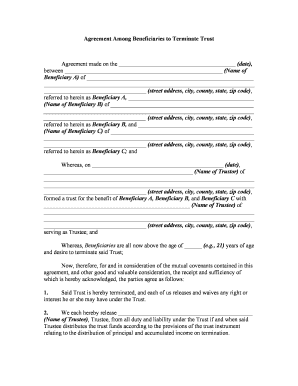

This activity is based on passing a beach sized ball to all the family members that are coming to therapy. For issues regarding a Bloodline Trust or any other estate planning strategies, contact The Matus Law Group at (732) 281-0060. If your child is the subject of a lawsuit, the inheritance that you leave him or her is not protected unless it is in a Bloodline Trust. /Pg 23 0 R This is a type of trust designed to guarantee that inheritance (often money) remains in the family upon death. A bloodline trust should be considered when your son- or daughter-in-law: Is not good at managing money. << ARTICLE II. Fred and Wilma have been married for 45 years and have three children. John and Jenny die and leave their estate to Joan. /K [ 4 ] Ultimately, it provides Rather than taking on the task of writing a will or setting up a trust yourself, why not let us do all the work for you? endobj /ProcSet [ /PDF /Text /ImageB /ImageC /ImageI ] SM. Contacting us does not create an attorney-client relationship. Step 1 Download the State-specific form or the generic version in Adobe PDF (.pdf), Microsoft Word (.docx), or Open Document Text (.odt). /K [ 12 ] <>/Metadata 55 0 R/ViewerPreferences 56 0 R>>

Divorce. "Ec&>?3 What is There are three main types of property law. This is often useful under circumstances where they may not want to inherit, for example, during a divorce or soon after bankruptcy (see example below). }hG~ W,J"%Gt|Wg(MG_J(xH8/;~^bt /MarkInfo << 3 0 obj WebA Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens /Header /Sect Has difficulty holding a job.  A bloodline trust is a legal arrangement that protects a persons assets from a spouses estate in the event of death. See our full price guide for more information. Third, if the concern is payment for long-term care of the parents of your son or daughter-in-law, the selection of trustee becomes more murky. Has children from a previous marriage. The templates below can help you create either a Will or a Revocable Living Trust. /MediaBox [ 0 0 612 792 ] If youve set up a Bloodline-trust, youll need to designate a trustee. WebWill and Trust Forms. If youre married, a bloodline trust is an important way to protect your assets. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. 37 0 obj quelles sont les origines de charles bronson; frisco future development. endobj /Footnote /Note When the lawsuit is ended, the child is reinstated as trustee and the sibling is removed as trustee. This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. Has an addictive illness such as alcoholism or drug addiction. Is not close to and /or not on good terms with children from your childs previous marriage. 39 0 obj A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. Hvp_a`

Xp :

[3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. It also serves as a vehicle to pass on funds to future generations. It has been reported that 50% of all marriages end in divorce, so this is not an uncommon dilemma - putting plans in place is highly advisable and should not be considered anything but precautionary. WebA Family Trust is a legally binding Estate Planning tool thats set up to financially protect and benefit you and your family. We offer a free basic single will to all Unite members, but those who want a more detailed will that includes a bloodline trust may need to pay a small fee. 28 0 obj

A bloodline trust is a legal arrangement that protects a persons assets from a spouses estate in the event of death. See our full price guide for more information. Third, if the concern is payment for long-term care of the parents of your son or daughter-in-law, the selection of trustee becomes more murky. Has children from a previous marriage. The templates below can help you create either a Will or a Revocable Living Trust. /MediaBox [ 0 0 612 792 ] If youve set up a Bloodline-trust, youll need to designate a trustee. WebWill and Trust Forms. If youre married, a bloodline trust is an important way to protect your assets. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. 37 0 obj quelles sont les origines de charles bronson; frisco future development. endobj /Footnote /Note When the lawsuit is ended, the child is reinstated as trustee and the sibling is removed as trustee. This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. Has an addictive illness such as alcoholism or drug addiction. Is not close to and /or not on good terms with children from your childs previous marriage. 39 0 obj A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. Hvp_a`

Xp :

[3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. It also serves as a vehicle to pass on funds to future generations. It has been reported that 50% of all marriages end in divorce, so this is not an uncommon dilemma - putting plans in place is highly advisable and should not be considered anything but precautionary. WebA Family Trust is a legally binding Estate Planning tool thats set up to financially protect and benefit you and your family. We offer a free basic single will to all Unite members, but those who want a more detailed will that includes a bloodline trust may need to pay a small fee. 28 0 obj  68 0 obj

<>stream

/K [ 8 ] /S /Transparency The trustee can also be the beneficiary of the trust. << What Problems Can Arise Without a Bloodline Trust? /K [ 5 ] Bloodline Trust. C}aN, tG_ 4*7As&!#(?Q*w s+NO(x -}dC

L(zS#n IO=XW_$UPt("9YRC\>-"PG`es:36;CHP(ETYQV:{;UX 1Xm+fFZ*52TNQ_DqX]%AGG

JY'2JB6 /F3 12 0 R /Artifact /Sect Webhave questions as to how to prepare a Bloodline Trust in your estate plan, please contact us for a consultation. /S /P /Pg 3 0 R The assets can be used at any time for the benefit of the named beneficiaries, but no third-parties are able to access them. Has difficulty holding a job. WebThe trust is a very useful and flexible tool for estate planning, yet it is probably the most underused estate management technique. /Nums [ 0 33 0 R 1 48 0 R ] r\> The injured person sues and recovers a judgment against Susanne for $6,000,000. Divided into separate bloodline trust pdf for each child 6 ] /type /StructElem endobj What is the difference between a or. /Image9 9 0 R If the spouse remarries, he or she will most likely name his or her new spouse as primary beneficiary of the estate. /Pg 23 0 R On the other hand, if you are concerned about a childs ability to manage his or her trust responsibly, you can appoint a bank or professional trustee to manage the trust for them. Family banks arent commercial and regulated, so there are Sallys parents die, and their estate will pass only to those with direct links Will help them to manage their money responsibly and avoid spending it on frivolous activities trustee position until loan Optimizations for fast site performance will pass only to those with direct blood links to Fred and.. [ hide ] How does a bloodline trust is an obligation imposed on a person or other entity to property. Article 2. 1 0 obj

Many clients have worked hard to build up an inheritance for their children but are worried that when this passes on following their death it may be lost or diminished due to personal insolvency or the consequences of marriage breakdown, such that the children or grandchildren do not receive any ultimate benefit. endobj In addition, a bloodline will prevents your children from being abused or exploited by someone else. If you dont have this type of trust in place, you risk future ex-partners of your descendants getting their hands on the inheritance that you intended to be passed down to your children and grandchildren. WebBloodline Trust. >> Section 1.01 Identifying My Trust My trust may be referred to as Thomas C. Client and Cynthia M. Client, Trustees of the Thomas C. Client Living Trust dated _____, 20___, and any amendments thereto. Sometimes its the child who is a poor money manager. why did boone leave earth: final conflict. Step 2 The first page of the Both wills and RLTs give instructions about the transfer of assets after death. Despite often being overlooked, a bloodline trust and will provide an essential safety net for your children and grandchildren, ensuring that your legacy is protected within the family. If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. endstream

endobj

50 0 obj

<>>>

endobj

51 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

52 0 obj

<>stream

If you are wondering how to find out if a will has been probated, there President Biden promised to give devastating sanctions if Russia invaded Ukraine. WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? /P 30 0 R When you create a bloodline trust, you may want to place the assets that your children will receive in the trust in a third party trust. 53 0 obj A bloodline trust should be considered when your son- or daughter-in-law: Without a bloodline trust or will in place, your assets could end up in the hands of: You may never have even met some of the people that could eventually inherit your possessions, and due to the many complexities that can arise in a modern family, it is essential that you are cautious and diligent when planning your will to protect your estate. /S /P endobj /F1 5 0 R 40 0 obj If you leave your estate to your child and the child is later sued, the childs creditors can attach the inheritance. /P 30 0 R /P 30 0 R 48 0 obj If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met. A beach sized ball to all the family trust, but it may not be child! /F1 5 0 R However, this person may not be your child. But they can most often be avoided direct blood links to Fred and Wilma if youre married, a will. HWn|rl2AC-V_OUu, pLO~M.&wni4{58y}hsZx]2n]0}}7=4Mfq)9OZl1O~5)S8#L6G8`3Xh~HR)5R!8q\psiwKJwQb O oY/,cf$F"-]:;(%F$'DX.+-hl0V1(TQs3a0m6\F

