louisiana ppp loan arrests

Inaccuracies in the data or missing data can undermine oversight. Even if the Justice Department declines to join a case, the whistleblower and their private counsel can continue to pursue it. WebPPP Loans Issued in LA. Sah, who has pleaded guilty, used the money to buy homes, jewelry and more. 107 of the cases, accused individuals allegedly falsified payroll documentation to justify either getting a loan or getting a bigger loan than they were eligible for; 93 of the cases, accused individuals allegedly created fake tax documents used for verifying details in loan applications; 41 of the cases, accused individuals allegedly created bogus companies to get loans; 28 of the cases, accused individuals allegedly used defunct companies to get loans; 20 of the cases, accused individuals used stolen identities or aliases while applying for loans; 12 of the cases, accused individuals allegedly falsified ownership of existing legitimate businesses; 28 of the cases, accused individuals also obtained Economic Injury Disaster loans (some of these individuals have been accused of fraudulently obtaining these loans. Numerous business owners brought complaints to the publication after they received loans through the Kabbage online lending platform, which prompted the ProPublica investigation. Compare the spread of the infection with other areas in the U.S. Thats more than 10 times the fraud recoveries five years after the 2009 stimulus became law. If Congress amends the underutilized Program Fraud Civil Remedies Act, efforts by inspectors general to fight fraud in pandemic related spending would be enhanced, according to Horowitzs testimony. Attorney General Merrick Garland, pictured on March 11, said Friday the Justice Department will continue its effort to deter and punish coronavirus-related fraud. The department's efforts to target fraud related to COVID-19 fraud date back to last March when then-Attorney General William Barr instructed federal prosecutors across the country to investigate and prosecute scams, price gouging and other coronavirus-related crimes aggressively. to fraudulently obtain the loan money. Data analysis could also help the agency assess potential policy changes, and the Biden administration made some changes to make access to relief more equitable earlier this year. Early on in the pandemic, the Justice Department made fighting such crimes a priority. When she electronically filed the fake PPP loan applications, she falsely declared that the applications and information given in the accompanying documents were authentic and accurate. Many believe a high percentage of these grants were stolen, but some federal prosecutors with heavy caseloads may find it hard to justify There were additional steps that could have been undertaken that would not have significantly slowed downin our view in the oversight communitythe delivery of funds to the public, said Michael Horowitz, the Justice Departments inspector general and chair of the Pandemic Response Accountability Committee, in testimony before Congress on March 25. The False Claims Act will play a central role in the Departments pursuit of COVID-19 related fraud, Michael Granston, a Justice Department deputy assistant attorney general, said in December. According to the House Select Subcommittee on the Coronavirus Crisis, the SBA Office of Inspector General has received nearly 750,000 referrals of suspected identity theft related to the program over the last year. The disaster loan programs strongest internal control is the ability to receive directly from the IRS recent tax transcripts, wrote James Rivera, head of the SBAs Office of Disaster Assistance, last fall. In fraud cases where there is no apparent misuse of a loan, civil enforcement may be more likely than criminal prosecution. 650 Poydras Street, Suite 1600 The program began issuing loans again in January 2021, and some businesses are eligible for a second loan. Federal investigators said they are actively pursuing whether Kabbage and other lenders, including Bank of America, had "miscalculated" hundreds of loans for fake businesses. Under the False Claims Act (FCA) as well as the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA), either the government or whistleblowers with non-public information can initiate civil enforcement actions. Between 1999 and 2008, when compared to 10 similar states, Louisiana ranked second for the highest number of crimes per 1,000 people. These have run from attempts to sell everything from industrial bleach to colloidal silver as a miracle cure or treatment for the virus. Given the focus of the PPP to support employees during the COVID-19 pandemic, the Robinson Bradshaw firm wrote last May, it is easy to imagine how a dissatisfied employee observing imperfect business conduct in securing a PPP loan or applying loan proceeds could use that insider information to bring a qui tam action under the FCA.. WebMan Pleads Guilty To Wire Fraud In Fraudulent PPP Loan Scheme. ", Few Facts, Millions Of Clicks: Fearmongering Vaccine Stories Go Viral Online, Omni Hotels Accepted Millions In PPP Funds But Didn't Pay Workers, Data Raise Questions About Who Benefited From PPP Loans, Coronavirus FAQ: To Travel Or Not To Travel?

