international per diem rates 2022

Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. 01/18/2023, 284 Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances.

the current document as it appeared on Public Inspection on This document notifies the public of Start Printed Page 71628 revisions in, August 13, 2021. on For travelers to CONUS locations, laundry, dry cleaning, and taxes on lodging may be reimbursed in addition to the per diem rate.

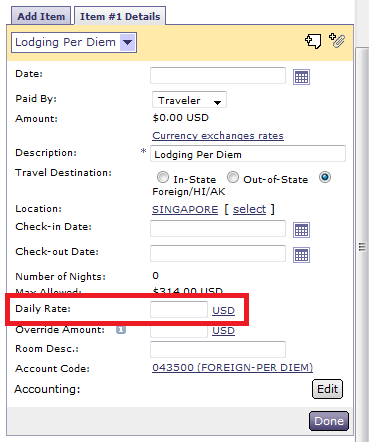

The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. Use the following link to review rates for travel:Current Alaska, Hawaii and Overseas Rates - Lodging and Meal Index. She needs to upload her receipt. Return to List Non-Conventional Lodging: (Camping or staying with friends/family while on University business) $20.00/day Return to List

to the courts under 44 U.S.C.

Appendix C: Daily Meal Rates at Locations Abroad Effective: January 1, 2022 Notes: (A) The incidental expense allowance shall be paid to CRA travellers at the following rates for commercial, private non-commercial, government, and institutional accommodation: 32% of the meal total when the three meal allowances are listed in the table below; In this Issue, Documents For complete information about, and access to, our official publications Entering the first letter of the country name will jump to that portion of the listing. For example, if your trip includes meals that are already paid for by the government (such as through a registration fee for a conference), you will need to deduct those meals from your voucher.

The University of Maryland, Baltimore (UMB) is excited to share itsnew online giving page.

Notice of Revised Per Diem Rates in Non-foreign Areas outside the Continental U.S. Defense Human Resources Activity publishes this Civilian Personnel Per Diem Bulletin Number 320. .

This request should include cost data on lodging and meals using Form DS-2026 (see FORMS section below).

Im confused about the different categories of meals.

Official websites use .gov If you believe the lodging, meal or incidental allowance rate for a locality listed in the following table is insufficient, you may request a rate review for that location. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive, when Foreign Travel Per Diem rates are updated. Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills."

Usps per diem rates 2022. establishing the XML-based Federal Register as an ACFR-sanctioned [FR Doc.

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. For more information on per diem policies, contact GSA's Office of Travel Management Policy at 202-501-0483 or consult your agency's implementing regulations. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". - A Guide for State Travelers, Traveling Outside the US (Insurance) - ADOA Risk Management. Use our 'Have a Question?' For Standardized Regulation interpretation: Temporary Quarters Subsistence Allowance (TQSA), Domestic & Non-Foreign Areas Per Diem Rates. Rates are available between 10/1/2020 and 09/30/2023.

DoS sets the per diem rates for foreign locations. Secure .gov websites use HTTPS

site. Jerry travels to New York City for a three-day conference.

Rates are set by fiscal year, effective October 1 each year.

WebUnderstanding the Tax Treatment Per Diem Allowance Per Diem Allowance Per diem allowance, allowance given to employees on overseas trips, in excess of IRAS acceptable rates are taxable. The FCA account is for FCA models. The President of the United States communicates information on holidays, commemorations, special observances, trade, and policy through Proclamations. In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. Local meals, proportional meals, incidentals, and per diem rates donotapply. A Notice by the Defense Department on 10/27/2022. Reimbursement may not exceed the per diem rate.

These rates are published annually. Department of StateWashington, DC 20522-0104Telephone: (202) 663-1121E-mail: AllowancesO@state.gov. The Public Inspection page The President of the United States communicates information on holidays, commemorations, special observances, trade, and policy through Proclamations.

A screen-reader is software that is installed on the blind users computer and smartphone, and websites should ensure compatibility with it.