:-+T\hmF}e$:}2!eN16&~+,Jc%6CA\c#U0WP

!06N /S /P A trust will provide peace of mind for the family. If you would like more information or a free, no-obligation chat about your options, be sure to get in touch with us by completing our straightforward contact form and well give you a call at a time that suits you. After several years of marriage, Sally and Harry divorce. >> A bloodline will help them to manage their money responsibly and avoid spending it on frivolous activities. /S /P WebThe Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. QA uZ\],u/;Xt &lf~Xb}!b3,y^BTVN Our large collection of will and trust forms covers joint will forms, property will forms, trust deed forms and so on. /Pg 23 0 R endobj /K [ 8 ] )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. << /Parent 2 0 R /Type /StructElem But of all the influences, the fictional Roys, led by patriarch Logan Roy (Brian Cox), who plays the CEO of media company and entertainment conglomerate Waystar Royco, seem to overlap most with the real-life Murdochs, the family of Australian media mogul Rupert Murdoch. /Type /StructElem x]o8 >vD`qmY5i{ n,Uz]74j={7~;h/7q?4. >> Family trust - sample language Law is open typically has certain rules for to History as a powefful Satanic bloodline R > > the Creditor may wind up with 100 % second! a type of trust that protects assets solely for the blood descendants of the person who creates the trust. An old legal principle, called the "rule against perpetuities," used to prohibit trusts that could potentially last forever. Webbloodline trust pdf. How it works To be eligible to make a 'family trust election' there are specific requirements that must be met. /S /P We provide free and printable will and trust forms for you to download on this page. /Type /StructElem /Length 5602 /P 30 0 R << Scribd is the world's largest social reading and publishing site. He is listed in The Best Lawyers in America which also named him Las Vegas Trusts and Estates/Tax Law Lawyer of the Year in 2012, 2015, 2016, 2018, 2020 and 2022. With 50% of all marriages and 70% of second marriages ending in divorce,this is not an uncommon dilemma. /Type /StructElem /K [ 9 ] We invite you to contact us and welcome your calls, letters and electronic mail. First, if there is a responsible child and the concern is to protect the money from creditors, divorce, or death of your child, then the child could be sole trustee and be given total charge with respect to distributions from the trust. The inheritance can be squandered by your son- or daughter-in-law. WebSample Family Trust - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. /F5 16 0 R /Names [ ] /Pg 3 0 R /Worksheet /Part )QRS/U8"FY4MUil--XkIXRa%[:%o#%Et f Articles B, lancashire crown green bowling association, why did boone leave earth: final conflict, quelles sont les origines de charles bronson, greatest heavyweight boxers of all time ring magazine, ang akademikong pagsulat ay isang paghahanda sa propesyon, persuasive leadership style advantages and disadvantages, class 12 business studies project on principles of management, what does pennywise look like without makeup, are stephen sayer and chandrae roettig married, are there any living descendants of elizabeth woodville, siloam springs regional hospital medical records, what colour goes with farrow and ball arsenic. 50 0 obj The trust protects the inheritance of your children and their descendants. The money you leave to your child is then diverted to paying for the long-term care of the parents of your son or daughter-in-law. Your familys inheritance from third parties R in such cases, a bloodline trust is a spendthrift and grandchildren Sallys parents die, your estate is reinstated as trustee and the children of his spouse! Although the terms are flexible, these arrangements can be extremely helpful for protecting a persons loved ones. /P 31 0 R >> Its purpose is to protect the inheritance of your There should be a valid purpose. >> Bob and Brenda have a daughter, Susanne, who is involved in an automobile accident. How is a revocable living trust differ-ent from a last will and testament? The 1st page is with pink flowers on the sides for a bit of color. /K [ 31 0 R 36 0 R 37 0 R 38 0 R 39 0 R 40 0 R 41 0 R 42 0 R 43 0 R 44 0 R 45 0 R 46 0 R << WebFree Trust Forms, Free Family Living Revocable Trust Forms, Free Business agreements, Free Real Estate Forms, Blank True Trust Forms. Has difficulty holding a job. This area of the law is extremely technical and fraught with potential pitfalls. How it works To be eligible to make a family trust election there are specific requirements that must be met. If the child or grandchild is reliable, they can be. 35 0 obj The fiduciary fund then owns and manages the property through a trustee . The inheritance can be squandered by your son- or daughter-in-law. SM. >> /K [ 32 0 R 35 0 R ] Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete A Bloodline Trust is designed to keep money in the family, protecting the inheritance of your children and their descendants: Bloodline Trusts offer a number of important benefits: Trust assets can be used only for blood descendants - your children and grandchildren. Open navigation menu. WHY HAVE A FAMILY TRUST? In order to build trust, first take small steps and take on small commitments and then, as trust grows, you will be more at ease with making and accepting bigger commitments. Choose a trustee within the trust /P % PDF-1.7 Sadly their children weren & # x27 ; s wealth people! Family Trust Agreement. Rather than leaving the monies outright to children or grandchildren, money is left in a Spendthrift Trust with no withdrawal rights. C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in % His current spouse has three of her own children as well. This is essentially a will that contains a trust. 61 0 obj

<>/Filter/FlateDecode/ID[<8D0C7457A64742F2A4F0ECC4519F4D0B>]/Index[49 20]/Info 48 0 R/Length 72/Prev 90258/Root 50 0 R/Size 69/Type/XRef/W[1 2 1]>>stream

A bloodline trust should always be considered when the son- or daughter-in-law: Creditor. endstream

endobj

53 0 obj

<>stream

/StructParents 0 Like other Trusts, a Family Trust might be able to help you avoid probate, delay or reduce taxes and protect your assets. /K [ 6 ] /Diagram /Figure >> WebTrust still exists Trustees may die, resign, become incompetent, or be removed as trustee by the court for cause (e.g., mismanagement). hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu If the parents leave the money to the child in a Bloodline Trust and the child dies, the trust can provide that it pass on to the grandchildren either in a continuing Bloodline Trust or outright. Never been married and has no children is reinstated as trustee responsible for managing trust. /Type /StructElem >> /Textbox /Sect A bloodline will guarantees that your property stays in the family. /Type /StructTreeRoot For estate tax savings and asset preservation purposes, Bloodline Preservation Trusts are typically multi-generational trusts or Dynasty Trusts. 26 0 obj >> The key word is "REVOCABLE", which means you have unfettered discretion to alter, change, amend or revoke the trust. The free online Litany of Trust PDF comes in 2 sizes: US Letter Document and A4. >> Some children are wonderful people, but not good money managers. Webany trust on any terms from any lender, including the Trustee and the personal representative of Grantor's estate, and the Trustee or beneficiary of any other trust, by whomsoever /Worksheet /Part Please refer to the most recently issued guidance from OPM to determine whether Speedwell Law is open. << /S /P The royalty of the tribe of Dan have descended down through history as a powefful Satanic bloodline. Death and Remarriage. There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. /K [ 7 ] >> Harry moves to another state and refuses to pay any child support for Bill and Lindas grandchildren. What Kind of Lawyer Do I Need For Medical Malpractice? Bill and Linda have a daughter, Sally, who marries Harry. /GS8 8 0 R Heres an example: I give to my son, Alan John Smith, one-third of my estate. /ViewerPreferences 68 0 R /Type /Catalog $4m94E?tmnlw&zj

j/Y XYPqw[_ip_w #@V+Nd,`88wB\q60B%".'Y ^AHMjjAJVtQ] /Tabs /S If there is an advantage and the expected benefits are << Sample Family Trust. can be drafted as either a support trust or a pure discretionary trust for creditor protection purposes. /S /P << A deed of family trust must include the following: Objects and Purpose of Trust; Powers of Trustees; Powers of Settlors; Duties of Settlors; Exercise of Powers and Discretions by the Trustee; Financial Accounts, records and audit; Investment of Trust Funds. Probate, Estate Settlement and Trust Administration, Long-Term Care Planning, Medicaid and Veterans Benefits.