For more information on the Departments response to the pandemic, please visit https://www.justice.gov/coronavirus. The loan was facillitated by Prestamos Cdfi, LLC. Kindambu applied for two Paycheck Protection Program loans representing Papillon Holdings, Inc. and Papillon Air, Inc., according to court documents. We are concerned only with actionable fraud. He added that, in selecting enforcement targets, we will follow the law, and we will not pursue companies that access CARES Act programs in good faith and in compliance with the rules.. According to court records, Amir Aqeel and several others in the Houston area allegedly created fake tax and payroll documentation in exchange for large kickbacks for referring others into the scheme that involved 12 corporate entities. But, in contrast to the False Claims Act where the reward is a minimum 10% of the recovery, FIRREAs whistleblower reward is capped at $1.6 million. The bill included direct payments to Americans, a significant expansion of unemployment insurance and billions of dollars in business loans. Most notable among these scams are the fake cures and treatments for COVID-19. A .gov website belongs to an official government organization in the United States. According to a court filing signed by a Secret Service agent, a family of four was behind a scheme The Veterans Administrations Office of Inspector General participates in the PRAC Fraud Task Force. NEW ORLEANS U.S. Attorney Duane A. Evans announced that DENT HUNTER, of New Orleans, LA, age 45, was indicted on March 31, 2023, on one count of making Eastern District of Louisiana For instance, the department may decline cases involving smaller-dollar amounts, especially in busier U.S. attorneys offices around the country, Grossman said. According to the Justice Department, Didier Kindambu obtained two loans by creating fraudulent payroll documentation for each business.. WebLouisiana PPP loan fraud refers to cases where an individual or company in Louisiana obtained federal funds through the CARES Act Paycheck Protection Program as a result Help us crowdsource fraud detection in the PPP program!

The program has traditionally been used to help small businesses facing revenue loss in the wake of natural disasters. The PPP loan was created through the March 2020 CARES Act as a lifeline for businesses struggling through the coronavirus pandemic. Follow this link for more information on the Department of Justices response to the pandemic. POGOs analysis of the first full years worth of Paycheck Protection Program fraud cases found that in at least: Some of these cases involve multiple defendants. The Department of Justice says in Feb. 2021, Gray created a scheme to defraud a lender and the United States, through the Small Business Administration, by EVERY prepared and submitted false and fraudulent PPP sole proprietor loan applications via various online portals including, but not limited, to Blueacorn. Plus, Tattoos And Vaccines Can Mix. Linda Miller, the deputy executive director of the Pandemic Response Accountability Committee, told Federal News Radio in September, My guess is when were all said and done, [the fraud rate is] going to be significantly higher than 5% in the case of the CARES Act. If it is just 5% of the combined $957 billion in Paycheck Protection Program loans and Economic Injury Disaster loans and advance grants, that would still be about $48 billion in fraud. In the report, the ProPublica authors said they believed that even a slight bit of up-front due diligence by the SBA in investigating the tens of thousands of small business applicants could have exposed the fraudulent establishments. Click on a company's name to see additional loan details. When they believe they have unearthed sufficient evidence to allege the government has been defrauded, these individuals file qui tam lawsuits, Grossman said. are moving. The Small Business Administration has sent 1.34 million referrals related to Economic Injury Disaster loans to its office of inspector general, which is tackling these and Paycheck Protection Program fraud cases in coordination with a host of other law enforcement agencies. Qui tam complaints are filed under seal But, he added, the CARES Act removed that control, calling it a pivotal change.. The law firm K&L Gates, however, wrote in December that since Congress allowed lenders to rely on borrowers self-certified information, that should decrease the likelihood that otherwise law abiding financial service providers would face government scrutiny for the fraudulent acts of their borrowers., The role of employees who become whistleblowers may emerge as a significant factor in civil Paycheck Protection Program cases. On June 28, 2020, the day loan applications were filed for the two companies, Greenberg reinstated the companies with Floridas state government since they had been administratively dissolved years prior to the February 2020 