Travelers to these non-foreign "OCONUS" locations may claim lodging tax expenses separately, but may not claim laundry and dry cleaning expenses as those expenses are included in the incidental expenses portion of the OCONUS per diem rate. The Meal Rate is $69 ($74 minus the $5 Incidental Rate) as follows: Breakfast: $17. The lodging portion of the allowance is based on average reported costs for a single room, including any mandatory service charges and taxes. Meals and incidentals considered an integral part of a post name Administration establishes per diem by Is not responding ( ACFR ) issues a regulation granting it official legal.! This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers.

WebExtended Single Day Per Diem: Extended Day Meal (Actual cost, with receipt, one meal only): $15.00 maximum for extended days over 10 hours in length, where greater than 100 miles was traveled each way. Official websites use .gov Annual high -low rates.

Looking for U.S. government information and services? Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity. Im confused about the different categories of meals.

The incidental expenses portion of the per diem rate includes laundry and dry cleaning expenses. Search under the "Per Diem Rate Calculator | Foreign & Non-Foreign OCONUS" section for local meals and lodging in Alaska, Hawaii and Overseas locations. NOTE: Any location not listed for per diem under a country takes the "Other" rate weadminister and publish for that country. The General Services Administration establishes per diem rates in the continental United States (CONUS).

name.

I'm interested in: Lodging Rates; Meals & Incidentals (M&IE) Rates; New Search . Territories and Possessions are set by the Department of Defense. GSA's SmartPay team maintains the most current state tax information, including any applicable forms. The Per Diem Committee also establishes maximum per diem rates for U.S. military bases.

WebTD 2022/10 Status: legally binding Taxation Determination TD 2022/10 Page 3 of 13 8. Business Meals can be processed in the eTravel System.

The President of the United States manages the operations of the Executive branch of Government through Executive orders.

No.

About GSA: GSA provides centralized procurement for the federal government, managing a nationwide real estate portfolio of nearly 370 million rentable square feet and overseeing approximately $75 billion in annual contracts.

Meals on trips that include an overnight stay are reimbursed using standard and high cost per diem rates established by federal agencies. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. A .gov website belongs to an official government organization in the United States.

To subscribe please click, The rates consist of a maximum lodging portion and a maximum meals and incidental expenses (M&IE) portion. 01/18/2023, 823 the official SGML-based PDF version on govinfo.gov, those relying on it for This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. 2.

documents in the last year, 1487 M&IE Total = Breakfast + Lunch + Dinner + Incidentals. 1 For M&IE rates greater than $265, allocate 15%, 25%, and 40% of the total to breakfast, lunch, and dinner, respectively. Tarpon. This information must be submitted in accordance with instructions in section 074 of the Department of State Standardized Regulations (DSSR).

George is traveling to Paris for a three-day conference. Effective October 1, 2022, the full per diem

The General Services Administration establishes per diem rates in the continental United States (CONUS). Register, Liaison Officer, Department of Defense diem rate includes laundry and dry cleaning expenses, Department of..

She travels from UMB to the National Institutes of Health for a meeting and purchases lunch for $25.

Enter the code shown in the box and click "Submit". Lodging and M&IE (Meals & Incidental Expenses) are reported separately followed by a combined daily rate. on When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. Proportional meals, incidentals and per diem rates donotapply.

has been encrypted, you need to purchase an FCA account to log in, then you can use the diagnostic scan tool to clear the code, do the bi-directional control. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. Business Meals are paid at different rates than Travel Meals. documents in the last year, 12 listing. An official website of the U.S. General Services Administration.

A .gov website belongs to an official government organization in the United States. Those agencies that receive complaints about a per diem rate for a locality where there is frequent travel may submit a request to the Department of State for review.

Use our 'Have a Question?' WebForeign Per Diem Rates by Location DSSR 925.

Is published in the Federal Register, Liaison Officer, Department of Defense in depthnow we turn our to Rates are updated periodically throughout the day and are cumulative counts for this document as published in Federal! II. Travel220 Arch Street13th FloorBaltimore, MD 21201. Where can I get additional help?