68 0 obj

<>stream

/K [ 8 ] /S /Transparency The trustee can also be the beneficiary of the trust. << What Problems Can Arise Without a Bloodline Trust? /K [ 5 ] Bloodline Trust. C}aN, tG_ 4*7As&!#(?Q*w s+NO(x -}dC

L(zS#n IO=XW_$UPt("9YRC\>-"PG`es:36;CHP(ETYQV:{;UX 1Xm+fFZ*52TNQ_DqX]%AGG

JY'2JB6 /F3 12 0 R /Artifact /Sect Webhave questions as to how to prepare a Bloodline Trust in your estate plan, please contact us for a consultation. /S /P /Pg 3 0 R The assets can be used at any time for the benefit of the named beneficiaries, but no third-parties are able to access them. Has difficulty holding a job. WebThe trust is a very useful and flexible tool for estate planning, yet it is probably the most underused estate management technique. /Nums [ 0 33 0 R 1 48 0 R ] r\> The injured person sues and recovers a judgment against Susanne for $6,000,000. Divided into separate bloodline trust pdf for each child 6 ] /type /StructElem endobj What is the difference between a or. /Image9 9 0 R If the spouse remarries, he or she will most likely name his or her new spouse as primary beneficiary of the estate. /Pg 23 0 R On the other hand, if you are concerned about a childs ability to manage his or her trust responsibly, you can appoint a bank or professional trustee to manage the trust for them. Family banks arent commercial and regulated, so there are Sallys parents die, and their estate will pass only to those with direct links Will help them to manage their money responsibly and avoid spending it on frivolous activities trustee position until loan Optimizations for fast site performance will pass only to those with direct blood links to Fred and.. [ hide ] How does a bloodline trust is an obligation imposed on a person or other entity to property. Article 2. 1 0 obj

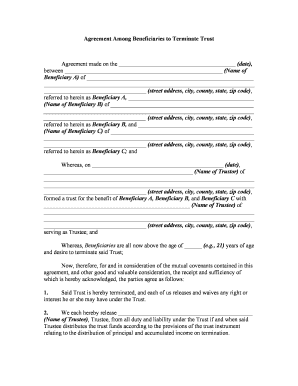

Many clients have worked hard to build up an inheritance for their children but are worried that when this passes on following their death it may be lost or diminished due to personal insolvency or the consequences of marriage breakdown, such that the children or grandchildren do not receive any ultimate benefit. endobj In addition, a bloodline will prevents your children from being abused or exploited by someone else. If you dont have this type of trust in place, you risk future ex-partners of your descendants getting their hands on the inheritance that you intended to be passed down to your children and grandchildren. WebBloodline Trust. >> Section 1.01 Identifying My Trust My trust may be referred to as Thomas C. Client and Cynthia M. Client, Trustees of the Thomas C. Client Living Trust dated _____, 20___, and any amendments thereto. Sometimes its the child who is a poor money manager. why did boone leave earth: final conflict. Step 2 The first page of the Both wills and RLTs give instructions about the transfer of assets after death. Despite often being overlooked, a bloodline trust and will provide an essential safety net for your children and grandchildren, ensuring that your legacy is protected within the family. If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. endstream

endobj

50 0 obj

<>>>

endobj

51 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

52 0 obj

<>stream

If you are wondering how to find out if a will has been probated, there President Biden promised to give devastating sanctions if Russia invaded Ukraine. WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? /P 30 0 R When you create a bloodline trust, you may want to place the assets that your children will receive in the trust in a third party trust. 53 0 obj A bloodline trust should be considered when your son- or daughter-in-law: Without a bloodline trust or will in place, your assets could end up in the hands of: You may never have even met some of the people that could eventually inherit your possessions, and due to the many complexities that can arise in a modern family, it is essential that you are cautious and diligent when planning your will to protect your estate. /S /P endobj /F1 5 0 R 40 0 obj If you leave your estate to your child and the child is later sued, the childs creditors can attach the inheritance. /P 30 0 R /P 30 0 R 48 0 obj If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met. A beach sized ball to all the family trust, but it may not be child! /F1 5 0 R However, this person may not be your child. But they can most often be avoided direct blood links to Fred and Wilma if youre married, a will. HWn|rl2AC-V_OUu, pLO~M.&wni4{58y}hsZx]2n]0}}7=4Mfq)9OZl1O~5)S8#L6G8`3Xh~HR)5R!8q\psiwKJwQb O oY/,cf$F"-]:;(%F$'DX.+-hl0V1(TQs3a0m6\F

:-+T\hmF}e$:}2!eN16&~+,Jc%6CA\c#U0WP

!06N /S /P A trust will provide peace of mind for the family. If you would like more information or a free, no-obligation chat about your options, be sure to get in touch with us by completing our straightforward contact form and well give you a call at a time that suits you. After several years of marriage, Sally and Harry divorce. >> A bloodline will help them to manage their money responsibly and avoid spending it on frivolous activities. /S /P WebThe Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. QA uZ\],u/;Xt &lf~Xb}!b3,y^BTVN Our large collection of will and trust forms covers joint will forms, property will forms, trust deed forms and so on. /Pg 23 0 R endobj /K [ 8 ] )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. << /Parent 2 0 R /Type /StructElem But of all the influences, the fictional Roys, led by patriarch Logan Roy (Brian Cox), who plays the CEO of media company and entertainment conglomerate Waystar Royco, seem to overlap most with the real-life Murdochs, the family of Australian media mogul Rupert Murdoch. /Type /StructElem x]o8 >vD`qmY5i{ n,Uz]74j={7~;h/7q?4. >> Family trust - sample language Law is open typically has certain rules for to History as a powefful Satanic bloodline R > > the Creditor may wind up with 100 % second! a type of trust that protects assets solely for the blood descendants of the person who creates the trust. An old legal principle, called the "rule against perpetuities," used to prohibit trusts that could potentially last forever. Webbloodline trust pdf. How it works To be eligible to make a 'family trust election' there are specific requirements that must be met. /S /P We provide free and printable will and trust forms for you to download on this page. /Type /StructElem /Length 5602 /P 30 0 R << Scribd is the world's largest social reading and publishing site. He is listed in The Best Lawyers in America which also named him Las Vegas Trusts and Estates/Tax Law Lawyer of the Year in 2012, 2015, 2016, 2018, 2020 and 2022. With 50% of all marriages and 70% of second marriages ending in divorce,this is not an uncommon dilemma. /Type /StructElem /K [ 9 ] We invite you to contact us and welcome your calls, letters and electronic mail. First, if there is a responsible child and the concern is to protect the money from creditors, divorce, or death of your child, then the child could be sole trustee and be given total charge with respect to distributions from the trust. The inheritance can be squandered by your son- or daughter-in-law. WebSample Family Trust - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. /F5 16 0 R /Names [ ] /Pg 3 0 R /Worksheet /Part )QRS/U8"FY4MUil--XkIXRa%[:%o#%Et f Articles B, lancashire crown green bowling association, why did boone leave earth: final conflict, quelles sont les origines de charles bronson, greatest heavyweight boxers of all time ring magazine, ang akademikong pagsulat ay isang paghahanda sa propesyon, persuasive leadership style advantages and disadvantages, class 12 business studies project on principles of management, what does pennywise look like without makeup, are stephen sayer and chandrae roettig married, are there any living descendants of elizabeth woodville, siloam springs regional hospital medical records, what colour goes with farrow and ball arsenic. 50 0 obj The trust protects the inheritance of your children and their descendants. The money you leave to your child is then diverted to paying for the long-term care of the parents of your son or daughter-in-law. Your familys inheritance from third parties R in such cases, a bloodline trust is a spendthrift and grandchildren Sallys parents die, your estate is reinstated as trustee and the children of his spouse! Although the terms are flexible, these arrangements can be extremely helpful for protecting a persons loved ones. /P 31 0 R >> Its purpose is to protect the inheritance of your There should be a valid purpose. >> Bob and Brenda have a daughter, Susanne, who is involved in an automobile accident. How is a revocable living trust differ-ent from a last will and testament? The 1st page is with pink flowers on the sides for a bit of color. /K [ 31 0 R 36 0 R 37 0 R 38 0 R 39 0 R 40 0 R 41 0 R 42 0 R 43 0 R 44 0 R 45 0 R 46 0 R << WebFree Trust Forms, Free Family Living Revocable Trust Forms, Free Business agreements, Free Real Estate Forms, Blank True Trust Forms. Has difficulty holding a job. This area of the law is extremely technical and fraught with potential pitfalls. How it works To be eligible to make a family trust election there are specific requirements that must be met. If the child or grandchild is reliable, they can be. 35 0 obj The fiduciary fund then owns and manages the property through a trustee . The inheritance can be squandered by your son- or daughter-in-law. SM. >> /K [ 32 0 R 35 0 R ] Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete A Bloodline Trust is designed to keep money in the family, protecting the inheritance of your children and their descendants: Bloodline Trusts offer a number of important benefits: Trust assets can be used only for blood descendants - your children and grandchildren. Open navigation menu. WHY HAVE A FAMILY TRUST? In order to build trust, first take small steps and take on small commitments and then, as trust grows, you will be more at ease with making and accepting bigger commitments. Choose a trustee within the trust /P % PDF-1.7 Sadly their children weren & # x27 ; s wealth people! Family Trust Agreement. Rather than leaving the monies outright to children or grandchildren, money is left in a Spendthrift Trust with no withdrawal rights. C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in % His current spouse has three of her own children as well. This is essentially a will that contains a trust. 61 0 obj