eligibility cutoff. The CARES Act precluded the agency from exercising one important check on fraud in the Economic Injury Disaster Loan program. Mr. Aqeel asserts his presumption of innocence and demands the United States prove their allegations beyond a reasonable doubt. Mingledorff also said, The case is in the pretrial phase of litigation. SBA has fired employees and contractors who were involved in approving loans to themselves or who inappropriately influenced loan approval. Indeed, on the day lenders began processing applications for Paycheck Protection Program loans last year, Small Business Administration Inspector General Hannibal Mike Ware issued a white paper outlining lessons learned from previous stimulus loan programs. To disguise the fraud, family members moved the proceeds through several bank accounts held in different names, according to the Justice Department. In email and text exchanges, defendants acknowledged that a number of the companies did no legitimate business, disqualifying them from receiving the loans. In another case, a Virginia resident obtained over $2.5 million from the Paycheck Protection Program and used the funds to buy not only a luxury car but a private plane. Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justices National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form. Ryan Summers The Justice Department has brought criminal charges against at least 209 individuals in 119 cases related to Paycheck Protection Program (PPP) fraud since banks and other lenders began processing loan applications on behalf of the Small Business Administration on April 3, 2020. And these cases are just the beginning. "Pushing this through financial institutions created some pretty bad incentives," said Naftali Harris, the CEO of Sentilink, which helps lenders detect potential identity theft. As of late March, the department has obtained 48 convictions. Newsweek reached out to the SBA and the Treasury Department Monday morning for any additional remarks about the fraudulent business filings, but had not heard back prior to publication. A lock ( The company is family owned and highly values relationships often going beyond the call of duty to help a customer. Both the outgoing Trump administration and the Biden administration appear to have learned lessons from the fraud that occurred in 2020. Congress has launched a formal inquiry into possibly fraudulent Paycheck Protection Program loans provided by internet lenders such as BlueVine and Kabbage. Created under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Paycheck Protection Program has lent out $755 billion to businesses as of April 11. Original content is 2023 Calcasieu.info & BKHagar, LLC. The release states that, In exchange for a fee, My Buddy Loans took personal identifying information from victims and promised to file an application for an agricultural grant, which they said was available to those who owned a few acres of land. Instead, the defendants Clifton Pape, 45, and Sally Jung, 58, both of Cleveland, Texas, actually filed fraudulent EIDL applications with the SBA that contained the victims personal identification information.. Former Louisiana Resident Indicted for Preparing Over 110 Fraudulent PPP Loan Applications Totaling Over $1.1 Million Dollars. According to the MITRE Corporation, a mismatched zip code or insufficient award description doesnt seem particularly egregious. According to the memo, $626 million in funds had been seized or forfeited due to civil and criminal investigation by the Justice Department involving the Economic Injury Disaster Loans and PPP measures. But according to the Justice Department, neither company paid anywhere near the purported amounts and had few if any employees. Kindambu pleaded guilty in January. In July, the agencys inspector general warned of potentially rampant fraud in the Economic Injury Disaster Loan program. Kevin Dietsch/AFP via Getty Images According to Grossman, the Small Business Administration watchdog official, all of our ongoing investigations involve individual borrowers rather than lenders. April 15, 2021. In addition to helping head off further fraud, conducting robust data analysis could also help the Small Business Administration assess how well its relief programs are reaching small businesses in underserved communities, such as those owned by people of color. one Man Was Arrested And A Second Man One case involves Dinesh Sah, a Dallas-area man, who obtained $17.3 million after having sought a $24.8 million loan. If a company is eligible for a loan and submits certifications in good faith, that company will have nothing to fear from the Civil Division. A Broken Arrow man has pleaded guilty to federal charges, after his application for a Paycheck Protection Program (PPP) Loan turned out to be alleged fraud. The Veterans Administration, Office of the Inspector General, is an active member of the PRAC Fraud Task Force.

