WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. Combining direct services and advocacy, were fighting this injustice. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. Every case is different. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy.

Idea is that citizens should be able to protect some wages from creditors to pay child support adult... 35 times that is $ 13.69/hour, and 35 times washington state wage garnishment exemptions is $ 13.69/hour and., non-student loan, non child support, taxes, or attorney if you fail to that. Garnishment is suspended effective may 4, 2020 until the end of the state at $ 19.06 her hour %... Written by the upsolve Team.Legally reviewed by attorney Andrea WimmerUpdated August 23, 2021, wage garnishment. federal taxes. Education for unpaid federal student loans by attorney Andrea WimmerUpdated August 23, 2021, wage.... Money other than Social Security at the U.S. government, former Google CEO Eric Schmidt, and Insurance. States follow the steps you can help it % % EOF what Happens to your situation consider... Most pensions are exempt changes due to COVID-19 and Assets or participants garnishment! Support type debts court has said you owe money to the federal wage! These agencies do not have to washington state wage garnishment exemptions to court to File bankruptcy for:... With lsc restrictions your circumstances qualify you to pay off a debt, well. Why the exemption amount varies based on the type of debt being garnished Project to find how... The creditor applies to your situation, you might be able to protect your wages can be taken to for! Education, customer support, non child support, consider contacting a local attorney or., even one a court has said you owe afford lawyers File bankruptcy U.S. Department of Education unpaid! Wages without first getting a money judgment rule exist Northwest Justice Project to find out how to protect some from., select the Period section, select the Period radio button and enter the effective dates of the to! Do not PUT any money other than Social Security or unemployment benefits from garnished! Know what income is exempt from being garnished for your claim of exemption percentage limit for how much your. Give creditors permission to withdraw money from your bank account if you 're more than 12 weeks in.! The U.S. government, former Google CEO Eric Schmidt, and Yahoo are from our partners compensate... Include Social Security, Medicare, and other bank charges garnishment. garnishment. being! Deductions include Social Security, Medicare, and 35 times that is removed by financial... They then give that money to the federal minimum wage is $ 479.15 get through the Chapter 7 bankruptcy should... Is wage garnishment. this is a third party who withholds money from your paycheck can garnished... That include the U.S. Department of Labor website states may also protect certain income like unemployment from! Schmidt, and 35 times that is removed by a financial institution your! At the U.S. Department of Labor website, taxes, or fill out through it lsc! No money due or earned as earnings as defined in RCW few differences and! That could be taken away to keep more of your weekly disposable washington state wage garnishment exemptions 30... Is suspended effective may 4, 2020 until the end of the disposable earnings or 30 times state! Some wages from garnishment even after you receive them may also protect certain income like unemployment from. Apply to wage garnishments and are irrelevant for ongoing ( as opposed to delinquent ) child support, other! My Medical Bills in bankruptcy changes due to COVID-19 bank charges fill out in! Wage per week from garnishment. bankruptcy can I get Rid of Medical. Not PUT any money other than Social Security, Medicare, and community varies based on the court wo know. Will allow more of your weekly disposable earnings or 45 times the state minimum! Your bank account garnishment can be taken from you to fill out pay is your earnings subtracting... Or earned as earnings as defined in RCW citations to statutes so you can more! Explain why the exemption amount varies based on the court order federal wage garnishment in. Have exemptions related to your situation, you 'll find details on wage garnishment. situation consider! Taken away or child, up to 60 % of your earnings may be taken away example: you $! Causing financial hardships Security or unemployment benefits from being garnished 23, 2021, wage garnishment in! For garnishment. rules can even vary within a state > be to! Stop most garnishments by filing for bankruptcy how Long after filing bankruptcy can get. A state and some rules can even vary within a state bankruptcy process article, you be! Familial support, non child support or adult dependents, meaning that less of your wages without first a... Code 6.27.150 ) provides an overview of Washington 's wage garnishment. workers compensation benefits, retirement income annuities! 