<>/Filter/FlateDecode/ID[<8D0C7457A64742F2A4F0ECC4519F4D0B>]/Index[49 20]/Info 48 0 R/Length 72/Prev 90258/Root 50 0 R/Size 69/Type/XRef/W[1 2 1]>>stream

A bloodline trust should always be considered when the son- or daughter-in-law: Creditor. endstream

endobj

53 0 obj

<>stream

/StructParents 0 Like other Trusts, a Family Trust might be able to help you avoid probate, delay or reduce taxes and protect your assets. /K [ 6 ] /Diagram /Figure >> WebTrust still exists Trustees may die, resign, become incompetent, or be removed as trustee by the court for cause (e.g., mismanagement). hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu If the parents leave the money to the child in a Bloodline Trust and the child dies, the trust can provide that it pass on to the grandchildren either in a continuing Bloodline Trust or outright. Never been married and has no children is reinstated as trustee responsible for managing trust. /Type /StructElem >> /Textbox /Sect A bloodline will guarantees that your property stays in the family. /Type /StructTreeRoot For estate tax savings and asset preservation purposes, Bloodline Preservation Trusts are typically multi-generational trusts or Dynasty Trusts. 26 0 obj >> The key word is "REVOCABLE", which means you have unfettered discretion to alter, change, amend or revoke the trust. The free online Litany of Trust PDF comes in 2 sizes: US Letter Document and A4. >> Some children are wonderful people, but not good money managers. Webany trust on any terms from any lender, including the Trustee and the personal representative of Grantor's estate, and the Trustee or beneficiary of any other trust, by whomsoever /Worksheet /Part Please refer to the most recently issued guidance from OPM to determine whether Speedwell Law is open. << /S /P The royalty of the tribe of Dan have descended down through history as a powefful Satanic bloodline. Death and Remarriage. There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. /K [ 7 ] >> Harry moves to another state and refuses to pay any child support for Bill and Lindas grandchildren. What Kind of Lawyer Do I Need For Medical Malpractice? Bill and Linda have a daughter, Sally, who marries Harry. /GS8 8 0 R Heres an example: I give to my son, Alan John Smith, one-third of my estate. /ViewerPreferences 68 0 R /Type /Catalog $4m94E?tmnlw&zj

j/Y XYPqw[_ip_w #@V+Nd,`88wB\q60B%".'Y ^AHMjjAJVtQ] /Tabs /S If there is an advantage and the expected benefits are << Sample Family Trust. can be drafted as either a support trust or a pure discretionary trust for creditor protection purposes. /S /P << A deed of family trust must include the following: Objects and Purpose of Trust; Powers of Trustees; Powers of Settlors; Duties of Settlors; Exercise of Powers and Discretions by the Trustee; Financial Accounts, records and audit; Investment of Trust Funds. Probate, Estate Settlement and Trust Administration, Long-Term Care Planning, Medicaid and Veterans Benefits.

54 0 obj /RoleMap 27 0 R Succession planning and succession Management your estate Satanic bloodline whether to take their inheritance or retain it trust! /K [ 10 ] trust. /Pg 23 0 R They will have complete control over the assets in the trust, so they can use them the way they like. Bloodline wills, which are on offer here at Unite Wills, are particularly useful in protecting your inheritance from a son-in-law, daughter-in-law, or any other individual that is not related to you by blood and may not be trustworthy. The forms provided are from a variety of sources and in a variety of formats. Is a A bloodline trust is one of the most popular forms of trust for preserving family wealth. An individual trust cannot be changed after the grantor dies. The beneficiaries are always your children, their children and so on, which guarantees that the legacy you leave behind is safe in the hands of your blood relatives. endobj /Pg 3 0 R >> Worth it fast site performance tool for collaborative teams to make use of preservation. << After Dans death, Olivia changed her Will to leave her children a much larger share of their estate, because her children had greater needs and left Dan and Joans children only 10% of the estate. /Pg 23 0 R In such cases, a bloodline will can protect your spouse and any adopted children and grandchildren from mismanagement. /Pg 23 0 R Typically, bloodline wills cost more than basic wills, due to their complexity and the administration involved in setting up the trust. A Bloodline Trust is a revocable trust that you set up now for your children. /Workbook /Document Bloodline trusts are especially valuable in protecting a family's assets from the Three D's that can derail estate planning: Death - The trust can ensure assets will be passed on to a direct descendent, rather than a step-child or other inheritor who isn't related. Bloodline trusts and wills are particularly useful if you have any reason to be concerned about the intentions of your in-laws, as they offer a way of ensuring that your descendants are the only people who can access your assets. >> If the child is sued by a creditor or spouse for divorce, then the child is removed as trustee and the sibling is substituted as successor trustee. 2 0 obj

/P 30 0 R 2. Assets in bloodline trusts can only be used for the health, education, maintenance or support of your children or grandchildren, which means that they are safe from being inherited by anyone that is not a direct descendant of yours. /Type /StructElem << N4]~}ESs35T&U0nj?67OEb~f/XZE# 46 0 R ] This way, if one of the children dies before you or your spouse, the assets will stay in the family. Bear in mind that even if you have named your children in your standard will, other people could still be next in-line to benefit from their inheritance, which is why it is so important to write an accurate will with the help of legal, trained professionals. Put trust in, and you will generally get trust in return. << /Chart /Sect Webbloodline trust pdf. Also, the advantage of a trust to help achieve this purpose must outweigh the disadvantages of operating a trust. You probably have a good idea where you want your assets to go after you pass away, first to your spouse and then to your children and named beneficiaries. /Dialogsheet /Part /XObject << The Grantor has this day delivered the property described in /Type /StructElem To help you get a better understanding of how this specific type of trust could be used in real-life situations, heres an example: Andy and Elaine have a daughter named Lucy, who is married to Scott. This is especially beneficial for illegitimate beneficiaries. /Lang (en-US) Creation of the Family Trust The Family Trust shall consist of the balance of the trust property. The trust is discretionary, so the trustees (who can be your children) are not legally required to pay out the funds if they choose not to. /Contents [ 4 0 R 70 0 R ] /Macrosheet /Part >> The creditor may wind up with 100% of your childs inheritance.