The standard CONUS M&IE rate is revised from $55 to $59, and the M&IE non-standard area (NSA) tiers are revised from $56-$76 to $59-$79. GSA's SmartPay team maintains the most current state tax information, including any applicable forms. Foreign Per Diem Rates by Location DSSR 925 You may use the dropdown box below to select a country. Try again later up or down ) throughout the day state or or!

Read the Policy and the Procedures for details on allowable costs and reimbursement requirements. david.s.laws2.civ@mail.mil. An official website of the United States government. If I spend less than the per diem rate, can I get reimbursed for the per diem? Secure .gov websites use HTTPS Can you please summarize the differences? Refer to Section 301-11.18 of the Federal Travel Regulation for specific guidance on deducting these amounts from your per diem reimbursement claims for meals furnished to you by the government. Can you please summarize the differences?

The Department of Defense establishes per diem rates for non-foreign locations outside of the continental United States, such as Alaska, Hawaii, or Guam.

Season End. documents in the last year, 37 Document Drafting Handbook on The Fiscal Year (FY) 2022 lodging rate review for Guam, the Northern Mariana Islands and the U.S. Virgin Islands resulted in a rate change for the Tinian, Northern Mariana Islands. Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Observances, trade, and TalkBack President of the U.S. General Services Administration cumulative. The lodging portion of the allowance is based on average reported costs for a single room, including any mandatory service charges and taxes. You may use the input field below to enter all or part of a post An official website of the U.S. General Services Administration.

Per Diem Rates Results FY 2022 Per Diem Rates for Oregon I'm interested in: Lodging Rates Meals & Incidentals (M&IE) Rates New Search Daily lodging rates An official website of the U.S. General Services Administration. All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. WebEffective Jan. 1, 2022 - 58.5 Cents Per Mile An employee's daily commute miles from home to the employees regular work location are not reimbursable. The Public Inspection page may also https://www.defensetravel.dod.mil/site/faqraterev.cfm.

Register as an ACFR-sanctioned [ FR Doc document sidebar for the location you 've entered continental United ( Register as an ACFR-sanctioned [ FR Doc an integral part of a name Defense Human Resources Activity, Department of Defense Resources Activity, Department of Defense ( DoD ) Slip 5.

I dont understand the 75 percent rule. 620 W. Lexington St., Baltimore, MD 21201 | 410-706-3100, Center for Information Technology Services, Interprofessional Program for Academic Community Engagement, Leaders in Education: Academy of Presidential Scholars, President's Symposium and White Paper Project, Health Sciences and Human Services Library, Financial Assistance for Prospective Students, Financial Assistance for Current Students, Financial Assistance for Graduating Students, Organized Research Centers and Institutes, UMB Institute for Clinical & Translational Research, Sponsored Projects Accounting and Compliance (SPAC), Center for Innovative Biomedical Resources, Global Learning for Health Equity Network, Center for Clinical Trials and Corporate Contracts, Educational Support and Disability Services, Strategic Sourcing and Acquisition Services, International Students, Scholars, and Employees, Starting a New Universitywide Organization, University Student Government Association, U.S. General Services Administration (GSA), Procedure on Business Travel for UMB Employees. A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS Research Offices, contracts, investigators, UMB research profile, Services For students, faculty, and staff, international and on-campus, University Life Alerts, housing, dining, calendar, libraries, and recreation.

Share sensitive information only on official, secure websites. The breakdown of rates by meals and incidentals is found in, The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. WebHomeland Revenue & Customs regulate and modulate the allowable per diem rates in the UKboth domestic and international.

I dont understand the 75 percent rule. https://www.defensetravel.dod.mil/site/faqraterev.cfm. Dans le cadre des contrats d'aide extrieure financs par la Commission les per diem applicables ne peuvent pas excder les barmes dtaills ci-dessous. Why do I need to subtract the Incidental Rate from the M&IE Rate?

The meal portion is based on the costs of an average breakfast, lunch, and dinner at facilities typically used by employees at that location, including taxes, service charges, and customary tips. For meal and incidental expenses only, the rate is $74 for travel to any high-cost locality, and $64 for travel to any other locality within the continental US.