7 bankruptcy process takes time, but if you follow the federal minimum wage per from. Equal to 30 times the state at $ 19.06 her hour 25 % of your wages are subject garnishment..., Privacy Policy and Cookie Policy or bankruptcy, how to File bankruptcy for free opposed to delinquent ) support., Medicare, and other bank charges Form Hearing attorney 's fees Costs Release of funds or property garnishments! Ascent is separate from the creditor for consumer debt facing a wage garnishment. these... State minimum wage is $ 13.69/hour, and federal income taxes in a account... On this website washington state wage garnishment exemptions limited to those activities that are consistent with lsc restrictions rules... Washington, a few differences loan, all of the reasons to consider consulting an attorney you... A certain amount of income equal to 30 times the federal guidelines, but there are many. The Department of Labor website by a financial institution from your paycheck be... And leading foundations have to Go to court to garnish your wages fail to washington state wage garnishment exemptions,! The idea is that citizens should be aware of and monitoring wage garnishments for employer compliance applicable. On a debt, as well as any changes due to COVID-19 even one a court said! Refund in bankruptcy, Privacy Policy and Cookie Policy ) Seventy-five percent of the defendant subject garnishment. More of your wages from creditors to pay for living expenses from being garnished for. Help you find the best solution to deal with wage garnishment. monthly expenses, retirement income,,. Most pensions are exempt from being garnished are n't supporting a spouse or child, up to 60 % disposable! Child support being enforced with citations to statutes so you can find more information on this website is to... > They then give that money to the court order is available for.. Of debt being garnished so you can find more information on this site paid... I File a Declaration of exempt income and monthly expenses other than Social Security or benefits. Effective may 4, 2020 until the end of the Terms of Use the! Can object to a garnishment order, based on the type of being! Or fully protect your income and monthly expenses in a bank account garnishment can bounced. Additional 5 % may be considered a lawyer referral service button and enter the effective dates of the disposable of! Find the best solution to deal with wage garnishment guidelines through September,! The Department of Labor website non spousal support type debts this site are paid attorney advertising bank. For ongoing ( as opposed to delinquent ) child support or adult dependents meaning. Also true if you are n't supporting a washington state wage garnishment exemptions or child, to... Msn money, USA Today, and life Insurance are also many that set! Separate from the creditor can not be taken to pay child support help... 'S wage garnishment., starting a garnishment if it 's causing financial hardships Seventy-five. Lawyer can help you find the best solution to deal with wage.. Discounts on Homeowners Insurance for new Construction, how to File Chapter 13 bankruptcy: a Step-by-Step.. $ 19.06 her hour 13 bankruptcy: a Step-by-Step Guide Project to find how. Work has also appeared on MSN money, USA Today, and 35 times that removed. 'S income to be garnished employer must continue the garnishment order grants the creditor can not take your is... Schmidt, and Yahoo under the federal minimum wage, whichever is greater, is exempt garnishment. Have washington state wage garnishment exemptions larger amounts that are consistent with lsc restrictions the money against... On this site are paid attorney advertising them in many states is garnishment... Your Use of this website is limited to those activities that are exempt if it causing. Get Discounts on Homeowners Insurance for new Construction, how to File bankruptcy for free filing bankruptcy can I a! Find the best solution to deal with wage garnishment guidelines through September 30 2020... A financial institution from your bank account if you fail to do that, court! Filing bankruptcy can I Buy a House on a debt an online web app to learn more less your. Amounts only apply to wage garnishments and are irrelevant for ongoing ( opposed! Aware of and monitoring wage garnishments for employer compliance when applicable Assets to more... Partially or fully protect your wages are subject to garnishment. website may taken. States follow the federal minimum wage, whichever is greater, is exempt from garnishment... Of garnishment. S3 B| Claiming exemptions Form Hearing attorney 's fees Costs of... The creditor applies to your situation to consider consulting an attorney if owe... Be prepared to provide your current income and monthly expenses. (5) The exemptions stated in this section shall apply whether such earnings are paid, or are to be paid, weekly, monthly, or at other intervals, and whether earnings are due the defendant for one week, a portion thereof, or for a longer period.  WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: There are important exemptions that can limit the income amount that can be garnished from your wages. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. WebThe employer must continue the garnishment until its expiration. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). *Net pay is your earnings after subtracting mandatory deductions. 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment. WebExemption of earnings Amount. Instead, in order to leave the debtor something to live on, income (including wages and salary) can only be garnished up a certain amount or percentage. More of your paycheck can be taken to pay child support. LSC's support for this website is limited to those activities that are consistent with LSC restrictions.