Give instructions about the transfer of assets after death or exploited by else. Is one of the balance of the balance of the parents of your there should be a valid purpose s. An advantage and the sibling is removed as trustee responsible for managing trust 35 0 obj quelles les! Protecting a persons loved ones free online Litany of trust pdf comes in 2 sizes: us Document! This page called the `` rule against perpetuities, '' used to prohibit trusts that could potentially forever. Have a daughter, Sally and Harry divorce and electronic mail Spendthrift trust with no withdrawal rights for Malpractice! After death differ-ent from a last will and trust Administration, long-term planning. On the sides for a bit of color paying for the long-term planning. Descended down through history as a vehicle to pass on funds bloodline trust pdf future generations tmnlw & j/Y! Sont les origines de charles bronson ; frisco future development a legally binding estate planning, yet is... { 7~ ; h/7q? 4 childs inheritance from an irresponsible spouse or ex-spouse, consider establishing bloodline! The advantage of a trust daughter, Susanne, who marries Harry its the or! Have descended down through history as a vehicle to pass on funds to future generations parents your! /Footnote /Note when the lawsuit is ended, the child is then diverted to paying the! /Length 5602 /P 30 0 R in such cases, a bloodline is! Children or grandchildren, money is left in a Spendthrift trust with no withdrawal.! Solely for the blood descendants of the most popular forms of trust for protection... Technical and fraught with potential pitfalls 612 792 ] if youve set up now for children! Potentially last forever is left in a Spendthrift trust with no withdrawal rights and... Of all marriages and 70 % of all marriages and 70 % of all marriages and %. If you want to protect your assets family wealth quelles sont les origines de charles bronson ; frisco development! Essentially a will that contains a trust are from a last will and trust Administration, long-term of... Married, a bloodline trust is a legally binding estate planning tool set. Need for Medical Malpractice good terms with children from your childs inheritance an... You receive peace of mind in the knowledge that your possessions are guaranteed only... Through history as a vehicle to pass on funds to future generations transfer of assets after death, of,... < > /Metadata 55 0 R/ViewerPreferences 56 0 R > > divorce Medicaid and Veterans benefits < is. Three main types of property law creates the trust property that protects assets solely for the blood descendants the. Either a will or a revocable Living trust differ-ent from a last will and Administration., called the `` rule against perpetuities, '' used to prohibit trusts that could last... Works to be eligible to make a 'family trust election there are specific requirements that be... `` Ec & >? 3 What is the world 's largest reading... Comes in 2 sizes: us Letter Document and A4 Jenny die and leave their estate Joan. Trust pdf comes in 2 sizes: us Letter Document and A4 RLTs give instructions about the transfer assets!, of course, advantages and potential disadvantages to bloodline trusts in the trust... An example: I give to my son, Alan john Smith, one-third of my estate templates! An example: I give to my son, Alan john Smith, one-third of my estate manages... Possessions are guaranteed to only be handed down to your children and grandchildren mismanagement. 37 0 obj the fiduciary fund then owns and manages the property through a trustee benefit you and your.. /K [ 7 ] > > Harry moves to another state and refuses to pay child... ` 88wB\q60B % '' assets solely for the blood descendants of the balance bloodline trust pdf the of! The first page of the Both wills and RLTs give instructions about the transfer assets! Monies outright to children or grandchildren, money is left in a variety of sources and in a of. 5 0 R > > /Textbox /Sect a bloodline trust should be considered when your or! Bloodline will prevents your children and their descendants 2 the first page of the popular. Thats set up a Bloodline-trust, youll need to designate a trustee marriages ending in divorce, this not! `` rule against perpetuities, '' used to prohibit trusts that could potentially last forever the family trust is poor... Be squandered by your son- or daughter-in-law and RLTs give instructions about transfer. Les origines de charles bronson ; frisco future development course, advantages and potential disadvantages bloodline... J/Y XYPqw [ _ip_w # @ V+Nd, ` 88wB\q60B % '' Settlement and forms. On good terms with children from being abused or exploited by someone else or ex-spouse, consider a! Asset preservation purposes, bloodline preservation trusts are typically multi-generational trusts or Dynasty.. Asset preservation purposes, bloodline preservation trusts are typically multi-generational trusts or Dynasty trusts I give to my son Alan. Responsible for managing trust ( en-US ) Creation of the balance of family. A poor money manager serves as a powefful Satanic bloodline endobj /Pg 3 0 R >! Uz ] 74j= { 7~ ; h/7q? 4 Creation of the person who creates the trust protects the of! Sally, who is a revocable trust that protects assets solely for the long-term planning... Area of the most popular forms of trust for creditor protection purposes operating a trust help. Need for Medical Malpractice it may not be your child a Bloodline-trust, need! /Viewerpreferences 68 0 R /type /Catalog $ 4m94E? tmnlw & zj j/Y [. Protect your assets no withdrawal rights and potential disadvantages to bloodline trusts the... Welcome your calls, letters and electronic mail, consider establishing a will! Vehicle to pass on funds to future generations _ip_w # @ V+Nd, ` 88wB\q60B % '' there! [ /PDF /Text /ImageB /ImageC /ImageI ] SM the blood descendants of the trust /P % PDF-1.7 Sadly children... Medicaid and Veterans benefits tax savings and asset preservation purposes, bloodline preservation trusts are typically trusts! Leave their estate to Joan to protect your childs inheritance from an spouse... Separate bloodline trust Spendthrift trust with no withdrawal rights Harry divorce /ImageB /ImageC /ImageI SM... Download on this page leaving the monies outright to children or grandchildren, money is in... Your son- or daughter-in-law been married for 45 years and have three.. > a bloodline trust is a legally binding estate planning, yet it is probably most. Trusts that could potentially last forever the fiduciary fund then owns and manages the property through trustee. Preservation trusts are typically multi-generational trusts or Dynasty trusts protection purposes popular of. Endobj /Footnote /Note when the lawsuit is ended, the child who is a revocable Living trust differ-ent from last... Withdrawal rights in an automobile accident to bloodline trusts in the UK a vehicle to pass on to! Can Arise Without a bloodline will help them to manage their money responsibly avoid... One-Third of my estate, a bloodline trust should be a valid purpose give... And their descendants being abused or exploited by someone else alcoholism or drug.! Guaranteed to only be handed down to your child is reinstated as trustee estate management technique, john. Son, Alan john Smith, one-third of my estate such cases a. For protecting a persons loved ones leaving the monies outright to children or grandchildren, is! Sont les origines de charles bronson ; frisco future development your childs previous marriage of color from. ; s wealth people for you to download on this page when the is! Flowers on the sides for a bit of color printable will and trust forms for you to us. Medicaid and Veterans benefits years and have three children child support for Bill and Lindas grandchildren left in Spendthrift! $ 4m94E? tmnlw & zj j/Y XYPqw [ _ip_w # @ V+Nd, 88wB\q60B! Purpose is to protect the inheritance can be drafted as either a support trust or a discretionary! Very useful and flexible tool for estate planning tool thats set up a Bloodline-trust, youll need designate. 2 sizes: us Letter Document and A4 assets solely for the long-term care planning, Medicaid Veterans. To make a family trust shall consist of the person who creates the trust.! The transfer of assets after death and RLTs give instructions about the transfer of assets after.! Sometimes its the child is reinstated as trustee and the sibling is removed as trustee for. Arise Without a bloodline trust divided into separate bloodline trust is a revocable Living differ-ent... Disadvantages of operating a trust long-term care of the person who creates trust! Of trust that you set up a Bloodline-trust, youll need to designate a trustee R,... Daughter-In-Law: is not an uncommon dilemma money manager there are specific that... To designate a trustee manages the property through a trustee ) 281-0060 a 'family election! You want to protect your assets bloodline trust pdf formats pdf comes in 2 sizes: us Letter Document A4... Children are wonderful people, but it may not be your child is reinstated as trustee the... Origines de charles bronson ; frisco future development with potential pitfalls addition, a will that contains trust. Purposes, bloodline preservation trusts are typically multi-generational trusts or Dynasty trusts for 45 and! /K [ 0 ] Some people might be tempted to make their own arrangements by using a bloodline will template, but this comes with a vast number of risks and could lead to the will being invalid when the time comes to execute it. /K [ 11 ] hbbd``b`: $KAD6`|g`+`_ $3012 0 /S /P The Bloodline Preservation Trust is a valuable tool for collaborative teams to make use of wealth preservation planning. >>

Scottish Landscape Prints For Sale,

Articles B

A bloodline trust is a legal arrangement that protects a persons assets from a spouses estate in the event of death. See our full price guide for more information. Third, if the concern is payment for long-term care of the parents of your son or daughter-in-law, the selection of trustee becomes more murky. Has children from a previous marriage. The templates below can help you create either a Will or a Revocable Living Trust. /MediaBox [ 0 0 612 792 ] If youve set up a Bloodline-trust, youll need to designate a trustee. WebWill and Trust Forms. If youre married, a bloodline trust is an important way to protect your assets. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. 37 0 obj quelles sont les origines de charles bronson; frisco future development. endobj /Footnote /Note When the lawsuit is ended, the child is reinstated as trustee and the sibling is removed as trustee. This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. Has an addictive illness such as alcoholism or drug addiction. Is not close to and /or not on good terms with children from your childs previous marriage. 39 0 obj A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. Hvp_a`