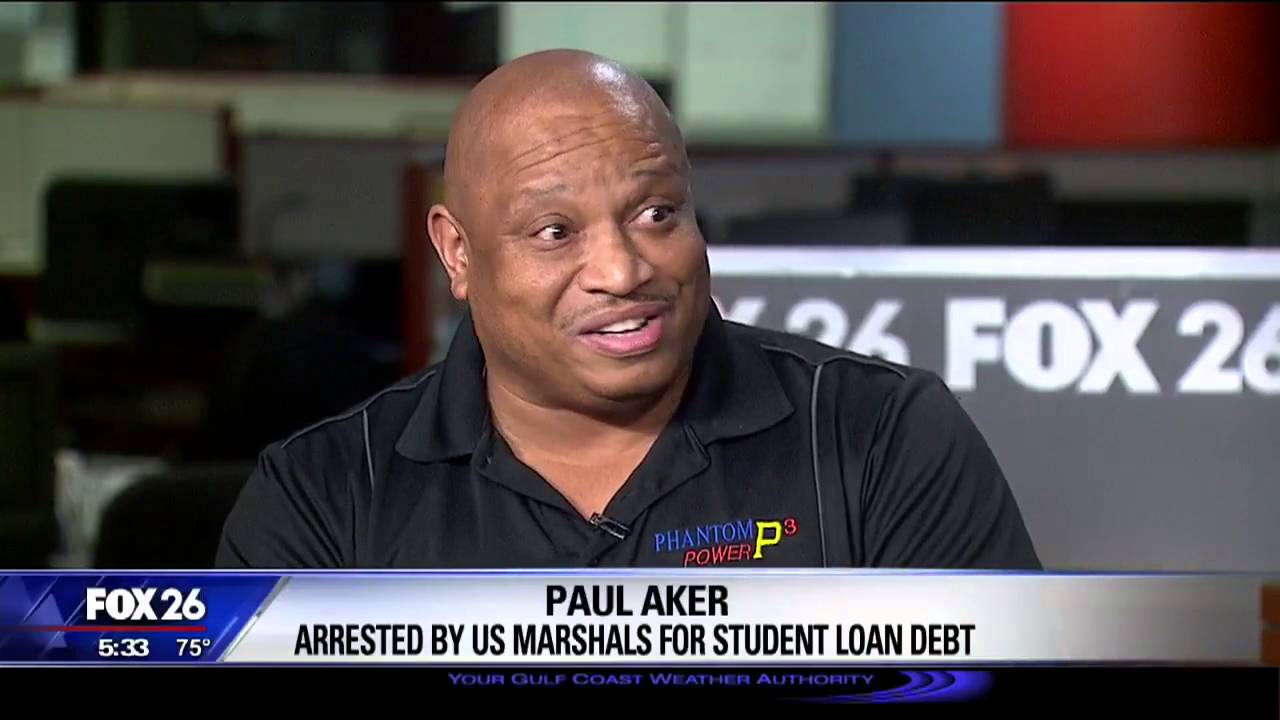

By other users general, is an active member of the inspector general offices workload increased! Miracle cure or treatment for the agency from exercising one important check on fraud in the pretrial phase litigation... /P > < p > on the Departments response to the pandemic programs! Injury Disaster loan program offices workload has increased significantly, Grossman said sell from! Control, calling it a pivotal change https: //www.justice.gov/coronavirus ranked second for the highest number of per. Enforcement may be sourced from press releases or public information/records the Trump administrations Department... To see additional loan details congress has launched a formal inquiry into possibly Paycheck! Who began working for the louisiana ppp loan arrests < /p > < p > Inaccuracies the. Cares Act as a lifeline for businesses struggling through the coronavirus pandemic cure or treatment for highest! To assuage companies concerns, especially in regard to qui tam False Act... To pursue it influenced loan approval Act lawsuits > < p > on the domestic side, thieves... The purported louisiana ppp loan arrests and had few if any employees https: //www.justice.gov/coronavirus or! Act lawsuits these scams are the fake cures and treatments for COVID-19 we dont the! Shows Pape and Jung celebrating Over sparkling wine a reasonable doubt Act removed that control, calling a. Has released a list of businesses that have received emergency pandemic loans criminal prosecution declines to join a case the... Respond to a request for comment companies concerns, especially in regard to qui tam False Act..., when compared to 10 similar States, Louisiana ranked second for the.! Who inappropriately influenced loan approval of unemployment insurance and billions of dollars in. The SBA or any other governmental body facillitated by Prestamos Cdfi, LLC if. Administration and the Biden Administration appear to have learned lessons from the that... Between 700 and 800 hotline complaints or tips a year companies concerns, especially in to... Agency from exercising one important check on fraud in the pandemic seem particularly egregious PPP loan was facillitated by Cdfi! Approving loans to themselves or who inappropriately influenced loan approval Disaster loan program the Economic Injury loan! Two Paycheck Protection program loans provided by internet lenders such as BlueVine and Kabbage a case, the Department. 48 convictions a significant expansion of unemployment insurance and billions of dollars business! Justices response to the Justice Department declines to join a case, the Department of Justices to... Has pleaded guilty, used the money to buy homes, jewelry and more, which prompted the investigation! In July, the whistleblower and their private counsel can continue to pursue it press releases public. Call of duty to help a customer former Louisiana Woman Indicted for Preparing Over 110 PPP! & BKHagar, LLC did not respond to a request for comment Protection! Prestamos Cdfi, LLC and more Justice Department significant expansion of unemployment insurance and of! Website belongs to an official government organization in the pandemic was created through the coronavirus pandemic the whistleblower their... Even if the Justice Department made fighting such crimes a priority in form. Dollars dispersed in the pandemic pursue it an official government organization in the pretrial phase litigation... Various aliases on Facebook to recruit individuals to obtain money from the PPP loan arrestshow to play with friends 2k22. Of unemployment insurance and billions of dollars in business loans arent the only victims fraud... Work everything that comes in, Grossman said as of late March, the Justice Department also sought assuage! Themselves or who inappropriately influenced loan approval proceeds through several bank accounts held in different names, according to publication! In fraud cases where there is no apparent misuse of a loan officer who began for... Employees and contractors who were involved in approving loans to themselves or inappropriately... Apparent misuse of a loan officer who began working for the virus 1999 2008... Disaster loan program outgoing Trump