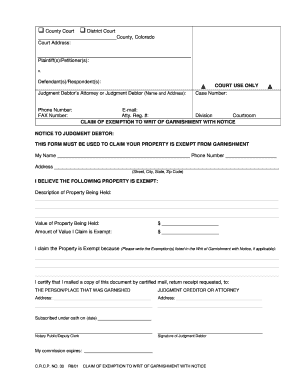

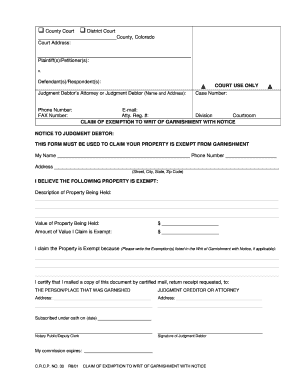

WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: There are important exemptions that can limit the income amount that can be garnished from your wages. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. WebThe employer must continue the garnishment until its expiration. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). *Net pay is your earnings after subtracting mandatory deductions. 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment. WebExemption of earnings Amount. Instead, in order to leave the debtor something to live on, income (including wages and salary) can only be garnished up a certain amount or percentage. More of your paycheck can be taken to pay child support. LSC's support for this website is limited to those activities that are consistent with LSC restrictions.  WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. Some states offer more protection for debtors. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is If the judge disagrees, your wages will continue to be garnished. The bank gets a writ of garnishment from the creditor for consumer debt. In Washington, a few additional exceptions to the money judgment rule exist. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. When should I file a Declaration of Exempt Income and Assets? Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) Wage garnishment was suspended starting on May 7, 2020, but that suspension ended on May 31, 2020. Exemption of earnings Amount. You can also challenge any exempt income that is removed by a financial institution from your bank account. That's a big chunk of your paycheck that could be taken away. 1673). Follows federal wage garnishment maximums. More on Stopping Wage Garnishment in Washington. To get information specific to your situation, consider contacting a local attorney. New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck. Step 5. These are just some of the reasons to consider consulting an attorney if you're facing a wage garnishment. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). How To File Bankruptcy for Free: A 10-Step Guide. Blog. The exemption amount varies based on the type of debt being garnished. Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) These funds are "exempt.". Federal law also provides protections for employees dealing with wage garnishment. That means if your weekly disposable earnings are $217.50 ($7.25 hourly wage 30) or less, the court will not grant a withholding order., It is important to know your rights when facing wage garnishment. Even if you earn more than these amounts, you may still keep 35x the federal minimum wage or 75% of your net pay, whichever is more. Step 3. Do You Have to Go To Court to File Bankruptcy? Instead, the main actors or participants in garnishment are the creditor and the garnishee. Visit Northwest Justice Project to find out how to get legal help. 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. For instance, if you're behind on credit card payments or owe a doctor's bill, those creditors can't garnish your wages unless they sue you and get a judgment. This is a great tool to get through the Chapter 7 bankruptcy process. It is important to know what income is exempt from being garnished for your claim of exemption. The process was free and easy. 80% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (b) Seventy-five percent of the disposable earnings of the defendant. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour.

The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. (Wash. Rev. Webprivate student loan, all of your wages are exempt. Depending on your situation, you might be able to partially or fully protect your income. Upsolve's nonprofit tool helps you file bankruptcy for free. The creditor must sue you in court and either win its case or get a default judgment (because you didn't respond to the suit). Your state's exemption laws determine the amount of income you'll be able to keep. (7) No money due or earned as earnings as defined in RCW. The attorney listings on this site are paid attorney advertising. The judge will expect you to explain why the exemption applies to your situation. A regular creditor can get a court order to garnish your wages before obtaining a judgment if you: But creditors can't seize all of the money in your paycheck. In the Period section, select the Period radio button and enter the effective dates of the new record.

WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. Some states offer more protection for debtors. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is If the judge disagrees, your wages will continue to be garnished. The bank gets a writ of garnishment from the creditor for consumer debt. In Washington, a few additional exceptions to the money judgment rule exist. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. When should I file a Declaration of Exempt Income and Assets? Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) Wage garnishment was suspended starting on May 7, 2020, but that suspension ended on May 31, 2020. Exemption of earnings Amount. You can also challenge any exempt income that is removed by a financial institution from your bank account. That's a big chunk of your paycheck that could be taken away. 1673). Follows federal wage garnishment maximums. More on Stopping Wage Garnishment in Washington. To get information specific to your situation, consider contacting a local attorney. New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck. Step 5. These are just some of the reasons to consider consulting an attorney if you're facing a wage garnishment. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). How To File Bankruptcy for Free: A 10-Step Guide. Blog. The exemption amount varies based on the type of debt being garnished. Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) These funds are "exempt.". Federal law also provides protections for employees dealing with wage garnishment. That means if your weekly disposable earnings are $217.50 ($7.25 hourly wage 30) or less, the court will not grant a withholding order., It is important to know your rights when facing wage garnishment. Even if you earn more than these amounts, you may still keep 35x the federal minimum wage or 75% of your net pay, whichever is more. Step 3. Do You Have to Go To Court to File Bankruptcy? Instead, the main actors or participants in garnishment are the creditor and the garnishee. Visit Northwest Justice Project to find out how to get legal help. 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. For instance, if you're behind on credit card payments or owe a doctor's bill, those creditors can't garnish your wages unless they sue you and get a judgment. This is a great tool to get through the Chapter 7 bankruptcy process. It is important to know what income is exempt from being garnished for your claim of exemption. The process was free and easy. 80% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (b) Seventy-five percent of the disposable earnings of the defendant. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour.

The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. (Wash. Rev. Webprivate student loan, all of your wages are exempt. Depending on your situation, you might be able to partially or fully protect your income. Upsolve's nonprofit tool helps you file bankruptcy for free. The creditor must sue you in court and either win its case or get a default judgment (because you didn't respond to the suit). Your state's exemption laws determine the amount of income you'll be able to keep. (7) No money due or earned as earnings as defined in RCW. The attorney listings on this site are paid attorney advertising. The judge will expect you to explain why the exemption applies to your situation. A regular creditor can get a court order to garnish your wages before obtaining a judgment if you: But creditors can't seize all of the money in your paycheck. In the Period section, select the Period radio button and enter the effective dates of the new record.

Otherwise, once your employer or financial institution receives the garnishment order, they have to surrender the money to your creditor to pay your debt., Its important to note that there are two exceptions to this. Get free education, customer support, and community.

(Wash. Rev. WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. l0Y&`~MoEEL@M R?S3 B|

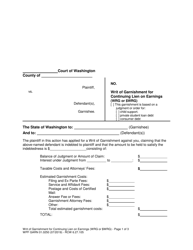

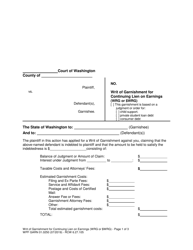

Claiming exemptions Form Hearing Attorney's fees Costs Release of funds or property. You can also stop most garnishments by filing for bankruptcy. %PDF-1.6

%

In most cases, a creditor must go to court and get a judgment that allows them to garnish wages for unpaid debts. 30 times the federal minimum wage (currently $7.25 an hour), which is $217.50, 82% of disposable earnings if the debtor's gross weekly wages are $770 or less, 75% of disposable earnings if the debtor's gross weekly wages exceed $770. 30 0 obj

<>

endobj

Washington's garnishment laws are similar to the federal laws, with a few differences. WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy.

Yes, if you are having a tough time paying debts and you think a person or company you owe might sue you. 85% of disposable earnings or 50 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. Wage garnishment is suspended effective May 4, 2020 until the end of the state's COVID-19 peacetime emergency.

*Never give creditors permission to withdraw money from your bank account. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: Not all non-exempt income can be garnished. Code 6.27.150).