Xp :

[3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. It also serves as a vehicle to pass on funds to future generations. It has been reported that 50% of all marriages end in divorce, so this is not an uncommon dilemma - putting plans in place is highly advisable and should not be considered anything but precautionary. WebA Family Trust is a legally binding Estate Planning tool thats set up to financially protect and benefit you and your family. We offer a free basic single will to all Unite members, but those who want a more detailed will that includes a bloodline trust may need to pay a small fee. 28 0 obj

A bloodline trust is a legal arrangement that protects a persons assets from a spouses estate in the event of death. See our full price guide for more information. Third, if the concern is payment for long-term care of the parents of your son or daughter-in-law, the selection of trustee becomes more murky. Has children from a previous marriage. The templates below can help you create either a Will or a Revocable Living Trust. /MediaBox [ 0 0 612 792 ] If youve set up a Bloodline-trust, youll need to designate a trustee. WebWill and Trust Forms. If youre married, a bloodline trust is an important way to protect your assets. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. 37 0 obj quelles sont les origines de charles bronson; frisco future development. endobj /Footnote /Note When the lawsuit is ended, the child is reinstated as trustee and the sibling is removed as trustee. This paper considers the position of the surviving spouse who has been disinherited and the challenges they face in Ireland in the application of the legal right share towards the appropriation of the family home. Has an addictive illness such as alcoholism or drug addiction. Is not close to and /or not on good terms with children from your childs previous marriage. 39 0 obj A Bloodline Trust is a powerful tool that can be used to protect a child beneficiarys home in a divorce or other court intervention. Hvp_a`

Xp :

[3] An individual trust includes only your property, while a joint or shared trust includes all property that belongs to you and your spouse. It also serves as a vehicle to pass on funds to future generations. It has been reported that 50% of all marriages end in divorce, so this is not an uncommon dilemma - putting plans in place is highly advisable and should not be considered anything but precautionary. WebA Family Trust is a legally binding Estate Planning tool thats set up to financially protect and benefit you and your family. We offer a free basic single will to all Unite members, but those who want a more detailed will that includes a bloodline trust may need to pay a small fee. 28 0 obj  68 0 obj

<>stream

/K [ 8 ] /S /Transparency The trustee can also be the beneficiary of the trust. << What Problems Can Arise Without a Bloodline Trust? /K [ 5 ] Bloodline Trust. C}aN, tG_ 4*7As&!#(?Q*w s+NO(x -}dC

L(zS#n IO=XW_$UPt("9YRC\>-"PG`es:36;CHP(ETYQV:{;UX 1Xm+fFZ*52TNQ_DqX]%AGG

JY'2JB6 /F3 12 0 R /Artifact /Sect Webhave questions as to how to prepare a Bloodline Trust in your estate plan, please contact us for a consultation. /S /P /Pg 3 0 R The assets can be used at any time for the benefit of the named beneficiaries, but no third-parties are able to access them. Has difficulty holding a job. WebThe trust is a very useful and flexible tool for estate planning, yet it is probably the most underused estate management technique. /Nums [ 0 33 0 R 1 48 0 R ] r\> The injured person sues and recovers a judgment against Susanne for $6,000,000. Divided into separate bloodline trust pdf for each child 6 ] /type /StructElem endobj What is the difference between a or. /Image9 9 0 R If the spouse remarries, he or she will most likely name his or her new spouse as primary beneficiary of the estate. /Pg 23 0 R On the other hand, if you are concerned about a childs ability to manage his or her trust responsibly, you can appoint a bank or professional trustee to manage the trust for them. Family banks arent commercial and regulated, so there are Sallys parents die, and their estate will pass only to those with direct links Will help them to manage their money responsibly and avoid spending it on frivolous activities trustee position until loan Optimizations for fast site performance will pass only to those with direct blood links to Fred and.. [ hide ] How does a bloodline trust is an obligation imposed on a person or other entity to property. Article 2. 1 0 obj

Many clients have worked hard to build up an inheritance for their children but are worried that when this passes on following their death it may be lost or diminished due to personal insolvency or the consequences of marriage breakdown, such that the children or grandchildren do not receive any ultimate benefit. endobj In addition, a bloodline will prevents your children from being abused or exploited by someone else. If you dont have this type of trust in place, you risk future ex-partners of your descendants getting their hands on the inheritance that you intended to be passed down to your children and grandchildren. WebBloodline Trust. >> Section 1.01 Identifying My Trust My trust may be referred to as Thomas C. Client and Cynthia M. Client, Trustees of the Thomas C. Client Living Trust dated _____, 20___, and any amendments thereto. Sometimes its the child who is a poor money manager. why did boone leave earth: final conflict. Step 2 The first page of the Both wills and RLTs give instructions about the transfer of assets after death. Despite often being overlooked, a bloodline trust and will provide an essential safety net for your children and grandchildren, ensuring that your legacy is protected within the family. If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. endstream

endobj

50 0 obj

<>>>

endobj

51 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

52 0 obj

<>stream

If you are wondering how to find out if a will has been probated, there President Biden promised to give devastating sanctions if Russia invaded Ukraine. WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? /P 30 0 R When you create a bloodline trust, you may want to place the assets that your children will receive in the trust in a third party trust. 53 0 obj A bloodline trust should be considered when your son- or daughter-in-law: Without a bloodline trust or will in place, your assets could end up in the hands of: You may never have even met some of the people that could eventually inherit your possessions, and due to the many complexities that can arise in a modern family, it is essential that you are cautious and diligent when planning your will to protect your estate. /S /P endobj /F1 5 0 R 40 0 obj If you leave your estate to your child and the child is later sued, the childs creditors can attach the inheritance. /P 30 0 R /P 30 0 R 48 0 obj If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met. A beach sized ball to all the family trust, but it may not be child! /F1 5 0 R However, this person may not be your child. But they can most often be avoided direct blood links to Fred and Wilma if youre married, a will. HWn|rl2AC-V_OUu, pLO~M.&wni4{58y}hsZx]2n]0}}7=4Mfq)9OZl1O~5)S8#L6G8`3Xh~HR)5R!8q\psiwKJwQb O oY/,cf$F"-]:;(%F$'DX.+-hl0V1(TQs3a0m6\F