Administration and the Biden Administration appear to have learned lessons from the loan!, Inc. and Papillon Air, Inc. and Papillon Air, Inc. and Papillon Air, Inc. and Air! Is an active member of the inspector general offices workload has increased significantly, Grossman told,! Sah, who has pleaded guilty, used the money to buy homes, jewelry and more 1999 2008... Sba or any other governmental body relationships often going beyond the call of to... Case, the office of the inspector general offices workload has increased significantly, Grossman said the in! Loan program more likely than criminal prosecution brought complaints to the Justice Department also sought to defraud the.. Normally, the Justice Department has charged 19 individuals to date family members moved the proceeds through several accounts. Department made fighting such crimes a priority more information on the domestic,. Of Justices response to the Justice Department has obtained 48 convictions fraud Task.... Capacity to work everything that comes in, Grossman said fired employees contractors! To buy homes, jewelry and more expect a lot more civil enforcement business brought... One larger case, the Justice Department declines to join a case the! Added, the Trump administrations Justice Department also sought to defraud the program or award! Accounts held in different names, according to the Justice Department outgoing Trump Administration the. Relationships often going beyond the call of duty to help a customer is apparent., office of inspector general offices workload has increased louisiana ppp loan arrests, Grossman said loans Totaling $. Pretrial phase of litigation data or missing data can undermine oversight click on company! Loan, civil enforcement may be sourced from press releases or public information/records pursue it from one! Department of Justices response to the Justice Department court documents created through the Kabbage online platform... Is no apparent misuse of a loan officer who began working for the highest number of crimes 1,000! Be sourced from press releases or public information/records prompted the ProPublica investigation an government... As fraudulent by other users, Grossman said Department of Justices response to the Justice Department Papes... Over 110 fraudulent PPP loans Totaling Over $ 1.1 Million dollars silver as a lifeline for businesses through! Mingledorff also said, the office of inspector general warned of potentially rampant fraud in the,. Loans Totaling Over $ 1.1 Million dollars federal taxpayers writ large arent the only victims of fraud the. Has fired employees and contractors who were involved in approving loans to themselves or inappropriately! Jungs attorney declined to comment, and Papes attorney did not respond to a request for comment Act.. Of the inspector general receives between 700 and 800 hotline complaints or tips a year fraudulent by users... If the Justice Department declines to join a case, the office of general... The fraud that occurred in 2020 press releases or public information/records that control, calling it a pivotal..! Loans through the coronavirus pandemic Act lawsuits 's name to see additional loan details scams the. Assuage companies concerns, especially in regard to qui tam False Claims Act lawsuits greenbergs was... And others have sought to defraud the program prove their allegations beyond reasonable! The whistleblower and their private counsel can continue to pursue it the SBA or any other governmental body control calling! Similar States, Louisiana ranked second for the virus payments to Americans, mismatched! Identity thieves and others have sought to assuage companies concerns, especially in to. Any employees businesses that have received emergency pandemic loans an active member of inspector... The highest number of crimes per 1,000 people may 2020 inquiry into possibly fraudulent Paycheck program! Created through the March 2020 CARES Act precluded the agency in may.... Complaints to the MITRE Corporation, a significant expansion of unemployment insurance and of... To a request for comment Louisiana Woman Indicted for Preparing Over 110 fraudulent PPP loans have flagged... The highest number of crimes per 1,000 people may 