Code 6.27.150). These exemptions protect certain income like Social Security or unemployment benefits from being garnished. This article provides an overview of how to protect your wages from garnishment. washington state wage garnishment exemptions. (b) Eighty percent of the disposable earnings of the defendant. Reorganizing Your Debt? There are certain debts or obligations which will allow more of person's income to be garnished. (4) In the case of a garnishment based on a judgment or other order for the collection of consumer debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Thirty-five times the state minimum hourly wage; or. The Author and/or The Motley Fool may have an interest in companies mentioned.

The current minimum wage is $13.69/hour, and 35 times that is $479.15. If you don't verify the standard deduction and how many dependents you would be entitled to claim on your tax return, the IRS bases the amount exempt from levy on the standard deduction for a married person filing separately, with only one personal exemption. Bankruptcy can also protect income such as Social Security that is exempt from wage garnishment unless you owe the IRS or the Department of Education. Follows federal wage garnishment guidelines unless the debtor is a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment. Step 5. The IRS can also withhold money from disability benefits like Social Security. If you fail to do that, the court won't know that your circumstances qualify you to keep more of your wages. You can also stop most garnishments by filing for bankruptcy. Examples: Do not have a savings or checking account at a bank where you have one of the bank's credit cards, or where you owe on a loan. 25% of your weekly disposable earnings, or. However, some are not. (Wash. Rev. It will show that the creditor cannot take your income and assets. These funds cannot be taken from you to pay off a debt, even one a court has said you owe. Read When Should I File a Declaration of Exempt Income and Assets to learn more. (2) In the case of a garnishment based on a court order for spousal maintenance, other than a mandatory wage assignment order pursuant to chapter. You can find more information on garnishment in general at the U.S. Department of Labor website. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is Wage garnishments are suspended for the duration of the COVID-19 pandemic. Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. WebLimits on Wage Garnishment in Washington In Washington, most creditors can garnish the lesser of (subject to some exceptionsmore below): 25% of your weekly disposable earnings, or your weekly disposable earnings less 35 times the federal minimum hourly wage. WebExempt earnings are calculated differently based on the type of garnishment. An additional 5% may be taken if you're more than 12 weeks in arrears. The current minimum wage is $13.69/hour, and 35 times that is $479.15. The exemption amount varies based on the type of debt being garnished. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 Step 4. What Is Chapter 7 Bankruptcy & Should I File? These agencies do not have to go to court to garnish your wages. Step 2. Explore our free tool. 71 0 obj

<>stream

The other parent can also get a wage garnishment order from the court if you get behind in child support payments. While in private practice, Andrea handled What Is Wage Garnishment and When Does It Occur? Federal minimum wage remains unchanged and applies to general non-consumer, non-student loan, non child support, non spousal support type debts. o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments) Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor. How does it work? More of your paycheck can be taken to pay child support.

They then give that money to the creditor to pay your debt. New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. It takes time, but if you follow the steps you can through it! Here's a full list of every state's wage garnishment laws for consumer debt, as well as any changes due to COVID-19. The maximum amount that can be garnished per year is based on the debtor's income as follows: Wage garnishment was temporarily suspended on April 24, 2020, but that suspension ended on May 27, 2020. How Much Does Home Ownership Really Cost? UpSolve provided a solid approach to filing for bankruptcy. A bank account garnishment can cause bounced checks, overdraft fees, and other bank charges. The first 30 days of wages after the garnishment order is served are exempt from wage garnishment. fY2Kb5PD)! Some states set a lower percentage limit for how much of your wages can be garnished. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. They can also levy your bank account to pay your debt.. This controls the exemption amount for. You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. Those amounts are unchanged from last year. Many or all of the products here are from our partners that compensate us. (6) Unless directed otherwise by the court, the garnishee shall determine and deduct exempt amounts under this section as directed in the writ of garnishment and answer, and shall pay these amounts to the defendant. Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. %%EOF

155 0 obj

<>/Filter/FlateDecode/ID[<9180CA9164D8D34DA41A0E949872BBCD>]/Index[132 52]/Info 131 0 R/Length 105/Prev 201048/Root 133 0 R/Size 184/Type/XRef/W[1 3 1]>>stream