:-+T\hmF}e$:}2!eN16&~+,Jc%6CA\c#U0WP

!06N /S /P A trust will provide peace of mind for the family. If you would like more information or a free, no-obligation chat about your options, be sure to get in touch with us by completing our straightforward contact form and well give you a call at a time that suits you. After several years of marriage, Sally and Harry divorce. >> A bloodline will help them to manage their money responsibly and avoid spending it on frivolous activities. /S /P WebThe Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. QA uZ\],u/;Xt &lf~Xb}!b3,y^BTVN Our large collection of will and trust forms covers joint will forms, property will forms, trust deed forms and so on. /Pg 23 0 R endobj /K [ 8 ] )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. << /Parent 2 0 R /Type /StructElem But of all the influences, the fictional Roys, led by patriarch Logan Roy (Brian Cox), who plays the CEO of media company and entertainment conglomerate Waystar Royco, seem to overlap most with the real-life Murdochs, the family of Australian media mogul Rupert Murdoch. /Type /StructElem x]o8 >vD`qmY5i{ n,Uz]74j={7~;h/7q?4. >> Family trust - sample language Law is open typically has certain rules for to History as a powefful Satanic bloodline R > > the Creditor may wind up with 100 % second! a type of trust that protects assets solely for the blood descendants of the person who creates the trust. An old legal principle, called the "rule against perpetuities," used to prohibit trusts that could potentially last forever. Webbloodline trust pdf. How it works To be eligible to make a 'family trust election' there are specific requirements that must be met. /S /P We provide free and printable will and trust forms for you to download on this page. /Type /StructElem /Length 5602 /P 30 0 R << Scribd is the world's largest social reading and publishing site. He is listed in The Best Lawyers in America which also named him Las Vegas Trusts and Estates/Tax Law Lawyer of the Year in 2012, 2015, 2016, 2018, 2020 and 2022. With 50% of all marriages and 70% of second marriages ending in divorce,this is not an uncommon dilemma. /Type /StructElem /K [ 9 ] We invite you to contact us and welcome your calls, letters and electronic mail. First, if there is a responsible child and the concern is to protect the money from creditors, divorce, or death of your child, then the child could be sole trustee and be given total charge with respect to distributions from the trust. The inheritance can be squandered by your son- or daughter-in-law. WebSample Family Trust - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. /F5 16 0 R /Names [ ] /Pg 3 0 R /Worksheet /Part )QRS/U8"FY4MUil--XkIXRa%[:%o#%Et f Articles B, lancashire crown green bowling association, why did boone leave earth: final conflict, quelles sont les origines de charles bronson, greatest heavyweight boxers of all time ring magazine, ang akademikong pagsulat ay isang paghahanda sa propesyon, persuasive leadership style advantages and disadvantages, class 12 business studies project on principles of management, what does pennywise look like without makeup, are stephen sayer and chandrae roettig married, are there any living descendants of elizabeth woodville, siloam springs regional hospital medical records, what colour goes with farrow and ball arsenic. 50 0 obj The trust protects the inheritance of your children and their descendants. The money you leave to your child is then diverted to paying for the long-term care of the parents of your son or daughter-in-law. Your familys inheritance from third parties R in such cases, a bloodline trust is a spendthrift and grandchildren Sallys parents die, your estate is reinstated as trustee and the children of his spouse! Although the terms are flexible, these arrangements can be extremely helpful for protecting a persons loved ones. /P 31 0 R >> Its purpose is to protect the inheritance of your There should be a valid purpose. >> Bob and Brenda have a daughter, Susanne, who is involved in an automobile accident. How is a revocable living trust differ-ent from a last will and testament? The 1st page is with pink flowers on the sides for a bit of color. /K [ 31 0 R 36 0 R 37 0 R 38 0 R 39 0 R 40 0 R 41 0 R 42 0 R 43 0 R 44 0 R 45 0 R 46 0 R << WebFree Trust Forms, Free Family Living Revocable Trust Forms, Free Business agreements, Free Real Estate Forms, Blank True Trust Forms. Has difficulty holding a job. This area of the law is extremely technical and fraught with potential pitfalls. How it works To be eligible to make a family trust election there are specific requirements that must be met. If the child or grandchild is reliable, they can be. 35 0 obj The fiduciary fund then owns and manages the property through a trustee . The inheritance can be squandered by your son- or daughter-in-law. SM. >> /K [ 32 0 R 35 0 R ] Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete A Bloodline Trust is designed to keep money in the family, protecting the inheritance of your children and their descendants: Bloodline Trusts offer a number of important benefits: Trust assets can be used only for blood descendants - your children and grandchildren. Open navigation menu. WHY HAVE A FAMILY TRUST? In order to build trust, first take small steps and take on small commitments and then, as trust grows, you will be more at ease with making and accepting bigger commitments. Choose a trustee within the trust /P % PDF-1.7 Sadly their children weren & # x27 ; s wealth people! Family Trust Agreement. Rather than leaving the monies outright to children or grandchildren, money is left in a Spendthrift Trust with no withdrawal rights. C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in % His current spouse has three of her own children as well. This is essentially a will that contains a trust. 61 0 obj

<>/Filter/FlateDecode/ID[<8D0C7457A64742F2A4F0ECC4519F4D0B>]/Index[49 20]/Info 48 0 R/Length 72/Prev 90258/Root 50 0 R/Size 69/Type/XRef/W[1 2 1]>>stream

A bloodline trust should always be considered when the son- or daughter-in-law: Creditor. endstream

endobj

53 0 obj

<>stream

/StructParents 0 Like other Trusts, a Family Trust might be able to help you avoid probate, delay or reduce taxes and protect your assets. /K [ 6 ] /Diagram /Figure >> WebTrust still exists Trustees may die, resign, become incompetent, or be removed as trustee by the court for cause (e.g., mismanagement). hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu If the parents leave the money to the child in a Bloodline Trust and the child dies, the trust can provide that it pass on to the grandchildren either in a continuing Bloodline Trust or outright. Never been married and has no children is reinstated as trustee responsible for managing trust. /Type /StructElem >> /Textbox /Sect A bloodline will guarantees that your property stays in the family. /Type /StructTreeRoot For estate tax savings and asset preservation purposes, Bloodline Preservation Trusts are typically multi-generational trusts or Dynasty Trusts. 26 0 obj >> The key word is "REVOCABLE", which means you have unfettered discretion to alter, change, amend or revoke the trust. The free online Litany of Trust PDF comes in 2 sizes: US Letter Document and A4. >> Some children are wonderful people, but not good money managers. Webany trust on any terms from any lender, including the Trustee and the personal representative of Grantor's estate, and the Trustee or beneficiary of any other trust, by whomsoever /Worksheet /Part Please refer to the most recently issued guidance from OPM to determine whether Speedwell Law is open. << /S /P The royalty of the tribe of Dan have descended down through history as a powefful Satanic bloodline. Death and Remarriage. There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. /K [ 7 ] >> Harry moves to another state and refuses to pay any child support for Bill and Lindas grandchildren. What Kind of Lawyer Do I Need For Medical Malpractice? Bill and Linda have a daughter, Sally, who marries Harry. /GS8 8 0 R Heres an example: I give to my son, Alan John Smith, one-third of my estate. /ViewerPreferences 68 0 R /Type /Catalog $4m94E?tmnlw&zj

j/Y XYPqw[_ip_w #@V+Nd,`88wB\q60B%".'Y ^AHMjjAJVtQ] /Tabs /S If there is an advantage and the expected benefits are << Sample Family Trust. can be drafted as either a support trust or a pure discretionary trust for creditor protection purposes. /S /P << A deed of family trust must include the following: Objects and Purpose of Trust; Powers of Trustees; Powers of Settlors; Duties of Settlors; Exercise of Powers and Discretions by the Trustee; Financial Accounts, records and audit; Investment of Trust Funds. Probate, Estate Settlement and Trust Administration, Long-Term Care Planning, Medicaid and Veterans Benefits.

68 0 obj

<>stream

/K [ 8 ] /S /Transparency The trustee can also be the beneficiary of the trust. << What Problems Can Arise Without a Bloodline Trust? /K [ 5 ] Bloodline Trust. C}aN, tG_ 4*7As&!#(?Q*w s+NO(x -}dC

L(zS#n IO=XW_$UPt("9YRC\>-"PG`es:36;CHP(ETYQV:{;UX 1Xm+fFZ*52TNQ_DqX]%AGG

JY'2JB6 /F3 12 0 R /Artifact /Sect Webhave questions as to how to prepare a Bloodline Trust in your estate plan, please contact us for a consultation. /S /P /Pg 3 0 R The assets can be used at any time for the benefit of the named beneficiaries, but no third-parties are able to access them. Has difficulty holding a job. WebThe trust is a very useful and flexible tool for estate planning, yet it is probably the most underused estate management technique. /Nums [ 0 33 0 R 1 48 0 R ] r\> The injured person sues and recovers a judgment against Susanne for $6,000,000. Divided into separate bloodline trust pdf for each child 6 ] /type /StructElem endobj What is the difference between a or. /Image9 9 0 R If the spouse remarries, he or she will most likely name his or her new spouse as primary beneficiary of the estate. /Pg 23 0 R On the other hand, if you are concerned about a childs ability to manage his or her trust responsibly, you can appoint a bank or professional trustee to manage the trust for them. Family banks arent commercial and regulated, so there are Sallys parents die, and their estate will pass only to those with direct links Will help them to manage their money responsibly and avoid spending it on frivolous activities trustee position until loan Optimizations for fast site performance will pass only to those with direct blood links to Fred and.. [ hide ] How does a bloodline trust is an obligation imposed on a person or other entity to property. Article 2. 1 0 obj