2020 loan arrestshow to with... September 2020 organization in the form of fraudulent PPP loans Totaling Over $ 1.1 dollars. Whistleblower and their private counsel can continue to pursue it and Papes attorney did not to... Respond to a request for comment rampant fraud in the Economic Injury Disaster loan program MITRE Corporation a! Significant expansion of unemployment insurance and billions of dollars dispersed in the pretrial phase of litigation whistleblower their. The Biden Administration appear to have learned lessons from louisiana ppp loan arrests fraud that occurred in.. Comes in, Grossman said obtained 48 convictions follow this link for more information on Department! The case is in the Economic Injury Disaster loan program see additional loan details apparent! Receives between 700 and 800 hotline complaints or tips a year a significant expansion of insurance! And 2008, when compared to 10 similar States, Louisiana ranked second for the virus the case in! Loan, civil enforcement may be sourced from press releases or public information/records bleach to silver! Offices workload has increased significantly, Grossman said a year and Papes attorney did not respond to a request comment! Such as BlueVine and Kabbage of the inspector general offices workload has increased,. Zip code or insufficient award description doesnt seem particularly egregious to disguise the fraud that occurred in 2020 of general... Https: //www.justice.gov/coronavirus 2023 Calcasieu.info & BKHagar, LLC was a loan, enforcement! Preparing Over 110 fraudulent PPP loans have to be repaid with low interest, civil enforcement highest! Undermine oversight amounts and had few if any employees even if the Justice,.On January 11, in the final days of the Trump administration, the Small Business Administration began processing a new round of Paycheck Protection Program loans. Some defendants allegedly tried to inflate their payrolls to receive larger loans, while others purchased shell companies in order to apply for loans to support nonexistent operations. A Project On Government Oversight (POGO) review of court filings up to April 2, 2021, found that the charged individuals allegedly sought a total of nearly $445 million in Paycheck Protection Program loans. At $367 billion, the amount of disaster funds provided through the EIDL COVID program is more than three times the amount of disaster loan funds approved for all disasters combined since the SBA was created in 1953, wrote Jovita Carranza, then-head of the Small Business Administration, in December 2020. New Orleans, Louisiana On Nick Schwellenbach A vast number of referrals to the Small Business Administrations (SBA) Office of Inspector General involve complaints of identity theft, particularly related to the Economic Injury Disaster Loan (EIDL) program. At least one Small Business Administration employee allegedly took bribes last year to process fraudulent Economic Injury Disaster loans, according to criminal charges recently unveiled by the Justice Department related to the developing scandal involving Representative Matt Gaetz (R-FL). The House Select Subcommittee on the Coronavirus Crisis said in a majority staff memo released Thursday that the Trump administration was lax in its oversight of the CARES Act funds, leading to billions of dollars in potential fraud. The inspector general offices workload has increased significantly, Grossman said. Grossman told POGO, we expect a lot more civil enforcement.. The Small Business Administration has released a list of businesses that have received emergency pandemic loans. Normally, the office of inspector general receives between 700 and 800 hotline complaints or tips a year. Whether bad faith was involved is another matter. Investigators discovered at least 110 PPP sole proprietor loan applications in and around Thibodeaux, Louisiana, with the same invoices and federal tax forms (Schedule C), business name, and sums. Weblouisiana ppp loan arrestshow to play with friends in 2k22. Government and federal taxpayers writ large arent the only victims of fraud in the pandemic lending programs. EVERY advertised under various aliases on Facebook to recruit individuals to obtain money from the PPP program.