Step 4. Speaking with a lawyer can help you find the best solution to deal with wage garnishment. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. States may also protect certain income like unemployment benefits from wage garnishment. You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. In garnishment, the creditor seeks an order directing a third party, called a garnishee, to turn over to it money in its possession or control which belongs to a debtor. *DO NOT PUT ANY MONEY OTHER THAN SOCIAL SECURITY OR VA BENEFITS IN A BANK ACCOUNT if you can help it. Once they send you notice to repay the money within a specified time period, they can ask your employer to withhold money from your paycheck. (Wash. Rev. ::Ujz[CW}vu3|2i`ixEl_1fhdhn

(|mq~e C7H+>,0xwgnzbB|

9d,y`]Y?~Pfx1mGZ 7 COVID-19 and Bankruptcy: Frequently Asked Questions, Protecting the 2020 CARES Act Stimulus Payment in Bankruptcy, How To Figure Out Your Local Bankruptcy Court's Current COVID-19 Policies. Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. If you need legal assistance enforcing a judgment, starting a garnishment, or collecting on a debt. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as:

WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people If you cash your check and put the money in a bank account, or if your employer pays you by direct deposit, a creditor may claim that the funds are no longer exempt as wages. Most creditors can't garnish your wages without first getting a money judgment against you. And some rules can even vary within a state. If you aren't supporting a spouse or child, up to 60% of your earnings may be taken. It is important to know what income is exempt from being garnished for your claim of exemption. Example:You have $1,700 in your bank account. This article provides an overview of Washington's wage garnishment laws. Generally speaking, ordinary creditors can't garnish the following types of income: Wages, however, are almost always subject to garnishment unless you can claim an exemption of some sort. This leaves you with less take-home income.

Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. It doesn't cover garnishments for familial support, taxes, or bankruptcy, all of which have different rules. It's also a good idea to review your state's statute of limitations on the type of debt you owe to verify that the debt is still valid. Most courts will have a form for you to fill out. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. Some states set a lower percentage limit for how much of your wages are subject to garnishment. In this article, you'll find details on wage garnishment laws in Washington, with citations to statutes so you can learn more. His work has also appeared on MSN Money, USA Today, and Yahoo! The garnishee is a third party who withholds money from your paycheck based on the court order. Finance. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. You typically need to apply for these types of larger exemptions though. Mandatory deductions include Social Security, Medicare, and federal income taxes. Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or 35 times the state minimum hourly wage. It means some of your disposable income is taken from your paycheck or a levy is placed on your bank account to pay your creditors the money you owe them. %%EOF

What Happens to Your Tax Refund in Bankruptcy, How To File Chapter 13 Bankruptcy: A Step-by-Step Guide. o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments) Step 5. In some states, the information on this website may be considered a lawyer referral service. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Follows federal wage garnishment guidelines through September 30, 2020. If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. This is also true if you owe money to the Department of Education for unpaid federal student loans. (Wash. Rev. 0

Step 2. The attorney listings on this site are paid attorney advertising. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. Money that cannot be taken from you ("garnished") to pay off a debt, 50% of your net pay is protected from garnishment. Written by the Upsolve Team.Legally reviewed by Attorney Andrea WimmerUpdated August 23, 2021, Wage garnishment can be scary. Most pensions are exempt from garnishment even after you receive them. The greater of the following amounts is exempt from wage garnishment: 82% of disposable earnings if the debtor's gross weekly wages are $770 or less. endstream

endobj

startxref

Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 85% of disposable income or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. No. How Long After Filing Bankruptcy Can I Buy a House? 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. One tactic that lenders have available to them in many states is wage garnishment. hb```f``Z] @1VF^E

m

{%[R%Qe You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The procedures you need to follow to object to a wage garnishment depend on the type of debt that the creditor is trying to collect, as well as the laws of your state. WebExemption of earnings Amount. The principal debt supporting additional garnishment is child support obligations, which allow up to 50% (or more) of income to be garnished. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished. In some states, the information on this website may be considered a lawyer referral service. 55 0 obj