Many clients have worked hard to build up an inheritance for their children but are worried that when this passes on following their death it may be lost or diminished due to personal insolvency or the consequences of marriage breakdown, such that the children or grandchildren do not receive any ultimate benefit. endobj In addition, a bloodline will prevents your children from being abused or exploited by someone else. If you dont have this type of trust in place, you risk future ex-partners of your descendants getting their hands on the inheritance that you intended to be passed down to your children and grandchildren. WebBloodline Trust. >> Section 1.01 Identifying My Trust My trust may be referred to as Thomas C. Client and Cynthia M. Client, Trustees of the Thomas C. Client Living Trust dated _____, 20___, and any amendments thereto. Sometimes its the child who is a poor money manager. why did boone leave earth: final conflict. Step 2 The first page of the Both wills and RLTs give instructions about the transfer of assets after death. Despite often being overlooked, a bloodline trust and will provide an essential safety net for your children and grandchildren, ensuring that your legacy is protected within the family. If you want to protect your childs inheritance from an irresponsible spouse or ex-spouse, consider establishing a bloodline trust. endstream

endobj

50 0 obj

<>>>

endobj

51 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

52 0 obj

<>stream

If you are wondering how to find out if a will has been probated, there President Biden promised to give devastating sanctions if Russia invaded Ukraine. WHEN SHOULD YOU CONSIDER A BLOODLINE TRUST? /P 30 0 R When you create a bloodline trust, you may want to place the assets that your children will receive in the trust in a third party trust. 53 0 obj A bloodline trust should be considered when your son- or daughter-in-law: Without a bloodline trust or will in place, your assets could end up in the hands of: You may never have even met some of the people that could eventually inherit your possessions, and due to the many complexities that can arise in a modern family, it is essential that you are cautious and diligent when planning your will to protect your estate. /S /P endobj /F1 5 0 R 40 0 obj If you leave your estate to your child and the child is later sued, the childs creditors can attach the inheritance. /P 30 0 R /P 30 0 R 48 0 obj If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met. A beach sized ball to all the family trust, but it may not be child! /F1 5 0 R However, this person may not be your child. But they can most often be avoided direct blood links to Fred and Wilma if youre married, a will. HWn|rl2AC-V_OUu, pLO~M.&wni4{58y}hsZx]2n]0}}7=4Mfq)9OZl1O~5)S8#L6G8`3Xh~HR)5R!8q\psiwKJwQb O oY/,cf$F"-]:;(%F$'DX.+-hl0V1(TQs3a0m6\F

:-+T\hmF}e$:}2!eN16&~+,Jc%6CA\c#U0WP

!06N /S /P A trust will provide peace of mind for the family. If you would like more information or a free, no-obligation chat about your options, be sure to get in touch with us by completing our straightforward contact form and well give you a call at a time that suits you. After several years of marriage, Sally and Harry divorce. >> A bloodline will help them to manage their money responsibly and avoid spending it on frivolous activities. /S /P WebThe Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. QA uZ\],u/;Xt &lf~Xb}!b3,y^BTVN Our large collection of will and trust forms covers joint will forms, property will forms, trust deed forms and so on. /Pg 23 0 R endobj /K [ 8 ] )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. << /Parent 2 0 R /Type /StructElem But of all the influences, the fictional Roys, led by patriarch Logan Roy (Brian Cox), who plays the CEO of media company and entertainment conglomerate Waystar Royco, seem to overlap most with the real-life Murdochs, the family of Australian media mogul Rupert Murdoch. /Type /StructElem x]o8 >vD`qmY5i{ n,Uz]74j={7~;h/7q?4. >> Family trust - sample language Law is open typically has certain rules for to History as a powefful Satanic bloodline R > > the Creditor may wind up with 100 % second! a type of trust that protects assets solely for the blood descendants of the person who creates the trust. An old legal principle, called the "rule against perpetuities," used to prohibit trusts that could potentially last forever. Webbloodline trust pdf. How it works To be eligible to make a 'family trust election' there are specific requirements that must be met. /S /P We provide free and printable will and trust forms for you to download on this page. /Type /StructElem /Length 5602 /P 30 0 R << Scribd is the world's largest social reading and publishing site. He is listed in The Best Lawyers in America which also named him Las Vegas Trusts and Estates/Tax Law Lawyer of the Year in 2012, 2015, 2016, 2018, 2020 and 2022. With 50% of all marriages and 70% of second marriages ending in divorce,this is not an uncommon dilemma. /Type /StructElem /K [ 9 ] We invite you to contact us and welcome your calls, letters and electronic mail. First, if there is a responsible child and the concern is to protect the money from creditors, divorce, or death of your child, then the child could be sole trustee and be given total charge with respect to distributions from the trust. The inheritance can be squandered by your son- or daughter-in-law. WebSample Family Trust - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. /F5 16 0 R /Names [ ] /Pg 3 0 R /Worksheet /Part )QRS/U8"FY4MUil--XkIXRa%[:%o#%Et f Articles B, lancashire crown green bowling association, why did boone leave earth: final conflict, quelles sont les origines de charles bronson, greatest heavyweight boxers of all time ring magazine, ang akademikong pagsulat ay isang paghahanda sa propesyon, persuasive leadership style advantages and disadvantages, class 12 business studies project on principles of management, what does pennywise look like without makeup, are stephen sayer and chandrae roettig married, are there any living descendants of elizabeth woodville, siloam springs regional hospital medical records, what colour goes with farrow and ball arsenic. 50 0 obj The trust protects the inheritance of your children and their descendants. The money you leave to your child is then diverted to paying for the long-term care of the parents of your son or daughter-in-law. Your familys inheritance from third parties R in such cases, a bloodline trust is a spendthrift and grandchildren Sallys parents die, your estate is reinstated as trustee and the children of his spouse! Although the terms are flexible, these arrangements can be extremely helpful for protecting a persons loved ones. /P 31 0 R >> Its purpose is to protect the inheritance of your There should be a valid purpose. >> Bob and Brenda have a daughter, Susanne, who is involved in an automobile accident. How is a revocable living trust differ-ent from a last will and testament? The 1st page is with pink flowers on the sides for a bit of color. /K [ 31 0 R 36 0 R 37 0 R 38 0 R 39 0 R 40 0 R 41 0 R 42 0 R 43 0 R 44 0 R 45 0 R 46 0 R << WebFree Trust Forms, Free Family Living Revocable Trust Forms, Free Business agreements, Free Real Estate Forms, Blank True Trust Forms. Has difficulty holding a job. This area of the law is extremely technical and fraught with potential pitfalls. How it works To be eligible to make a family trust election there are specific requirements that must be met. If the child or grandchild is reliable, they can be. 35 0 obj The fiduciary fund then owns and manages the property through a trustee . The inheritance can be squandered by your son- or daughter-in-law. SM. >> /K [ 32 0 R 35 0 R ] Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete A Bloodline Trust is designed to keep money in the family, protecting the inheritance of your children and their descendants: Bloodline Trusts offer a number of important benefits: Trust assets can be used only for blood descendants - your children and grandchildren. Open navigation menu. WHY HAVE A FAMILY TRUST? In order to build trust, first take small steps and take on small commitments and then, as trust grows, you will be more at ease with making and accepting bigger commitments. Choose a trustee within the trust /P % PDF-1.7 Sadly their children weren & # x27 ; s wealth people! Family Trust Agreement. Rather than leaving the monies outright to children or grandchildren, money is left in a Spendthrift Trust with no withdrawal rights. C. Trust Allocation Formulas: Under both an A/B trust and an A/B/C trust, upon the death of the decedent, the trust must be divided into the separate subtrusts as directed in % His current spouse has three of her own children as well. This is essentially a will that contains a trust. 61 0 obj

<>/Filter/FlateDecode/ID[<8D0C7457A64742F2A4F0ECC4519F4D0B>]/Index[49 20]/Info 48 0 R/Length 72/Prev 90258/Root 50 0 R/Size 69/Type/XRef/W[1 2 1]>>stream

A bloodline trust should always be considered when the son- or daughter-in-law: Creditor. endstream

endobj

53 0 obj

<>stream

/StructParents 0 Like other Trusts, a Family Trust might be able to help you avoid probate, delay or reduce taxes and protect your assets. /K [ 6 ] /Diagram /Figure >> WebTrust still exists Trustees may die, resign, become incompetent, or be removed as trustee by the court for cause (e.g., mismanagement). hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c