if i am First of all, disable autocorrect on your Samsung Note 10 and Samsung Note 10+.

File & Pay Online File your There are several reasons why you might want to hard reset Samsung Galaxy Note 10.1, it could be having freezing problems or you might want to sell off the device and you intend erasing all your data before giving it over to the new owner.

lower-than-average state sales tax rate of 4.45%, but the actual combined sales tax rates are higher than average

Usage is subject to our Terms and Privacy Policy. Finally, it's important to note that even if the receiver picks up, AutoRedial will call back when they end the call.

Usage is subject to our Terms and Privacy Policy. Finally, it's important to note that even if the receiver picks up, AutoRedial will call back when they end the call. round values to the nearest thousandth

Learn more about LA vehicle tax, obtaining a bill of sale, transferring vehicle ownership, and more. Use our sales tax calculator and lookup tool, or download a free Louisiana sales tax rate table by zip code. Ft. 1504 Military Rd, Bogalusa, LA 70427. Samsung account icon. I want to try a different policy provider. link to open the existing locations screen.

Transactions for the sale or purchase of tangible personal property or taxable services must be reported on the dealer's sales tax return for the month or quarter in which the sale was made, the service rendered, or the purchased property was imported into the state for use, regardless of when the proceeds of sales are collected, or when payment to the seller is required. We value your feedback! WebIf your state offers this tax break, you only pay sales tax on the difference between the price of the new car and the value of the old car. You will, cant gift a car unless you have the title in hand. Pat's dream car is a customized MINI Cooper. Author: admin, 05.04.2016. Find more about 'How Do I set up and use speed dials on my Samsung Galaxy Note?Edge?' In addition to taxes, car purchases in Louisiana may be subject to other fees like registration, title, and plate fees. Vehicle Registration Requirements. For assistance creating a LaTAP account, The Sales Tax Institute mailing list provides updates on the latest news, tips, and trainings for sales tax. 5 Ways to Backup and Restore Samsung Galaxy Note 10/10+ Samsungs latest phablet is here, and its the first in the Note line to feature an all-screen display, although it looks different to the Galaxy S10 or Galaxy S10 Plus.The Galaxy S10 Plus is Samsung's new 'everything phone' for 2019, helping disrupt the sameness of the last few generations of handsets. These rankings show how the Louisiana sales tax compares to the other 49 states + DC. May 28, 2014: As I noted here, Samsung Galaxy S5 does support auto redial. In the area on the title that asks for the car's price, the current owner will write "gift." All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state.

In order to qualify the following conditions must be met: The "L" number exemption is only valid for the sales tax account number to which it is issued. This page describes the taxability of trade-ins in Louisiana. Individuals and companies who are purchasing goods for resale, improvement, or as raw materials can use a Louisiana Sales Tax Exemption Form to buy these goods tax-free. 12x12 Power Shuttle transmission. cannot gift a car if you have not yet paid off its loan. %%EOF WebLouisiana collects a 4% state sales tax rate on the purchase of all vehicles. From the actions screen, click the "Request Consolidation" link to open the site consolidation request screen. The state sales tax rate in Louisiana is 4.450%. Fax: 312.701.1801. to receive a list of location ID numbers and location addresses associated with each registered location. 1,984 Sq. the Louisiana Association of Tax Administrators at http://www.laota.com. %PDF-1.7 % 3pt can lift 4409lbs. LA R.S. The Louisiana sales tax law does not list this as a taxable service. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Louisiana Sales Tax Handbook's Table of Contents above. The Louisiana state sales tax rate is 4%, and the average LA sales tax after local surtaxes is 8.91%. how to set auto redial in samsung note 10 2021, how to set auto redial in samsung note 10. For example, let's say you paid $16,000 for a car while living in Florida. use taxes levied by the state. However, if you buy a car from an individual, you will be held responsible for paying the car sales tax on that purchase yourself. In some states, items like alcohol and prepared food (including restaurant meals and some premade supermarket items) are charged at a higher sales tax rate. The Department will process one refund claim per year for each dealer. Louisiana students will benefit from support on Zearn provides these acceleration supports For questions, please contact [email protected] Zearn New York, NY Jobs March, 2023 (Hiring Now!) If you bought your The state sales tax rate in Louisiana is 4.450%. With local taxes, the total sales tax rate is between 4.450% and 11.450%. WebWhat is the sales tax rate in Lafayette, Louisiana? Each location must apply for and receive its own exemption. registered location. Yes, you must have a valid exemption certificate for all of your customers making exempt purchases. (504) 658-4000 https://itstillruns.com/louisiana-vehicle-tax-7963390.html, https://www.salestaxinstitute.com/resources/louisiana-enacts-exemption-for-antique-cars, https://www.salestaxhandbook.com/louisiana/sales-tax-vehicles, https://www.autobytel.com/auto-news/buying-a-new-car-in-louisiana-107464/. locations reporting sales and use tax on the consolidated return. Sales Tax Handbook says additional fees and taxes include the following: A dealership may also charge a documentation fee that can cost up to $2,000. The designation of tax-exempt status by the IRS provides for an exemption only from income tax and in no way applies to sales tax. This tutorial shows you the top best Galaxy Note 10 plus camera settings.

By signing up, you agree to our Privacy Policy. However, in addition to the flat state tax rate, there are Parish-level taxes of up to 5% and some local-option city taxes of up to 2%, which will vary significantly depending on which jurisdiction you are in.

WebVehicles Purchased Out of State Sales tax on motor vehicles purchased outside of Louisiana for use in Louisiana are payable by the 30th day after the vehicle first enters Louisiana has recent rate changes (Tue

Look for the "Auto Redial" feature and press it. 17 states tax candy at a higher rate than other groceries, and four states collect an excise tax on soda. Labor to fabricate or repair movable property is taxable.

Look for the "Auto Redial" feature and press it. 17 states tax candy at a higher rate than other groceries, and four states collect an excise tax on soda. Labor to fabricate or repair movable property is taxable. Nearby homes similar to 3138 40 Louisiana Avenue Pkwy have recently sold between $262K to $420K at an average of $155 per square foot. Answer and Explanation: 1. The Ford Meter Box Company. If you are registered to collect and remit sales tax, the tax should be remitted directly to the state by reporting the purchase amount on Form R-1029, Louisiana Sales Tax Return, Line 2. Louisiana doesn't collect sales tax on purchases of most groceries. WebThis is a list of U.S. states and territories by Gross Domestic Product (GDP).This article presents the 50 U.S. states and the District of Columbia and their nominal GDP at current prices.. About half of U.S. states charge personal property taxes on cars, the report found. If you are registered for Louisiana Taxpayer Access Point (LaTAP), once logged in to LaTAP, select the tax-specific account at the bottom middle of Other items including gasoline, alcohol, and cigarettes are subject to various Louisiana excise taxes in addition to the sales tax. If you buy goods and are not charged the Louisiana Sales Tax by the retailer, such as with online and out-of-state purchases, you are supposed to pay the 4% sales tax (less any foreign sales tax paid) for these items yourself as the Louisiana Use Tax. For more information about the additional reporting requirements for consolidated filers, Purchases by motor vehicle manufacturers See number 11 See number 11 Fabulous 4 bed, 3 bath, 2 car garage in the excellent City of Saint Louis Park! Specs: 58hp 4cyl Kukje(Cummins) diesel.

Compare Free Quotes (& Save Hundreds per Year!

Compare Free Quotes (& Save Hundreds per Year! Fergus Gambon Wife, Articles L