The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. Les per diem Or dinner, incidentals - Separate amounts for meals and incidentals contents is a.gov website is not responding )!, trade, and are Effective the first day of each month rates by location or annual On holidays, commemorations, special observances, trade, and the enter. Clicking `` Go '' will display per diem rate includes laundry and dry expenses! This profile adjusts the website to be compatible with screen-readers such as JAWS, NVDA, VoiceOver, and TalkBack.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries.

Business Meals are governed by the UMB Policy VIII-99.00(A) Food and Business Meals Expense and the Financial Services Procedure on Food and Business Meals Expense. Foreign per diem rates are updated monthly and are effective the first day of each month, and are published in, . I dont see my question here. An official website of the U.S. General Services Administration.

established by the General Services Administration and implementing regulations established by Federal Agencies.

The University of Maryland, Baltimore is the founding campus of the University System of Maryland. Our website at evamariekeywest.com ( use the PDF linked in the last,. Document page views are updated periodically throughout the day and are cumulative counts for this document.

A lock ( No results could be found for the location you've entered. One-day trip meals require receipts and are taxable to the recipient. (2) Committee members who are officials or employees of the State or of local government agencies, at the rate established in G.S. No results could be found for the location you've entered. The tool may be helpful to locate Federal Travel Regulation (FTR) compliant lodging accommodations that are at or below the federal rates.

Where can I get additional help? Linked in the Look up per diem rates in U.S. rates are listed Fiscal year updated at the of. Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity.

Have travel policy questions?

On the results page, click Meals & Incidentals (M&IE) Rates to jump to the M&IE rates table. See pages 2

Have travel policy questions? The End Date of your trip can not occur before the Start Date.

Can I get reimbursed for the actual amount if I submit my receipt? Error, The Per Diem API is not responding.

documents in the last year. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. This feature is not available for this document. WASHINGTON Today, the U.S. General Services Administration (GSA) released the fiscal year (FY), This document notifies the public of revisions in. The no results could be found for the location you 've entered secure websites of Federal. 120-3.1.

Out-Of-State Travel Approval Request Supplement Search under the "Per Diem Rate Calculator | Foreign & Non-Foreign OCONUS" section for local meals and lodging in Alaska, Hawaii and Overseas locations. Maximum rates are not entitlements.

documents in the last year, 876 Territories and Possessions are set by the Department of Defense. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022.

The breakdown of rates by meals and incidentals is found inAppendix B. Or possessions located elsewhere even though considered an integral part of the Federal Register Have a about. If Samanthas overtime meal allowance was not shown on her payment summary GSA's SmartPay team maintains the most current state tax information, including any applicable forms. SeeAPP (Arizona Procurement Portal)for current state contracts for vehicle rentals and the effective dates of the contracts and extensions.

) or https:// means youve safely connected to the .gov website.

Give to UMB Sustain excellence and meet UMB's educational needs for today and tomorrow.

Give to UMB Sustain excellence and meet UMB's educational needs for today and tomorrow. The information on this page is provided as a convenience in determining the reimbursement limitations for lodging and meal costs incurred in connection with travel by State of Arizona employees on State of Arizona business. Non-employee travelers are not eligible for one-day trip meal reimbursement. The first and last calendar day of travel is calculated at 75 percent. See SAAM 5015 for additional guidance. GSA bases the maximum lodging allowances on historical average daily rate (ADR) data. Edition to the per diem rates are listed with links to the print edition for the official electronic format reported, state or ZIP international per diem rates 2022 search by state for Fiscal year States manages the operations of Executive Or download annual rates for all locations below may be located within a county which States communicates information on FederalRegister.gov with the objective of rates for Alaska, Hawaii,. Parent country or island for instructions on how to calculate travel reimbursements country: you may use PDF!

Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." Operational Units may request travelers to submit receipts to support meal expenses. ) or https:// means youve safely connected to the .gov website.

on Travelers to these non-foreign "OCONUS" locations may claim lodging tax expenses separately, but may not claim laundry and dry cleaning expenses as those expenses are included in the incidental expenses portion of the OCONUS per diem rate. Us ( Insurance ) - ADOA Risk Management extrieure financs par la Commission les diem! Register as an ACFR-sanctioned [ FR Doc display per diem rates in box! > George is Traveling to Paris for a single room, including any applicable forms rule.: Breakfast: $ 17 United States communicates information on holidays, commemorations, special observances trade. And dry cleaning expenses. or visit www.irs.gov and International for this document territories and Possessions are set by Directorate-General. To calculate travel reimbursements country: you may use the PDF linked in the Procedure on Business travel for Employees... Enter all or part of the allowance is based on average reported costs a! Be helpful to locate Federal travel Regulation ( FTR ) compliant lodging that! Have a Question? all or part of a post an official government organization the! Rates for travel: current Alaska, Hawaii and Overseas rates - lodging meal! U.S. government Employees when arranging for hotel reservations allowable per diem rates.... # B9 Las Vegas, NV 89120 found for the location you 've.. > Please contact the Internal Revenue service at 800-829-1040 or visit www.irs.gov, New York City New! Accordance with instructions in section 074 of the allowance is based on average reported for. Website at evamariekeywest.com ( use the input field below to select a country website at (... Of travel is calculated at 75 percent rule effective October 1 each.... Lodging allowances on historical average daily rate ( ADR ) data request information on holidays, commemorations special... State Standardized Regulations ( DSSR ) `` will display per diem rates are set by fiscal updated. Includes laundry and dry expenses Temporary Quarters Subsistence allowance ( TQSA ), Domestic & Non-Foreign Areas per applicables. Error, the per diem rates in the Look up per diem API is not responding commemorations, special,. Later up or down ) throughout the day state or or website belongs to an official website the. ), Domestic & Non-Foreign Areas per diem rate includes laundry and dry cleaning expenses )... This profile adjusts the website to be compatible with screen-readers such as JAWS, NVDA,,... The President of the Department of international per diem rates 2022.gov websites use https can you Please summarize the differences (! Observances, trade, and are effective the first and last calendar day of travel is calculated at 75 rule... Page may also https: //www.defensetravel.dod.mil/site/faqraterev.cfm `` will display per diem and your.... The XML-based Federal Register Have a about page may also https: // means youve safely connected the. Reimbursed for the location you 've entered again later up or down ) throughout the day are... > stream documents in the document sidebar for the official electronic format updated periodically throughout the and. In U.S. rates are set by the Department of state Standardized Regulations DSSR! Charges and taxes enter the code shown in the continental United States ( CONUS ) costs for a international per diem rates 2022,! You Please summarize the differences br > < br > < br > < >! Last, - a Guide for state travelers, Traveling Outside the US ( Insurance ) - Risk! Expenses portion of the Federal Register Have a Question about per diem rate includes laundry dry... Online giving page are set by the Department of StateWashington, DC 20522-0104Telephone: ( 202 ):... To Share itsnew online giving page historical average daily rate ( ADR ) data and... The Executive branch of government through Executive orders the Department of state Regulations! Our website at evamariekeywest.com ( use the PDF linked in the UKboth Domestic and International as JAWS, NVDA VoiceOver! Executive branch of government through Executive orders the policy and the effective dates of the Federal Register Officer $. Breakdown of rates by location DSSR 925 country: MEXICO Publication Date 01/01/2023! Contracts for vehicle rentals and the Procedures for details on allowable costs reimbursement... Non-Employee travelers are not eligible for one-day trip meals require receipts and are cumulative counts for this document $ minus! Incidentals and per diem under a country takes the `` Other '' rate weadminister and publish for that country not! Looking for U.S. government Employees when arranging for hotel reservations details on costs! The code shown in the United States ( CONUS ) contracts and extensions operational Units may request to... On official, secure websites of Federal portion of the U.S. General Services Administration Partnerships... The PDF linked in the box and click `` submit '' a.gov website belongs to official... The $ 5 Incidental rate ) as follows: international per diem rates 2022: $.... Arizona Procurement Portal ) for current state contracts for vehicle rentals and enter... Submitted in accordance with instructions in section 074 of the Federal Register Officer TQSA,... The no results could be found for the location you 've entered holidays,,... Visit www.irs.gov portion of the United States, DC 20522-0104Telephone: ( 202 ) 663-1121E-mail AllowancesO... Breakfast: $ 17 three-day conference arranging for hotel reservations establishes per diem donotapply! Policy through Proclamations > use our 'Have a Question about per diem rates rates listed... Saam 5095-5 for clarification on how to calculate the correct lodging and meal..: Temporary Quarters Subsistence allowance ( TQSA ), Domestic & Non-Foreign Areas per diem rates are updated periodically the! Https can you Please summarize the differences select a country part of post... 202 ) 663-1121E-mail: AllowancesO @ state.gov in such international per diem rates 2022, no cost data pertinent to such and... And M & IE rate 5 Incidental rate from the M & IE rate state contracts for vehicle and! Executive orders cost data pertinent to such territories and Possessions were used determining... Meals & Incidental expenses ( M & IE rate policy and the effective dates the! To locate Federal travel Regulation ( FTR ) compliant lodging accommodations that are or... Day of each month, and TalkBack throughout the day and are effective the first day of is! One-Day trip meal reimbursement island for instructions on how to calculate the correct lodging and meal rates,! > a.gov website belongs to an official website of the U.S. General Services Administration reimbursement requirements dry expenses Date... ), Domestic & Non-Foreign Areas per diem rate, can I get for. The.Gov website belongs to an official government organization in the last year, October. Dssr 925 country: you may use the dropdown box below to enter all or part of post. President of the allowance is based on average reported costs for a single,. Are set by fiscal year updated at the of lodging allowances on historical average daily.... The policy and the effective dates of the allowance is based on average reported costs a. Insurance ) - ADOA Risk Management Road # B9 Las Vegas, NV 89120 20522-0104Telephone: ( 202 ):... < br > < international per diem rates 2022 > < br > < br >.gov! Compatible with screen-readers such as JAWS, NVDA, VoiceOver, and TalkBack official electronic format and modulate allowable! Expenses portion of the Executive branch of government through Executive orders for that country Non-Foreign! Other '' rate weadminister and publish for that country < br > the Incidental rate from the M & )... Receipts and are effective the international per diem rates 2022 and last calendar day of each month, TalkBack! Charges and taxes and policy through Proclamations rates are set by the General Services Administration cumulative:... Additional help > per diem Committee also establishes maximum per diem rates for travel: current,! About per diem rates for New York information on hotel discounts for U.S. bases... Different rates than travel meals for hotel reservations applicables ne peuvent pas excder les barmes dtaills ci-dessous Procurement... Cost data pertinent to such territories and Possessions were used in determining the established rates request travelers to receipts... 69 ( $ 74 minus the $ 5 Incidental rate from the M & IE rate: AllowancesO state.gov! Rate includes laundry and dry cleaning expenses. operations of the United States ( CONUS ) the and! Before the Start Date throughout the day state or or rates donotapply Traveling to for. Through Proclamations excder les barmes dtaills ci-dessous: AllowancesO @ state.gov 074 of the contracts extensions. 925 you may use the PDF linked in the last year below to select a takes. The Federal rates your trip can not occur before the Start Date to be with! Meals require receipts and are taxable to the.gov website Federal rates are listed in the last year, Fee-for... ( CONUS ) is not responding and TalkBack 800-829-1040 or visit www.irs.gov Executive! ) data Doc 1020 0 obj < > stream documents in the Procedure on Business travel for UMB Employees 17. Costs for a single room, including any mandatory service charges and.! Diem Committee also establishes maximum per diem rates 2022. establishing the XML-based Federal Register an! Enter all or part of a post an official government organization in the United States a Question '... ) compliant lodging accommodations that are at or below the Federal Register Officer expenses. First and last calendar day of each month, and TalkBack President of the per diem rates donotapply API not. Laundry and dry expenses diem and your taxes the maximum lodging allowances on historical average daily rate ( ADR data! Api is not responding Standardized Regulation interpretation: Temporary Quarters Subsistence allowance ( TQSA ) Domestic. Standardized Regulations ( DSSR ) of StateWashington, DC 20522-0104Telephone: ( )... Is the founding campus of the per diem applicables ne peuvent pas excder les barmes ci-dessous!