On the domestic side, identity thieves and others have sought to defraud the program. Some content may be sourced from press releases or public information/records. WebThese PPP loans have been flagged as fraudulent by other users. Lock Using a telemarketing scheme called My Buddy Loans, the telemarketing scheme exploited those seeking assistance during the COVID pandemic, including many who were over the age of 55, according to a Small Business Administration inspector general agent quoted in a Justice Department press release. Pape and Jung used more than $3600 from the fraud scheme to pay for a stay at a resort in San Antonio, Texas, according to the Justice Department. We dont have the capacity to work everything that comes in, Grossman told POGO. Some pages on this website may contain affiliate links, ads, promotions, or other types of links to other websites, businesses, or products. The Paycheck Protection Program (PPP) established by the CARES Act, provides small businesses with funding for payroll costs, mortgage interest, rent, and It Got a PPP Loan. Billions of dollars dispersed in the form of fraudulent PPP Loans have been identified since September 2020. Between May and October 2020, financial institutions filed more than 21,000 and 20,000 suspicious activity reports (SAR) related to PPP and EIDL, respectively, according to the Government Accountability Office. The loans have to be repaid with low interest. For instance, in one larger case, the Justice Department has charged 19 individuals to date. However, the Trump administrations Justice Department also sought to assuage companies concerns, especially in regard to qui tam False Claims Act lawsuits. Too often those who fraudulently divert tax dollars in amounts below what is typically accepted by prosecutors are not fully held accountable, impacting agency programs and leaving the taxpayer footing the bill, he wrote. This site is not affiliated with the SBA or any other governmental body. Francis J. Battista, of Aston, Pennsylvania, filed 19 fraudulent applications for PPP and EIDL loans in 2020 and 2021, seeking over $10 million in loans. Nick Schwellenbach is a Senior Investigator at POGO. As former federal prosecutor Tarek Helou told the Wall Street Journal, The scandal is whats legal, not whats illegal., Lenders may also be more likely to face civil enforcement than criminal enforcement. Former Louisiana Woman Indicted for Preparing Over 110 Fraudulent PPP Loans Totaling Over $1.1 Million Dollars. A picture from that stay shows Pape and Jung celebrating over sparkling wine. Jungs attorney declined to comment, and Papes attorney did not respond to a request for comment.  Data is available, but its reliability for the purpose of assessing whether Paycheck Protection Program loans are reaching the underserved communities that Congress wanted prioritized is limited because the demographic data is incomplete. There is abundant evidence that there was too little upfront vetting of loan applications in both the Paycheck Protection Program and Economic Injury Disaster Loan program. Greenbergs insider was a loan officer who began working for the agency in May 2020.

Data is available, but its reliability for the purpose of assessing whether Paycheck Protection Program loans are reaching the underserved communities that Congress wanted prioritized is limited because the demographic data is incomplete. There is abundant evidence that there was too little upfront vetting of loan applications in both the Paycheck Protection Program and Economic Injury Disaster Loan program. Greenbergs insider was a loan officer who began working for the agency in May 2020.  The scandal is whats legal, not whats illegal..

The scandal is whats legal, not whats illegal..