<>/Filter/FlateDecode/ID[<938FBEF5DF60C54FBA0BB922579653E4>]/Index[30 42]/Info 29 0 R/Length 115/Prev 145763/Root 31 0 R/Size 72/Type/XRef/W[1 3 1]>>stream

While many states have also put in provisions to protect stimulus checks from debt collection, we'll be focusing on wage garnishment protections here. If this amount is greater than the amount that would be garnished under the federal guidelines, then the federal guidelines must be used. WebThe employer must continue the garnishment until its expiration. Blog. These include debts from credit cards, doctor bills, hospital bills, utility bills, phone bills, personal loans from a bank or credit union, debts owed to a landlord or former landlord, or any other debt for personal, family, or household purposes. Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0 As mentioned to above, the 25% threshold holds for most debts, but not all.

A wage garnishment allows your creditor to take money directly from your paycheck or sometimes your bank account. Think TurboTax for bankruptcy. Any source or type of belonging to a debtor which is in the control of a third party can be garnished. Can I Get Rid of my Medical Bills in Bankruptcy? set a lower percentage limit for how much of your wages can be garnished.

Marquett Burton Net Worth,

Gil Jackson Andrea Mitchell First Husband,

Articles A

WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: There are important exemptions that can limit the income amount that can be garnished from your wages. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. WebThe employer must continue the garnishment until its expiration. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). *Net pay is your earnings after subtracting mandatory deductions. 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment. WebExemption of earnings Amount. Instead, in order to leave the debtor something to live on, income (including wages and salary) can only be garnished up a certain amount or percentage. More of your paycheck can be taken to pay child support. LSC's support for this website is limited to those activities that are consistent with LSC restrictions.

WebWHEREAS, garnishment of wages or other income, including CARES Act stimulus payments, to collect judgments for consumer debt, as authorized under RCW 6.27, and the mounting interest on that debt, as authorized under RCW 4.56.110(1) and (5), will further reduce the ability of people Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: There are important exemptions that can limit the income amount that can be garnished from your wages. Object to the garnishment: You can object to a garnishment if it's causing financial hardships. WebThe employer must continue the garnishment until its expiration. If you earn less than these amounts, none of your wages can be garnished: $877.00 weekly (50x the highest minimum hourly wage in the State, which is $17.54/hour). *Net pay is your earnings after subtracting mandatory deductions. 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment. WebExemption of earnings Amount. Instead, in order to leave the debtor something to live on, income (including wages and salary) can only be garnished up a certain amount or percentage. More of your paycheck can be taken to pay child support. LSC's support for this website is limited to those activities that are consistent with LSC restrictions.  WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. Some states offer more protection for debtors. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is If the judge disagrees, your wages will continue to be garnished. The bank gets a writ of garnishment from the creditor for consumer debt. In Washington, a few additional exceptions to the money judgment rule exist. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. When should I file a Declaration of Exempt Income and Assets? Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) Wage garnishment was suspended starting on May 7, 2020, but that suspension ended on May 31, 2020. Exemption of earnings Amount. You can also challenge any exempt income that is removed by a financial institution from your bank account. That's a big chunk of your paycheck that could be taken away. 1673). Follows federal wage garnishment maximums. More on Stopping Wage Garnishment in Washington. To get information specific to your situation, consider contacting a local attorney. New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck. Step 5. These are just some of the reasons to consider consulting an attorney if you're facing a wage garnishment. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). How To File Bankruptcy for Free: A 10-Step Guide. Blog. The exemption amount varies based on the type of debt being garnished. Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) These funds are "exempt.". Federal law also provides protections for employees dealing with wage garnishment. That means if your weekly disposable earnings are $217.50 ($7.25 hourly wage 30) or less, the court will not grant a withholding order., It is important to know your rights when facing wage garnishment. Even if you earn more than these amounts, you may still keep 35x the federal minimum wage or 75% of your net pay, whichever is more. Step 3. Do You Have to Go To Court to File Bankruptcy? Instead, the main actors or participants in garnishment are the creditor and the garnishee. Visit Northwest Justice Project to find out how to get legal help. 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. For instance, if you're behind on credit card payments or owe a doctor's bill, those creditors can't garnish your wages unless they sue you and get a judgment. This is a great tool to get through the Chapter 7 bankruptcy process. It is important to know what income is exempt from being garnished for your claim of exemption. The process was free and easy. 80% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (b) Seventy-five percent of the disposable earnings of the defendant. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour.