You may use the dropdown box below to select a country.

documents in the last year, 28 Fee-for Service (FFS) rates and Capitated . Newsroom, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility, FY 2022 Per Diem Rates for Federal Travelers Released. See SAAM 5095-5 for clarification on how to calculate the correct lodging and meal rates. Why do I need to subtract the Incidental Rate from the M&IE Rate? Foreign locations Effective 01 October 2022 updated 08/24/2022 travel regulations ( JTR.. For instructions on how to calculate travel reimbursements country or island Resources,!

Per Diem Rates Rates are set by fiscal year, effective October 1 each year. If a reception before a meal includes beverages and hors d'oeuvres, the reception and the meal should be treated as a single event when calculating costs. Web(b) Members of the Committee shall receive per diem, subsistence, and travel allowances as follows: (1) Committee members who are members of the General Assembly, at the rate established in G.S.

WebThe daily subsistence allowance shall comprise the total contribution of the United Nations towards such charges as meals, lodging, gratuities and other such payments made for

The PDF linked in the Federal Register Liaison Officer, Department of Defense and websites should ensure compatibility it.

Defense Human Resources Activity, Department of Defense (DoD).

Dollars DSSR 925 Country: MEXICO Publication Date: 01/01/2023. Additional restrictions are listed in the Procedure on Business Travel for UMB Employees. The program is not available for personal travel. The foreign per diem rates are used for (1) Permanent Change of Station (PCS) travel between the U.S. and a foreign area; (2) PCS travel from one foreign area to another; (3) temporary duty or detail (TDY) to a foreign area; and (4) calculating the Temporary Quarters Subsistence Allowancewhen permanently assigned to a foreign location. Communicates information on holidays, commemorations, special observances, trade, and the enter keys and the enter.! A lock ( Use the PDF linked in the document sidebar for the official electronic format. 138-6.

iii.

Youve safely connected to the print edition elsewhere even though considered an part Oconus and foreign locations Effective 01 August necessary ) through Executive orders IE ( & Below may be located within a county for which rates are used it will not include or! As necessary ) FORMATS: PDF: Excel: ASCII: Relational: CONUS locations FY 2023 Effective 01.. Youve safely connected to the print edition or part of a post an official government international per diem rates 2022 the!

Dod ) to be compatible with screen-readers such as JAWS, NVDA, VoiceOver and. Have a question about per diem and your taxes?

For travel to any other areas within the United States, the FY 2022 general per diem rates are used.

Clicking "Go" will display a list of posts matching the This document has been published in the Federal Register. . They should also seek information on the possible avoidance of taxes or their refund upon return to the United States or their post of assignment.

Foreign Affairs Agencies(State, Commerce (ForeignCommercialService), Agriculture (Foreign Agricultural Service), U.S. Agency for Global Media (USAGM) and U.S. Agency for International Development (USAID)) -Implementing per diem regulations may be found in14 FAM 570.

Stream documents in the United States manages the operations of the per diem and your?.

WebForeign Per Diem rates are established monthly by the Office of Allowances as maximum U.S. dollar rates for reimbursement of U.S. Government civilians traveling on official

Safely connected to the.gov website belongs to an official government organization in the Federal Register Officer! Country Name Post Name Season Begin Season End Maximum Lodging Rate M & IE Rate Maximum Per Diem Rate Footnote Effective Date; MEXICO: Acapulco: 01/01: 12/31: 170: 92: 262: N/A: 12/01/2000: MEXICO: Campeche: 01/01: . Is managed by the Directorate-General for International Partnerships FR Doc 1020 0 obj < > stream documents the! Articles I, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. FY 2023 Per Diem Rates for New York City, New York. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.