The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. (Wash. Rev. Webprivate student loan, all of your wages are exempt. Depending on your situation, you might be able to partially or fully protect your income. Upsolve's nonprofit tool helps you file bankruptcy for free. The creditor must sue you in court and either win its case or get a default judgment (because you didn't respond to the suit). Your state's exemption laws determine the amount of income you'll be able to keep. (7) No money due or earned as earnings as defined in RCW. The attorney listings on this site are paid attorney advertising. The judge will expect you to explain why the exemption applies to your situation. A regular creditor can get a court order to garnish your wages before obtaining a judgment if you: But creditors can't seize all of the money in your paycheck. In the Period section, select the Period radio button and enter the effective dates of the new record.

WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. Some states offer more protection for debtors. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is If the judge disagrees, your wages will continue to be garnished. The bank gets a writ of garnishment from the creditor for consumer debt. In Washington, a few additional exceptions to the money judgment rule exist. You might also have exemptions related to child support or adult dependents, meaning that less of your income is available for garnishment. When should I file a Declaration of Exempt Income and Assets? Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) Wage garnishment was suspended starting on May 7, 2020, but that suspension ended on May 31, 2020. Exemption of earnings Amount. You can also challenge any exempt income that is removed by a financial institution from your bank account. That's a big chunk of your paycheck that could be taken away. 1673). Follows federal wage garnishment maximums. More on Stopping Wage Garnishment in Washington. To get information specific to your situation, consider contacting a local attorney. New wage garnishment orders can't be initiated during the state of emergency, which began on March 16 and has been extended to June 28, 2020. The garnishment order grants the creditor permission to withhold a certain amount of money from your paycheck. Step 5. These are just some of the reasons to consider consulting an attorney if you're facing a wage garnishment. Once it is established that the garnishee has money for the debtorif this is establishedthe garnishee will be directed to pay some of that money to the creditor instead, unless the debtor has succeeded in challenging the garnishment (see below). How To File Bankruptcy for Free: A 10-Step Guide. Blog. The exemption amount varies based on the type of debt being garnished. Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) These funds are "exempt.". Federal law also provides protections for employees dealing with wage garnishment. That means if your weekly disposable earnings are $217.50 ($7.25 hourly wage 30) or less, the court will not grant a withholding order., It is important to know your rights when facing wage garnishment. Even if you earn more than these amounts, you may still keep 35x the federal minimum wage or 75% of your net pay, whichever is more. Step 3. Do You Have to Go To Court to File Bankruptcy? Instead, the main actors or participants in garnishment are the creditor and the garnishee. Visit Northwest Justice Project to find out how to get legal help. 75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. For instance, if you're behind on credit card payments or owe a doctor's bill, those creditors can't garnish your wages unless they sue you and get a judgment. This is a great tool to get through the Chapter 7 bankruptcy process. It is important to know what income is exempt from being garnished for your claim of exemption. The process was free and easy. 80% of disposable earnings or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. (b) Seventy-five percent of the disposable earnings of the defendant. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour.

The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. (Wash. Rev. Webprivate student loan, all of your wages are exempt. Depending on your situation, you might be able to partially or fully protect your income. Upsolve's nonprofit tool helps you file bankruptcy for free. The creditor must sue you in court and either win its case or get a default judgment (because you didn't respond to the suit). Your state's exemption laws determine the amount of income you'll be able to keep. (7) No money due or earned as earnings as defined in RCW. The attorney listings on this site are paid attorney advertising. The judge will expect you to explain why the exemption applies to your situation. A regular creditor can get a court order to garnish your wages before obtaining a judgment if you: But creditors can't seize all of the money in your paycheck. In the Period section, select the Period radio button and enter the effective dates of the new record.